- Philippines

- /

- Hospitality

- /

- PSE:PLUS

Global Dividend Stocks To Consider In November 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by mixed performances in major indices and shifting monetary policies, investors are keenly observing the implications of interest rate changes and trade agreements on their portfolios. In this environment, dividend stocks can offer a measure of stability and income potential, making them an attractive option for those looking to balance growth with income generation amidst economic uncertainties.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.11% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.98% | ★★★★★★ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.90% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.79% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.99% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.53% | ★★★★★★ |

| Daicel (TSE:4202) | 4.52% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.61% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.68% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.48% | ★★★★★★ |

Click here to see the full list of 1352 stocks from our Top Global Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

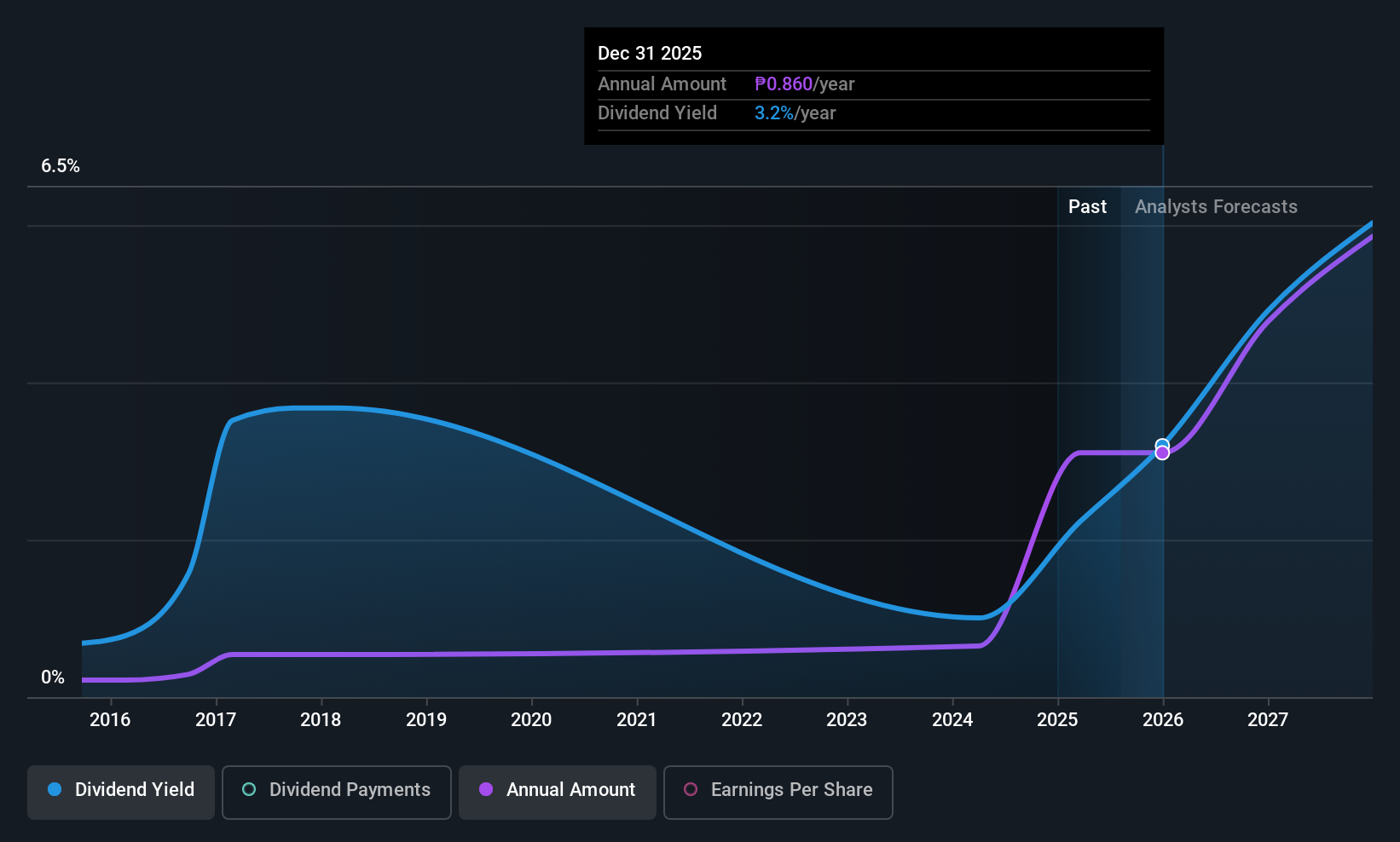

DigiPlus Interactive (PSE:PLUS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DigiPlus Interactive Corp. operates as a digital entertainment company in the Philippines, with a market capitalization of approximately ₱94.45 billion.

Operations: DigiPlus Interactive Corp.'s revenue is primarily derived from its Retail Group at ₱89.49 billion, followed by the Casino Group at ₱526.65 million, and the Network and License Group at ₱378.06 million, with additional contributions from Property and Other Investments totaling ₱46.20 million.

Dividend Yield: 3.8%

DigiPlus Interactive's dividend payments have been volatile over the past decade, with a history of unreliability. Despite this, dividends are well-covered by earnings and cash flows, with payout ratios of 24.1% and 25.2%, respectively. Recent earnings growth is strong; however, its dividend yield of 3.77% falls below the top quartile in the Philippine market. The company's strategic expansion into South Africa may impact future financial stability and dividend potential positively or negatively depending on execution success.

- Dive into the specifics of DigiPlus Interactive here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that DigiPlus Interactive is trading behind its estimated value.

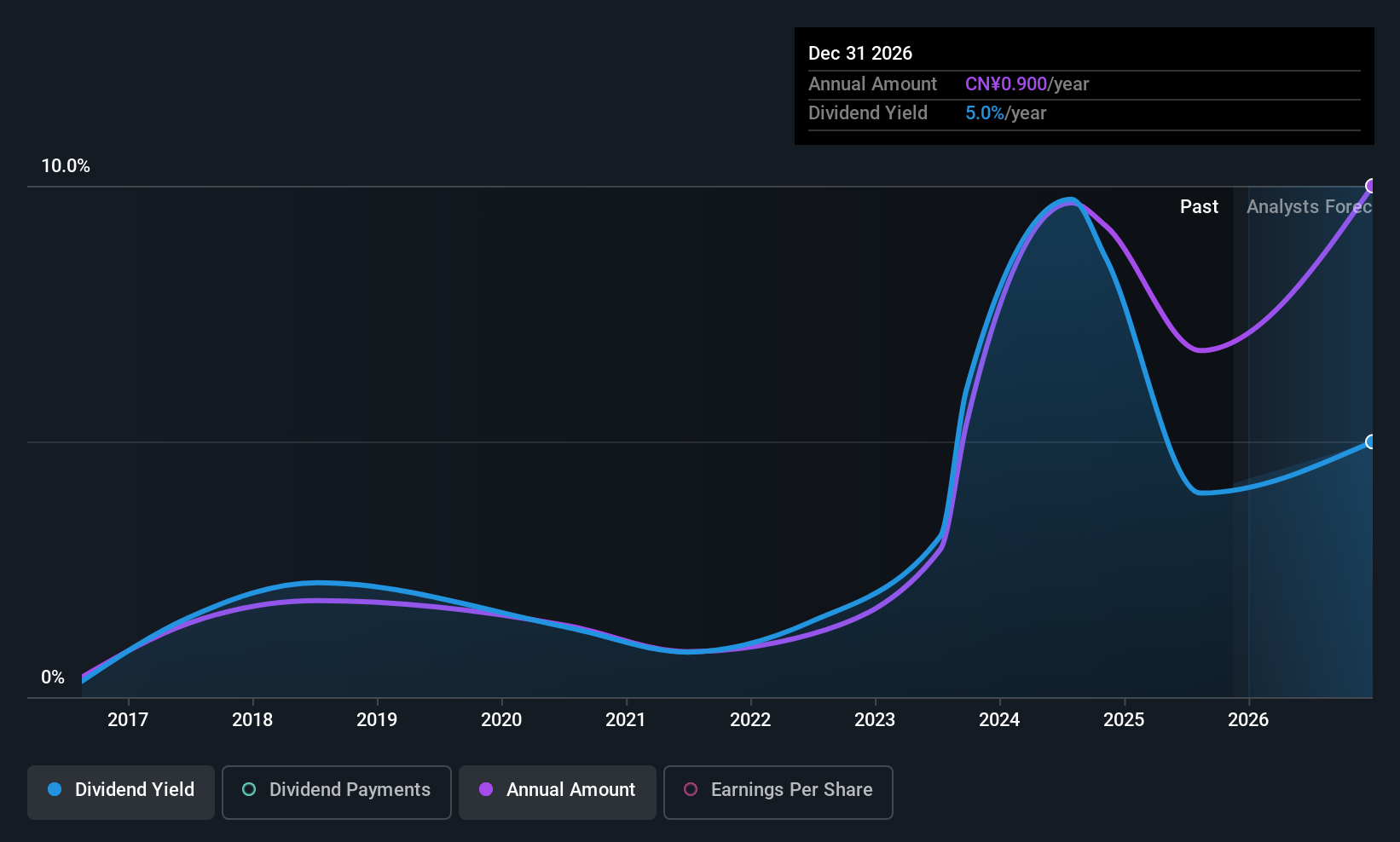

Cofco Sugar HoldingLTD (SHSE:600737)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cofco Sugar Holding Co., Ltd. operates in sugar and tomato processing both in China and internationally, with a market cap of CN¥33.43 billion.

Operations: Cofco Sugar Holding Co., Ltd. generates revenue through its activities in sugar and tomato processing across both domestic and international markets.

Dividend Yield: 3.8%

Cofco Sugar Holding's dividend payments have been inconsistent over the past decade, with a high cash payout ratio of 179.2% indicating poor coverage by cash flows. Despite a reasonable payout ratio of 64.2%, dividends remain unsustainable due to unreliable earnings coverage. The dividend yield of 3.9% is competitive within the Chinese market but recent financial results show declining sales and net income, which may impact future dividend stability and growth potential negatively.

- Click here to discover the nuances of Cofco Sugar HoldingLTD with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Cofco Sugar HoldingLTD is priced higher than what may be justified by its financials.

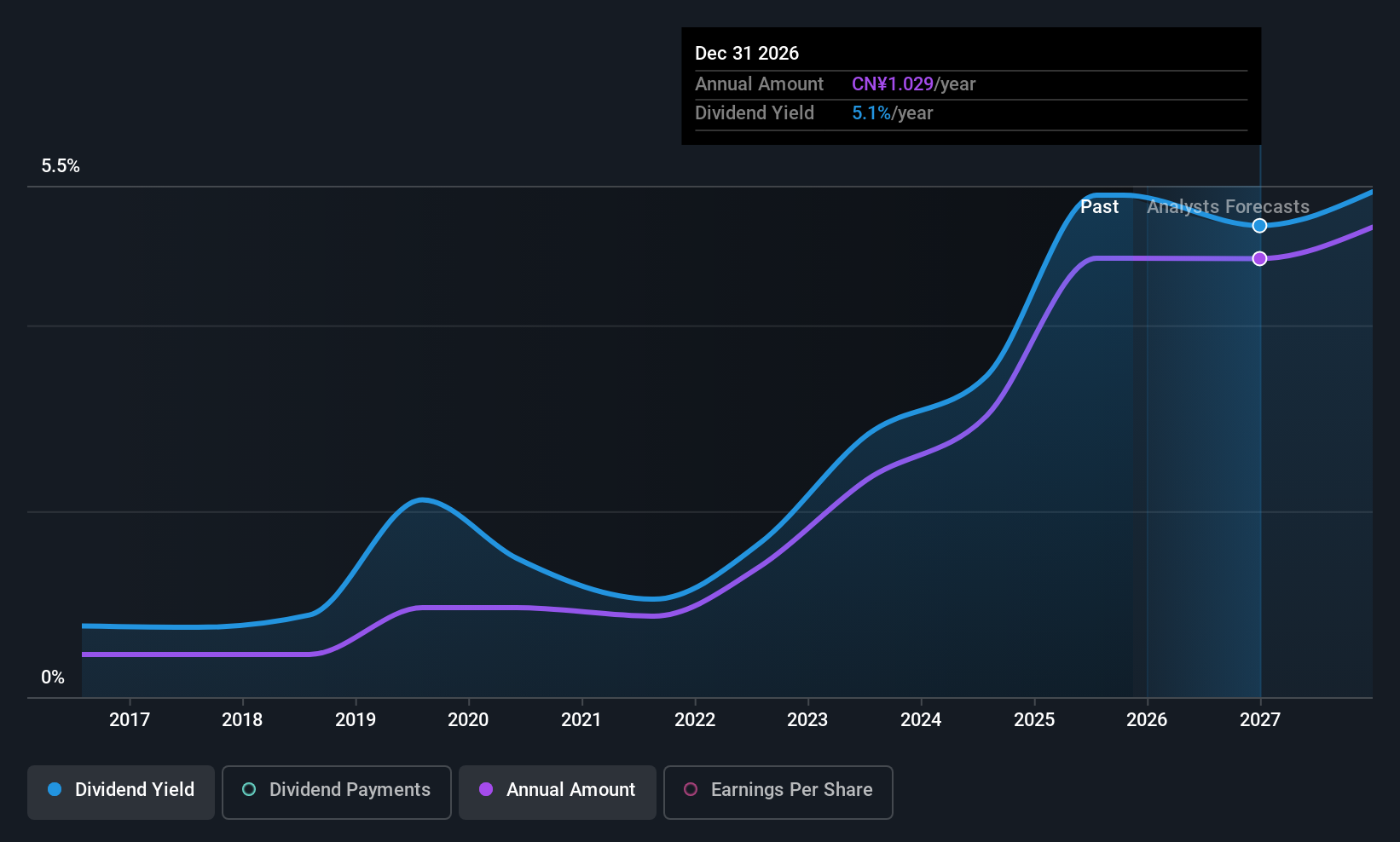

ENN Natural GasLtd (SHSE:600803)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ENN Natural Gas Co., Ltd. operates in natural gas distribution, trading, storage, transportation, production, and engineering across China with a market cap of CN¥59.96 billion.

Operations: ENN Natural Gas Co., Ltd. generates revenue through its operations in natural gas distribution, trading, storage, transportation, production, and engineering within China.

Dividend Yield: 5.2%

ENN Natural Gas Ltd.'s recent earnings report shows a slight decline in sales and net income, raising concerns about future dividend stability. While the company trades significantly below its estimated fair value, its profit margins have decreased over the past year. The dividend payments have been volatile historically but are currently covered by both earnings and cash flows with payout ratios of 56.3% and 63.2%, respectively. Despite this coverage, the dividend track record remains unstable.

- Get an in-depth perspective on ENN Natural GasLtd's performance by reading our dividend report here.

- According our valuation report, there's an indication that ENN Natural GasLtd's share price might be on the cheaper side.

Next Steps

- Investigate our full lineup of 1352 Top Global Dividend Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:PLUS

DigiPlus Interactive

Through its subsidiaries, operates as a digital entertainment company in the Philippines.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives