- China

- /

- Construction

- /

- SHSE:601886

Global Dividend Stocks To Consider In June 2025

Reviewed by Simply Wall St

As global markets experience a rally driven by easing geopolitical tensions and favorable trade developments, major indices like the S&P 500 and Nasdaq Composite have reached record highs. In this environment of heightened investor optimism, dividend stocks can offer an attractive blend of income and potential for capital appreciation, making them a worthwhile consideration for those seeking stability amidst market volatility.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.57% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.33% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.01% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.33% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.60% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.04% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.37% | ★★★★★★ |

| Daicel (TSE:4202) | 4.95% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.81% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.48% | ★★★★★★ |

Click here to see the full list of 1554 stocks from our Top Global Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Jangho Group (SHSE:601886)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jangho Group Co., Ltd. operates in the architectural decoration industry across Mainland China, Hong Kong, Macau, Taiwan, and internationally with a market cap of CN¥6.33 billion.

Operations: Jangho Group Co., Ltd. generates its revenue primarily from its architectural decoration operations across various regions, including Mainland China, Hong Kong, Macau, Taiwan, and international markets.

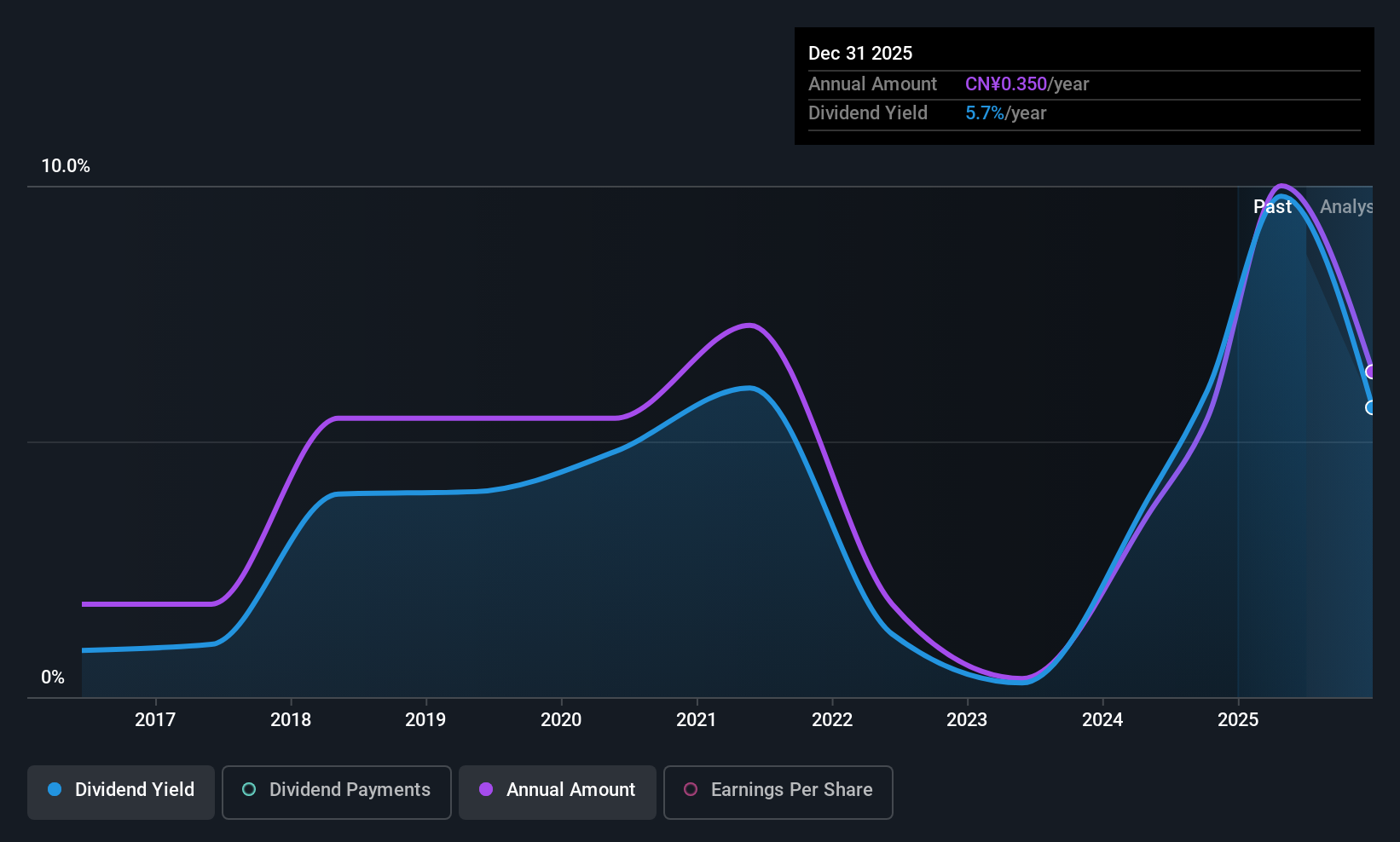

Dividend Yield: 8.9%

Jangho Group offers an attractive dividend yield of 8.94%, ranking in the top 25% of CN market payers, yet its dividends have been unreliable and volatile over the past decade. The high payout ratio (103.7%) indicates dividends are not well covered by earnings, though cash flows cover them with a reasonable cash payout ratio (56.9%). Recent earnings show a decline in net income to CNY 144.41 million from CNY 181.72 million year-on-year, which may impact future payouts.

- Unlock comprehensive insights into our analysis of Jangho Group stock in this dividend report.

- Our valuation report here indicates Jangho Group may be undervalued.

Beijing SDL TechnologyLtd (SZSE:002658)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Beijing SDL Technology Co., Ltd. develops and sells environmental monitoring equipment and solutions both in China and internationally, with a market cap of CN¥4.45 billion.

Operations: Beijing SDL Technology Co., Ltd.'s revenue is primarily derived from the development and sale of environmental monitoring equipment and solutions.

