- United States

- /

- Medical Equipment

- /

- NYSE:BSX

Have Insiders Sold Boston Scientific Corporation (NYSE:BSX) Shares Recently?

Anyone interested in Boston Scientific Corporation (NYSE:BSX) should probably be aware that a company insider, John Sorenson, recently divested US$319k worth of shares in the company, at an average price of US$42.48 each. That sale was 18% of their holding, so it does make us raise an eyebrow.

View our latest analysis for Boston Scientific

The Last 12 Months Of Insider Transactions At Boston Scientific

In the last twelve months, the biggest single sale by an insider was when the insider, Eric Francis Thépaut, sold US$838k worth of shares at a price of US$38.03 per share. That means that even when the share price was below the current price of US$42.23, an insider wanted to cash in some shares. We generally consider it a negative if insiders have been selling, especially if they did so below the current price, because it implies that they considered a lower price to be reasonable. However, while insider selling is sometimes discouraging, it's only a weak signal. This single sale was just 20% of Eric Francis Thépaut's stake.

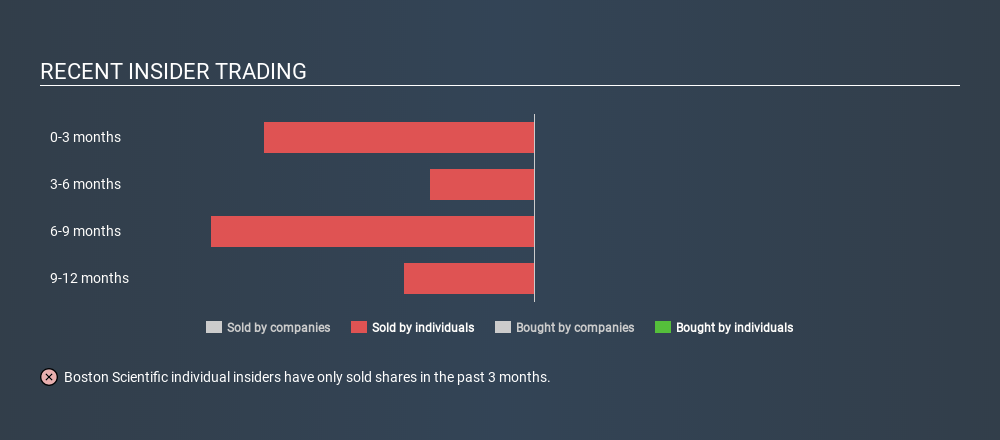

Insiders in Boston Scientific didn't buy any shares in the last year. The chart below shows insider transactions (by individuals) over the last year. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Does Boston Scientific Boast High Insider Ownership?

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. It's great to see that Boston Scientific insiders own 0.3% of the company, worth about US$163m. I like to see this level of insider ownership, because it increases the chances that management are thinking about the best interests of shareholders.

What Might The Insider Transactions At Boston Scientific Tell Us?

Insiders haven't bought Boston Scientific stock in the last three months, but there was some selling. Looking to the last twelve months, our data doesn't show any insider buying. But it is good to see that Boston Scientific is growing earnings. The company boasts high insider ownership, but we're a little hesitant, given the history of share sales. Therefore, you should should definitely take a look at this FREE report showing analyst forecasts for Boston Scientific.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:BSX

Boston Scientific

Develops, manufactures, and markets medical devices for use in various interventional medical specialties worldwide.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives