Health Check: How Prudently Does Yu Tak International Holdings (HKG:8048) Use Debt?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Yu Tak International Holdings Limited (HKG:8048) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Yu Tak International Holdings

What Is Yu Tak International Holdings's Debt?

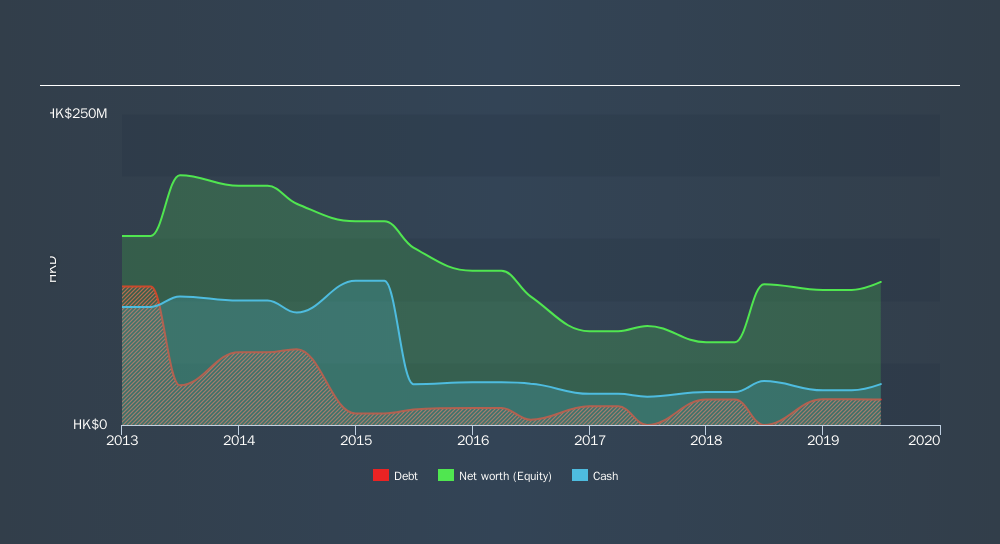

You can click the graphic below for the historical numbers, but it shows that as of June 2019 Yu Tak International Holdings had HK$20.6m of debt, an increase on , over one year. But on the other hand it also has HK$32.8m in cash, leading to a HK$12.3m net cash position.

How Strong Is Yu Tak International Holdings's Balance Sheet?

According to the balance sheet data, Yu Tak International Holdings had liabilities of HK$38.5m due within 12 months, but no longer term liabilities. On the other hand, it had cash of HK$32.8m and HK$40.7m worth of receivables due within a year. So it can boast HK$35.1m more liquid assets than total liabilities.

This surplus strongly suggests that Yu Tak International Holdings has a rock-solid balance sheet (and the debt is of no concern whatsoever). On this basis we think its balance sheet is strong like a sleek panther or even a proud lion. Succinctly put, Yu Tak International Holdings boasts net cash, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But it is Yu Tak International Holdings's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Yu Tak International Holdings saw its revenue drop to HK$93m, which is a fall of 19%. That's not what we would hope to see.

So How Risky Is Yu Tak International Holdings?

Statistically speaking companies that lose money are riskier than those that make money. And in the last year Yu Tak International Holdings had negative earnings before interest and tax (EBIT), truth be told. And over the same period it saw negative free cash outflow of HK$17m and booked a HK$22m accounting loss. However, it has net cash of HK$12.3m, so it has a bit of time before it will need more capital. Overall, its balance sheet doesn't seem overly risky, at the moment, but we're always cautious until we see the positive free cash flow. When I consider a company to be a bit risky, I think it is responsible to check out whether insiders have been reporting any share sales. Luckily, you can click here ito see our graphic depicting Yu Tak International Holdings insider transactions.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:8048

Yu Tak International Holdings

An investment holding company, engages in the development, sale, implementation, and maintenance of enterprise software products in Hong Kong, the People’s Republic of China, Taiwan, and Southeast Asia.

Adequate balance sheet slight.

Market Insights

Community Narratives