- Australia

- /

- Medical Equipment

- /

- ASX:AMT

Health Check: How Prudently Does Allegra Orthopaedics (ASX:AMT) Use Debt?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Allegra Orthopaedics Limited (ASX:AMT) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Allegra Orthopaedics

What Is Allegra Orthopaedics's Debt?

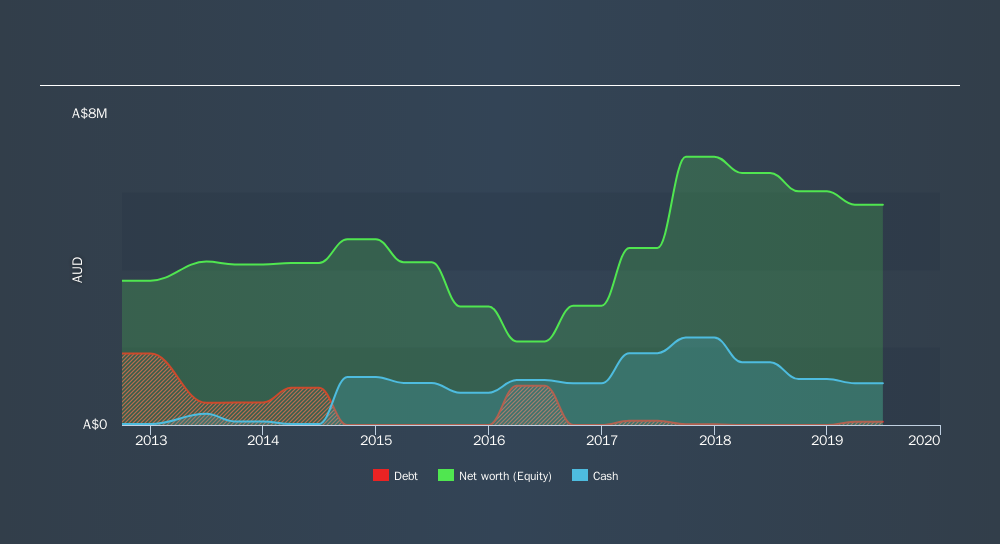

You can click the graphic below for the historical numbers, but it shows that as of June 2019 Allegra Orthopaedics had AU$84.4k of debt, an increase on , over one year. But it also has AU$1.08m in cash to offset that, meaning it has AU$992.0k net cash.

A Look At Allegra Orthopaedics's Liabilities

The latest balance sheet data shows that Allegra Orthopaedics had liabilities of AU$1.06m due within a year, and liabilities of AU$61.1k falling due after that. Offsetting these obligations, it had cash of AU$1.08m as well as receivables valued at AU$1.16m due within 12 months. So it actually has AU$1.11m more liquid assets than total liabilities.

This surplus suggests that Allegra Orthopaedics has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Simply put, the fact that Allegra Orthopaedics has more cash than debt is arguably a good indication that it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Allegra Orthopaedics will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Allegra Orthopaedics saw its revenue drop to AU$5.1m, which is a fall of 2.3%. That's not what we would hope to see.

So How Risky Is Allegra Orthopaedics?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And we do note that Allegra Orthopaedics had negative earnings before interest and tax (EBIT), over the last year. And over the same period it saw negative free cash outflow of AU$1.1m and booked a AU$836k accounting loss. With only AU$992.0k on the balance sheet, it would appear that its going to need to raise capital again soon. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. For riskier companies like Allegra Orthopaedics I always like to keep an eye on the long term profit and revenue trends. Fortunately, you can click to see our interactive graph of its profit, revenue, and operating cashflow.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:AMT

Allegra Medical Technologies

Allegra Medical Technologies Limited designs, sells, and distributes medical device products in Australia.

Medium with weak fundamentals.

Market Insights

Community Narratives