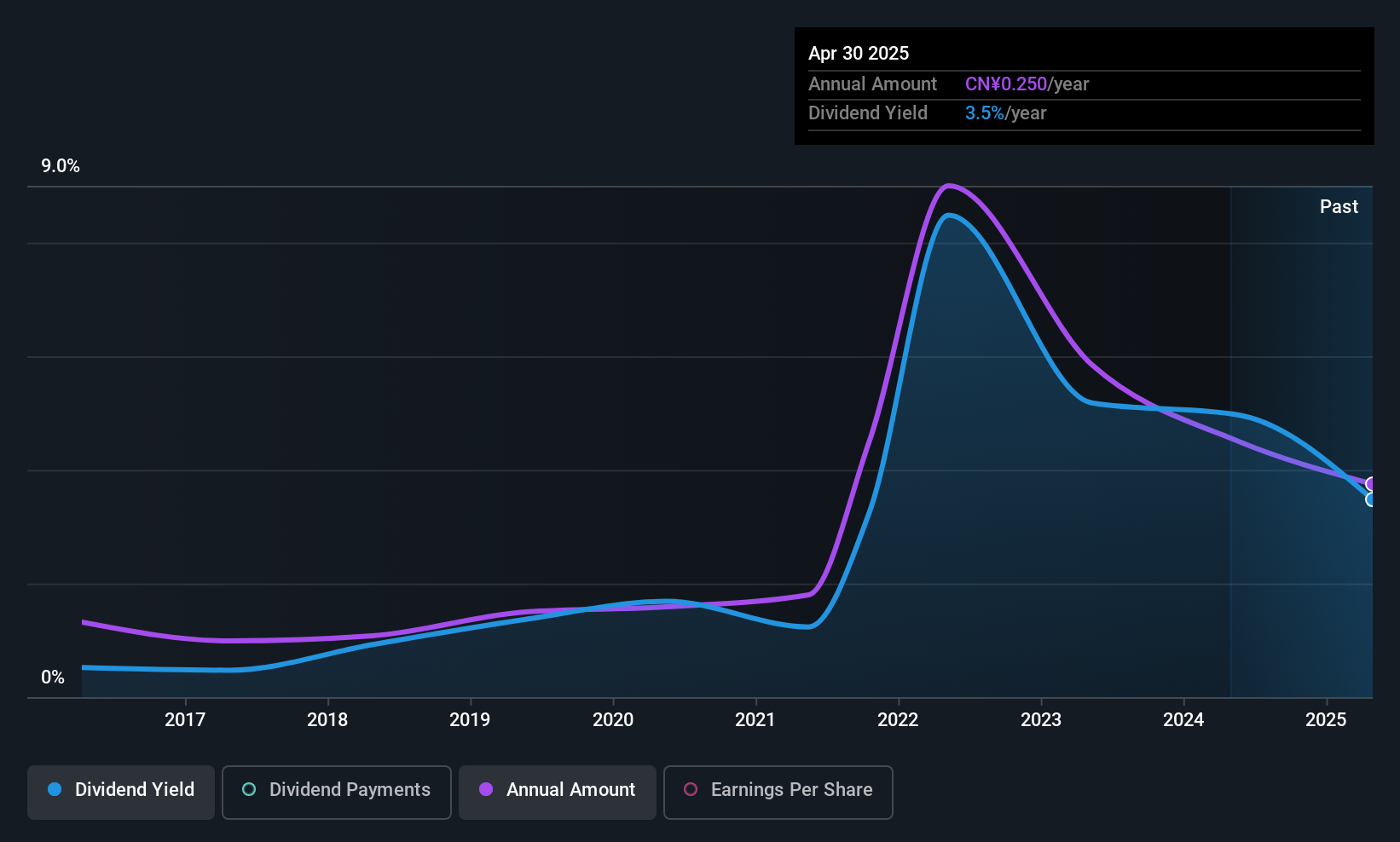

Dividend Yield: 3.2%

Beijing SDL Technology's dividend yield is among the top 25% in the CN market, supported by a payout ratio of 79.7% and a cash payout ratio of 75.7%, indicating coverage by both earnings and cash flows. However, its dividend history has been volatile over the past decade, with recent decreases in payouts despite improved Q1 earnings results showing net income of CNY 10.07 million compared to last year's loss.

- Click to explore a detailed breakdown of our findings in Beijing SDL TechnologyLtd's dividend report.

- Upon reviewing our latest valuation report, Beijing SDL TechnologyLtd's share price might be too optimistic.

Torishima Pump Mfg (TSE:6363)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Torishima Pump Mfg. Co., Ltd. is a company that manufactures and sells a range of pumps both in Japan and internationally, with a market capitalization of ¥51.47 billion.

Operations: Torishima Pump Mfg. Co., Ltd. generates revenue from the manufacturing and sale of various pumps in both domestic and international markets.

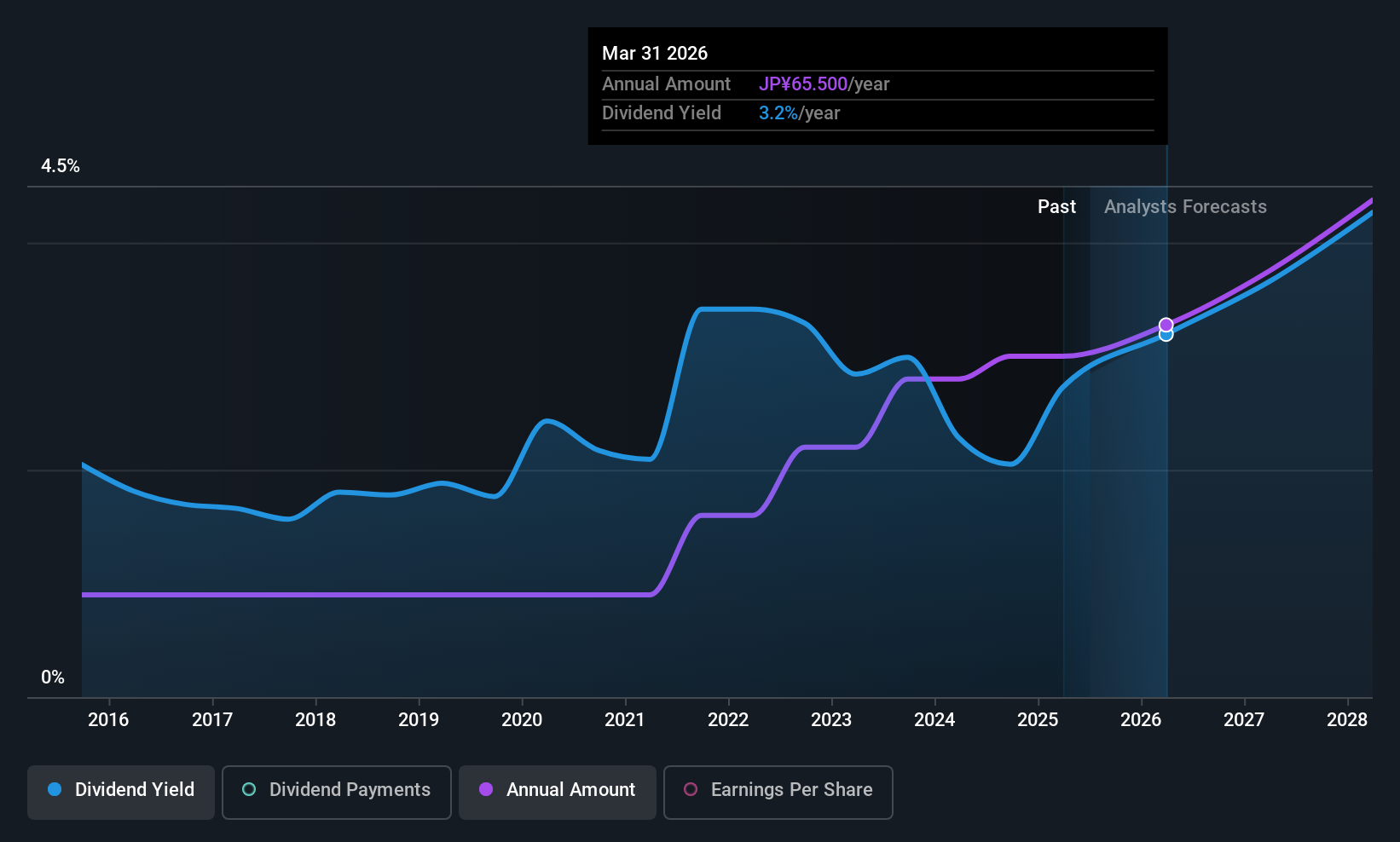

Dividend Yield: 3.1%

Torishima Pump Mfg. maintains stable and reliable dividends, with a low payout ratio of 25% covered by earnings, although not by free cash flows. The dividend yield of 3.1% is below the top tier in Japan's market. Recent news includes a share buyback program aimed at enhancing shareholder returns, with ¥1 billion allocated to repurchase up to 600,000 shares by March 2026, aligning with ongoing dividend increases for fiscal year-end payments.

- Take a closer look at Torishima Pump Mfg's potential here in our dividend report.

- The analysis detailed in our Torishima Pump Mfg valuation report hints at an deflated share price compared to its estimated value.

Key Takeaways

- Dive into all 1554 of the Top Global Dividend Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601886

Jangho Group

Engages in architectural decoration business in Mainland China, Hong Kong, Macau, Taiwan, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives