- United States

- /

- Transportation

- /

- NasdaqGS:GRAB

Grab Holdings (NasdaqGS:GRAB) Reports Robust Q1 Earnings Boosting Investor Confidence

Reviewed by Simply Wall St

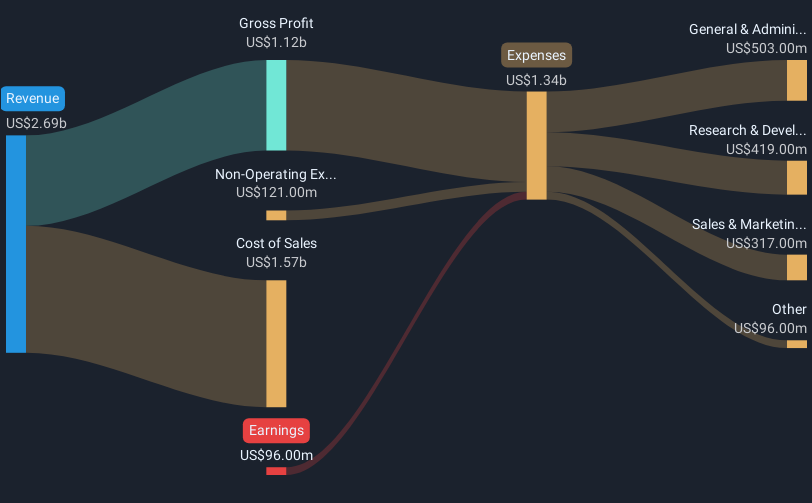

Grab Holdings (NasdaqGS:GRAB) is currently in discussions about a potential acquisition of PT GoTo Gojek Tokopedia Tbk, with Indonesia’s sovereign wealth fund considering involvement to mitigate regulatory challenges. This M&A activity likely contributed to the 4% increase in Grab's share price last quarter, as investors may view the deal as a chance to strengthen Grab's market position. Additionally, Grab's robust Q1 earnings report, revealing improved sales and a shift to net income, might have further bolstered investor confidence, adding weight to market trends despite the broader market's flat performance over the last week.

Be aware that Grab Holdings is showing 1 weakness in our investment analysis.

The proposed acquisition of PT GoTo Gojek Tokopedia Tbk could significantly enhance Grab Holdings' competitive edge in the Southeast Asian market. The potential involvement of Indonesia’s sovereign wealth fund may facilitate regulatory approvals, potentially leading to increased market confidence. Over the last three years, Grab’s shares have delivered impressive total returns of 96.14%, showcasing the company's strong long-term performance. Compared to the industry and market returns over the previous year, Grab stands out by exceeding the US Transportation industry's 6.1% return and the US market's 10.6% return.

This news has implications for Grab’s revenue and earnings forecasts. Investors may anticipate that the acquisition will offset intensified competition and economic uncertainties, thus potentially bolstering revenue growth. With analysts forecasting robust earnings growth to $588.6 million by 2028, the market will be watching closely. However, execution risks and integration challenges could impact these forecasts. The recent share price movement of around $4.79, reflecting a positive response to the acquisition news and strong Q1 results, remains below the consensus analyst price target of $5.68. This suggests potential upward movement, as analysts predict a 15.6% increase to reach this target, reinforcing the acquisition's perceived value in strengthening Grab's market position.

Assess Grab Holdings' future earnings estimates with our detailed growth reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GRAB

Grab Holdings

Engages in the provision of superapps in Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives