- South Korea

- /

- Machinery

- /

- KOSDAQ:A044490

Global Value Stocks Estimated Up To 43.3% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets navigate a landscape of solid corporate earnings and fluctuating inflation rates, investors are keenly observing indices like the S&P 500 and Nasdaq Composite, which have recently reached new highs. In this environment, identifying undervalued stocks becomes crucial as they present opportunities to capitalize on discrepancies between market prices and intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhuhai CosMX Battery (SHSE:688772) | CN¥14.07 | CN¥27.90 | 49.6% |

| Upsales Technology (OM:UPSALE) | SEK37.90 | SEK75.38 | 49.7% |

| Shin Maint HoldingsLtd (TSE:6086) | ¥1264.00 | ¥2321.99 | 45.6% |

| RVRC Holding (OM:RVRC) | SEK45.66 | SEK91.03 | 49.8% |

| Hibino (TSE:2469) | ¥2334.00 | ¥4673.98 | 50.1% |

| Forum Engineering (TSE:7088) | ¥1207.00 | ¥2405.52 | 49.8% |

| doValue (BIT:DOV) | €2.488 | €4.95 | 49.7% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.41 | €6.80 | 49.8% |

| Atea (OB:ATEA) | NOK144.00 | NOK286.37 | 49.7% |

| Absolent Air Care Group (OM:ABSO) | SEK243.00 | SEK482.96 | 49.7% |

We're going to check out a few of the best picks from our screener tool.

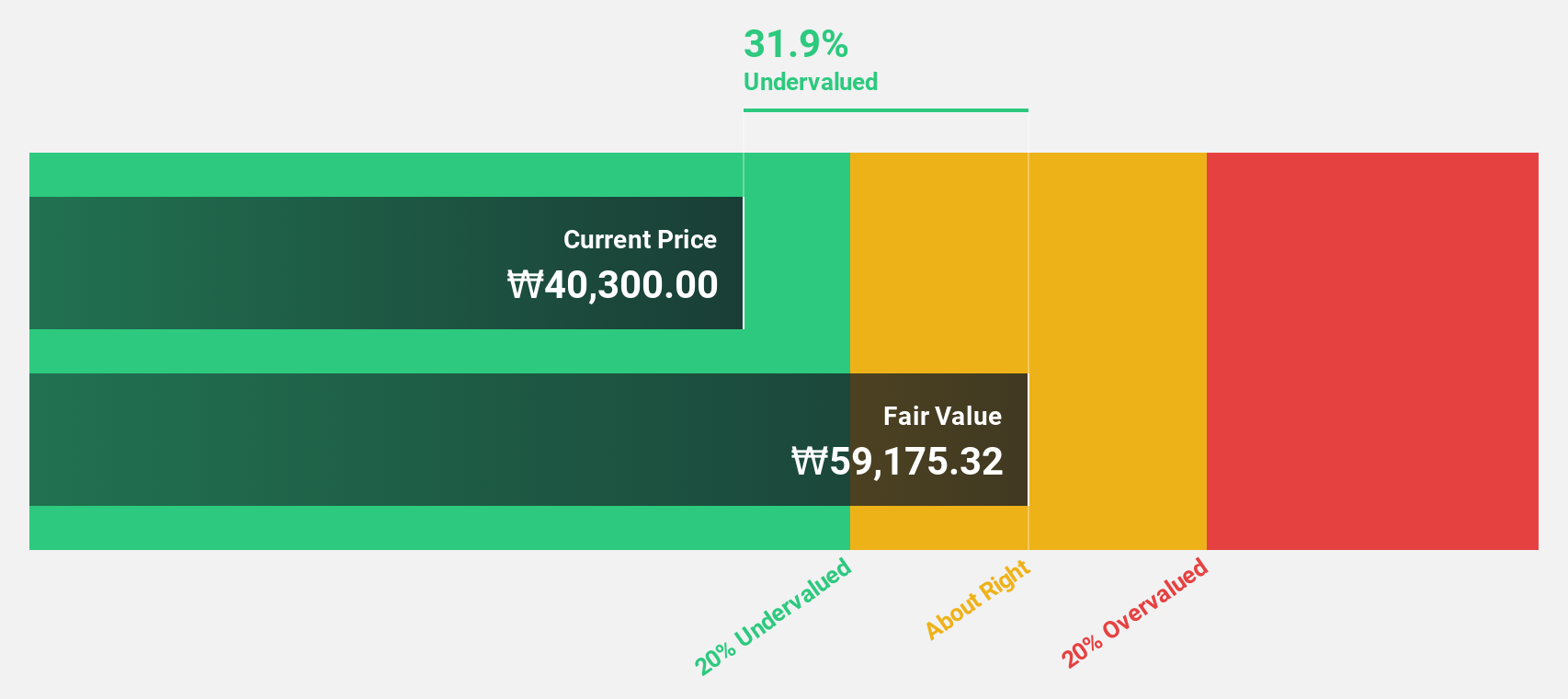

TaewoongLtd (KOSDAQ:A044490)

Overview: Taewoong Co., Ltd specializes in manufacturing and selling open-die forgings and ring rolled products both in South Korea and internationally, with a market cap of ₩765.28 billion.

Operations: Taewoong Co., Ltd generates its revenue through the production and sale of open-die forgings and ring rolled products, serving both domestic and international markets.

Estimated Discount To Fair Value: 31.4%

Taewoong Ltd. is trading at ₩38,250, significantly below its estimated fair value of ₩57,468.26, representing a 33.4% discount. Despite recent volatility in share price and a decline in profit margins from 8.9% to 5.1%, the company's earnings are projected to grow substantially at over 42% annually for the next three years, outpacing the Korean market's average growth rate of 20.8%.

- The growth report we've compiled suggests that TaewoongLtd's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of TaewoongLtd stock in this financial health report.

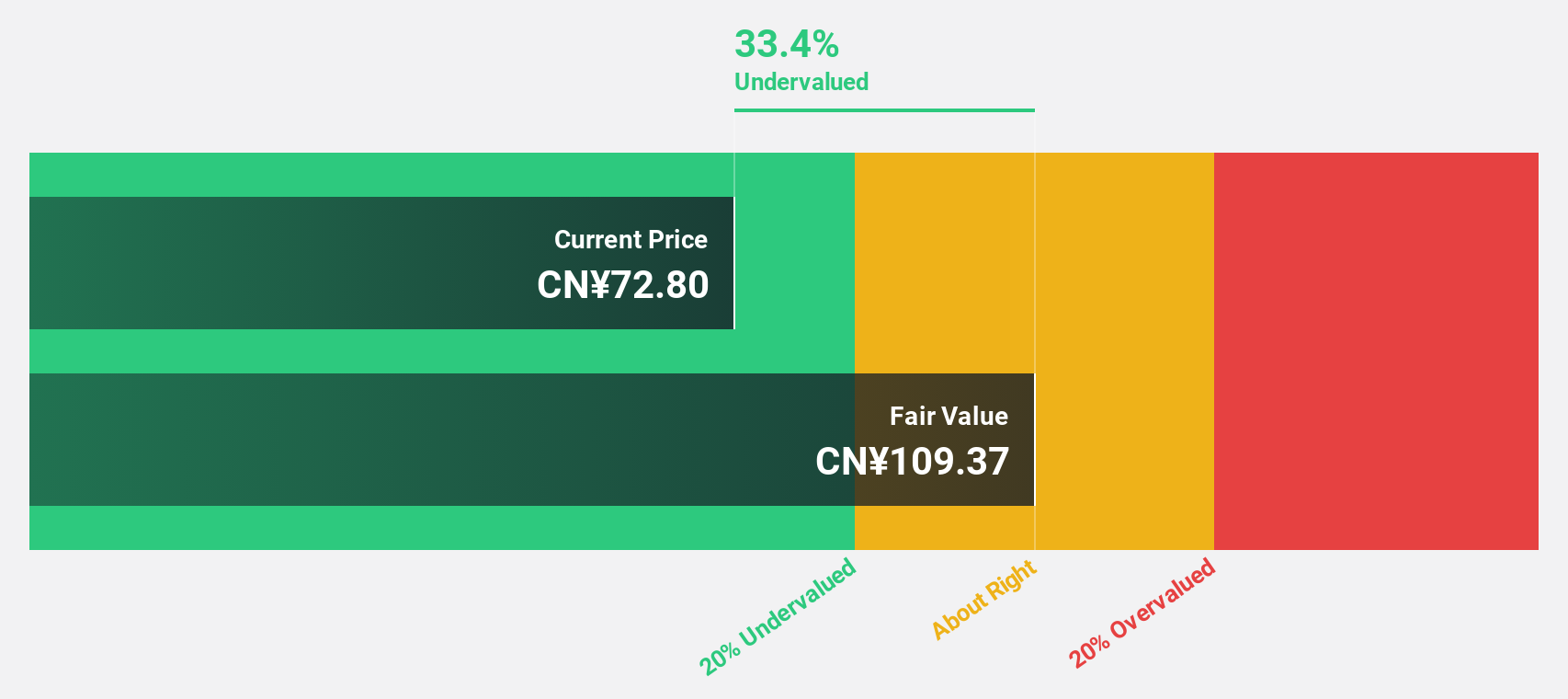

HangzhouS MedTech (SHSE:688581)

Overview: Hangzhou AGS MedTech Co., Ltd. operates in the research, development, production, sale, and service of endoscopic surgery equipment and accessories in China with a market cap of CN¥6.11 billion.

Operations: Hangzhou AGS MedTech Co., Ltd.'s revenue is primarily derived from its endoscopic surgery equipment and accessories business in China.

Estimated Discount To Fair Value: 24.9%

HangzhouS MedTech is trading at CN¥75.88, approximately 30.8% below its estimated fair value of CN¥109.66, indicating it is undervalued based on discounted cash flow analysis. While earnings are expected to grow significantly at 20.8% annually, this pace lags behind the broader Chinese market's forecast of 23.3%. However, revenue growth is robust, projected at 25.2% per year—outperforming both the company's earnings growth and the overall market rate.

- In light of our recent growth report, it seems possible that HangzhouS MedTech's financial performance will exceed current levels.

- Click here to discover the nuances of HangzhouS MedTech with our detailed financial health report.

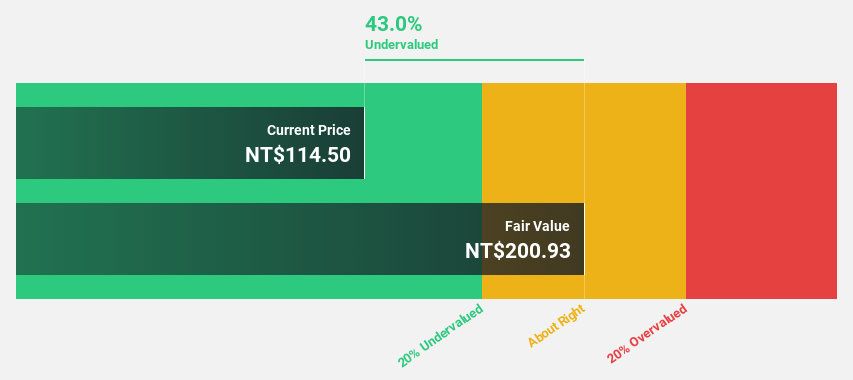

Evergreen Aviation Technologies (TWSE:2645)

Overview: Evergreen Aviation Technologies Corporation offers aircraft maintenance services to airline partners both in Taiwan and internationally, with a market cap of NT$40.27 billion.

Operations: The company's revenue is primarily derived from its Maintenance Segment, generating NT$13.47 billion, and its Manufacturing Segment, contributing NT$3.32 billion.

Estimated Discount To Fair Value: 43.3%

Evergreen Aviation Technologies, trading at NT$107.5, is undervalued compared to its fair value estimate of NT$195.16 based on discounted cash flow analysis. Despite a dividend yield of 4.19% not being fully covered by free cash flows, earnings are forecast to grow significantly at 27.81% annually, surpassing the Taiwanese market's growth rate of 13.3%. Recent regulatory fines and changes in board composition may impact short-term sentiment but don't overshadow long-term growth prospects.

- Our earnings growth report unveils the potential for significant increases in Evergreen Aviation Technologies' future results.

- Click to explore a detailed breakdown of our findings in Evergreen Aviation Technologies' balance sheet health report.

Key Takeaways

- Click this link to deep-dive into the 482 companies within our Undervalued Global Stocks Based On Cash Flows screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TaewoongLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A044490

TaewoongLtd

Manufactures and sells open-die forgings and ring rolled products in South Korea and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives