- Taiwan

- /

- Real Estate

- /

- TWSE:1442

Global Dividend Stocks To Consider In June 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of trade policies and inflation dynamics, investors are closely watching how these factors influence equity performance. With U.S. stocks showing resilience despite tariff uncertainties and European indices buoyed by easing inflation expectations, dividend stocks continue to offer a compelling option for those seeking steady income amidst market volatility. In this environment, a good dividend stock is often characterized by its ability to maintain consistent payouts and demonstrate financial stability, making it an attractive consideration for income-focused investors looking to weather economic fluctuations.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.07% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.23% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.50% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.44% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.32% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.18% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.40% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.88% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.70% | ★★★★★★ |

| Asian Terminals (PSE:ATI) | 6.38% | ★★★★★★ |

Click here to see the full list of 1563 stocks from our Top Global Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Mitsubishi Steel Mfg (TSE:5632)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mitsubishi Steel Mfg. Co., Ltd. specializes in manufacturing and selling steel products, construction machinery parts, automotive parts, and machinery and equipment, with a market capitalization of ¥22.62 billion.

Operations: Mitsubishi Steel Mfg. Co., Ltd.'s revenue primarily comes from its Special Steel segment at ¥81.53 billion, followed by the Spring segment at ¥66.10 billion, Machinery at ¥10.46 billion, and Formed & Fabricated Products at ¥9.22 billion.

Dividend Yield: 3.7%

Mitsubishi Steel Mfg. offers a dividend yield of 3.73%, slightly below the top 25% in the JP market, but its payout ratio of 41.1% indicates dividends are well covered by earnings despite an unstable track record over the past decade. Recent guidance suggests a JPY 40 per share dividend for fiscal year ending March 2026, up from JPY 34 previously, reflecting efforts to stabilize payouts under a new policy aiming for a total return ratio of at least 50%.

- Take a closer look at Mitsubishi Steel Mfg's potential here in our dividend report.

- Our valuation report here indicates Mitsubishi Steel Mfg may be overvalued.

Advancetek EnterpriseLtd (TWSE:1442)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Advancetek Enterprise Co., Ltd. operates in the construction, rental, and sale of residential and commercial buildings in Taiwan with a market capitalization of NT$27.47 billion.

Operations: Advancetek Enterprise Co., Ltd. generates revenue primarily from its Construction Business, which accounts for NT$8.27 billion, and its Construction Division, contributing NT$550.58 million.

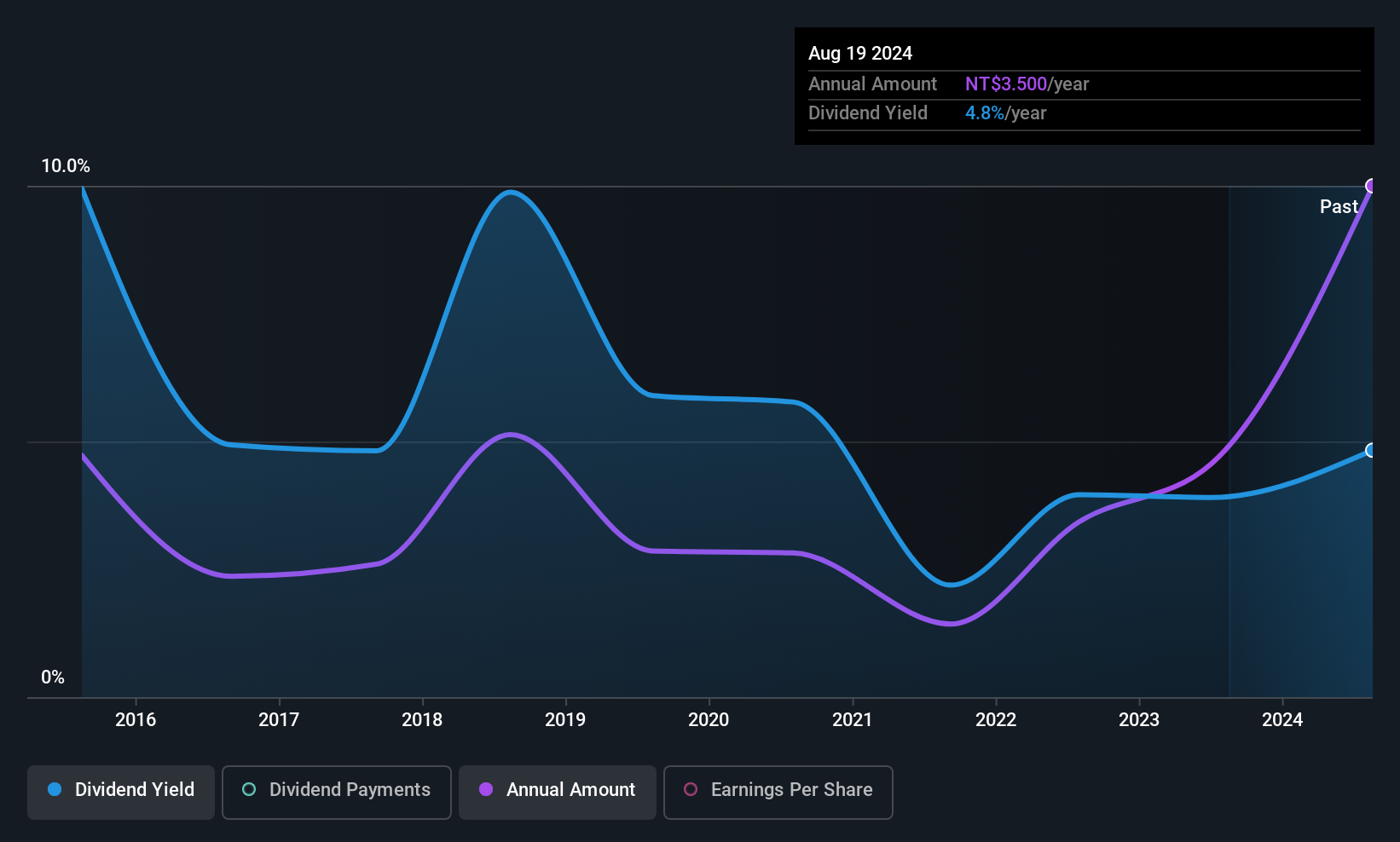

Dividend Yield: 4.6%

Advancetek Enterprise Ltd. offers a dividend yield of 4.59%, which is lower than the top 25% of dividend payers in Taiwan, yet its payout ratio of 35.5% ensures dividends are well covered by earnings and cash flows. Despite a history of volatility, recent announcements include a TWD 4.5 per share cash dividend for fiscal year-end 2024, totaling TWD 1.65 billion distributed to shareholders amidst ongoing regulatory investigations affecting company stability perceptions.

- Get an in-depth perspective on Advancetek EnterpriseLtd's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Advancetek EnterpriseLtd's share price might be too pessimistic.

AOPEN (TWSE:3046)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: AOPEN Incorporated is involved in the research, design, and marketing of computer products and lifestyle appliances across various global markets, with a market cap of NT$3.48 billion.

Operations: AOPEN's revenue is primarily derived from its operations in the research, design, and marketing of computer products and lifestyle appliances across Taiwan, the Americas, Europe, the Asia Pacific, and emerging markets.

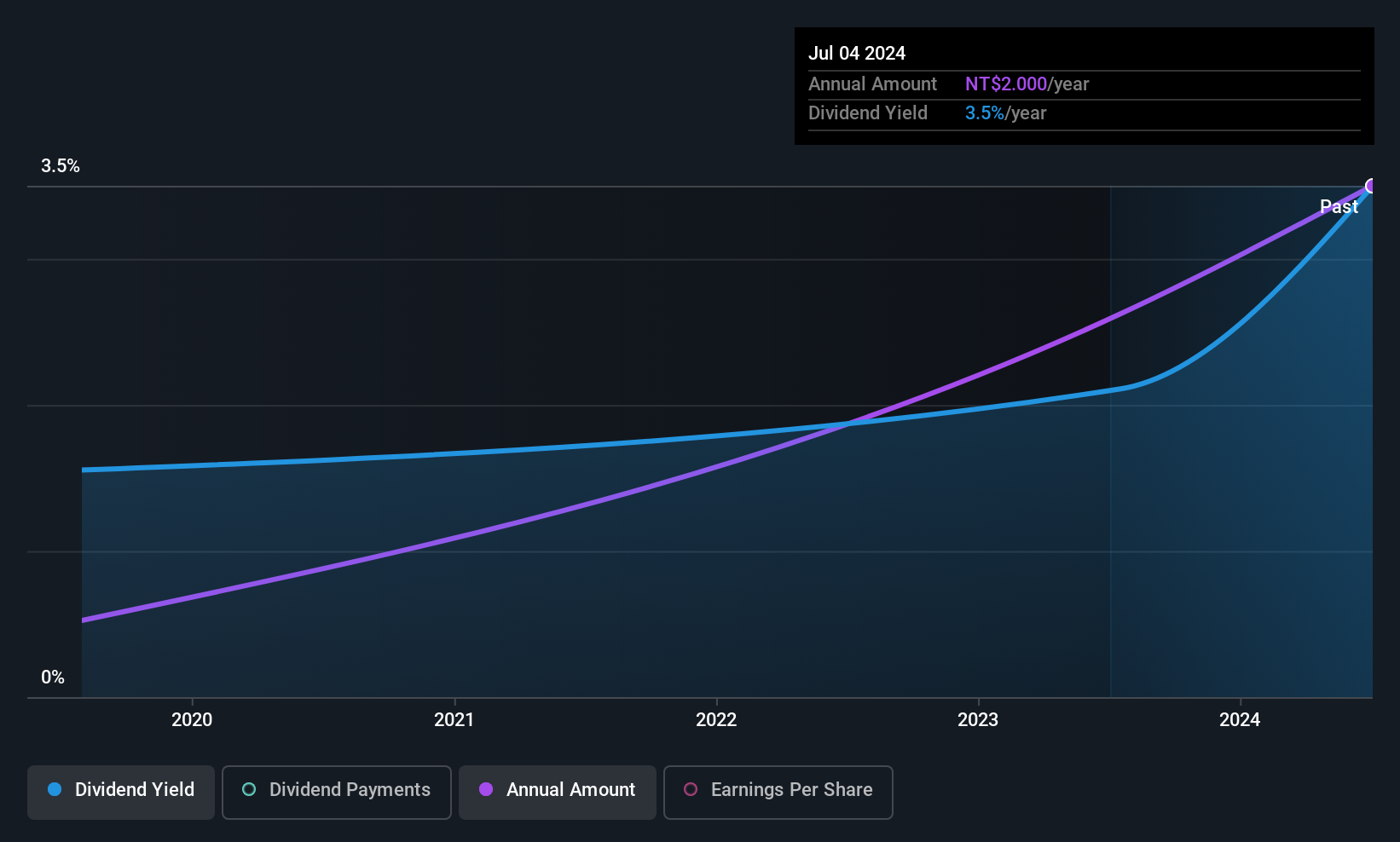

Dividend Yield: 5.5%

AOPEN's dividend yield of 5.54% ranks it among the top 25% of dividend payers in Taiwan, supported by a payout ratio of 68%. Despite earnings growth and dividends covered by cash flows (80.1%), its six-year history shows volatility and unreliability in payments. Recent earnings for Q1 2025 show increased sales and net income, while amendments to the Articles of Incorporation were approved at the May AGM, potentially impacting future governance.

- Unlock comprehensive insights into our analysis of AOPEN stock in this dividend report.

- Our comprehensive valuation report raises the possibility that AOPEN is priced higher than what may be justified by its financials.

Next Steps

- Unlock our comprehensive list of 1563 Top Global Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:1442

Advancetek EnterpriseLtd

Engages in the construction, rental, and sale of residential and commercial buildings in Taiwan.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives