As global markets navigate a landscape marked by new tariffs and mixed economic signals, investors are seeking stability amidst modest fluctuations in major indices. In this environment, dividend stocks can offer a reliable income stream and potential for growth, making them an attractive option for those looking to balance risk with reward in their portfolios.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.40% | ★★★★★★ |

| NCD (TSE:4783) | 4.35% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.27% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.43% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.11% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.46% | ★★★★★★ |

| Daicel (TSE:4202) | 4.79% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.01% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.65% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.53% | ★★★★★★ |

Click here to see the full list of 1521 stocks from our Top Global Dividend Stocks screener.

We'll examine a selection from our screener results.

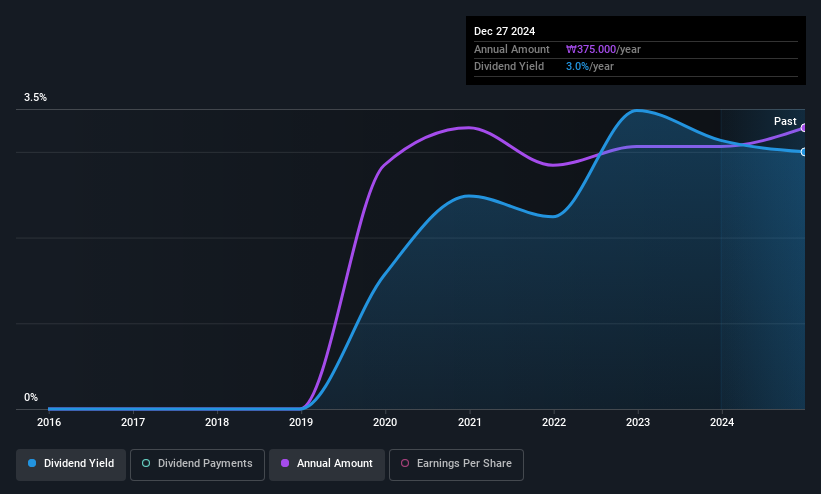

NeoPharm (KOSDAQ:A092730)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NeoPharm Co., Ltd. is a South Korean company that manufactures and sells skin care products, with a market cap of ₩245.41 billion.

Operations: NeoPharm Co., Ltd. generates revenue from its Personal Products segment, amounting to ₩122.41 billion.

Dividend Yield: 3.5%

NeoPharm's dividend, at 3.53%, ranks in the top 25% of Korean market payers, reflecting a stable yet relatively young history of six years. The company's dividends are well-supported by both earnings and cash flows, with payout ratios under 41%. While dividends have grown consistently and show little volatility, the stock trades at a significant discount to its estimated fair value. Earnings have grown steadily by 5.3% annually over five years, supporting future dividend sustainability.

- Dive into the specifics of NeoPharm here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that NeoPharm is trading behind its estimated value.

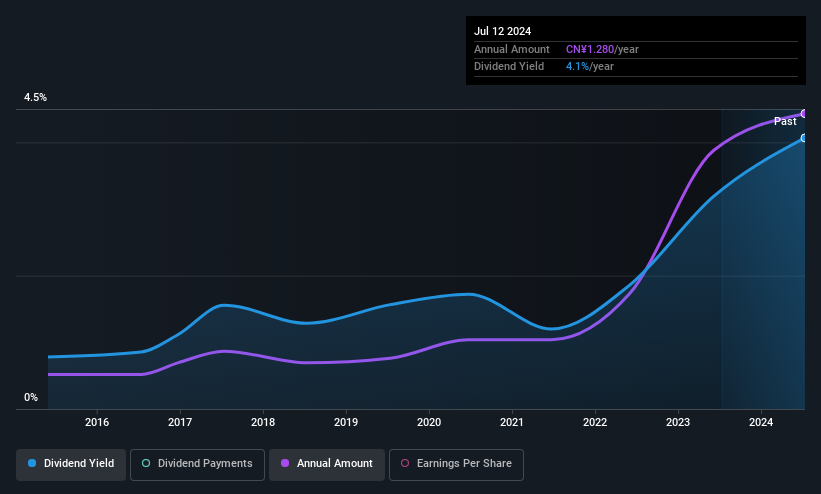

Tianjin Pharmaceutical Da Ren Tang Group (SHSE:600329)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tianjin Pharmaceutical Da Ren Tang Group Corporation Limited, with a market cap of CN¥23.51 billion, produces and sells traditional Chinese medicine, western medicine, and other products primarily in the People’s Republic of China.

Operations: Tianjin Pharmaceutical Da Ren Tang Group Corporation Limited generates revenue from its operations in traditional Chinese medicine and western medicine within the People’s Republic of China.

Dividend Yield: 3.6%

Tianjin Pharmaceutical Da Ren Tang Group's dividend yield of 3.58% is among the top 25% in China, with a payout ratio of 44.2%, indicating strong earnings support. However, its cash payout ratio of 79.4% suggests potential pressure on cash flows. Despite a decade-long increase in dividends, payments have been volatile and unreliable due to inconsistent growth patterns. The stock trades significantly below estimated fair value but faces challenges with forecasted earnings declines over the next three years.

- Take a closer look at Tianjin Pharmaceutical Da Ren Tang Group's potential here in our dividend report.

- Upon reviewing our latest valuation report, Tianjin Pharmaceutical Da Ren Tang Group's share price might be too pessimistic.

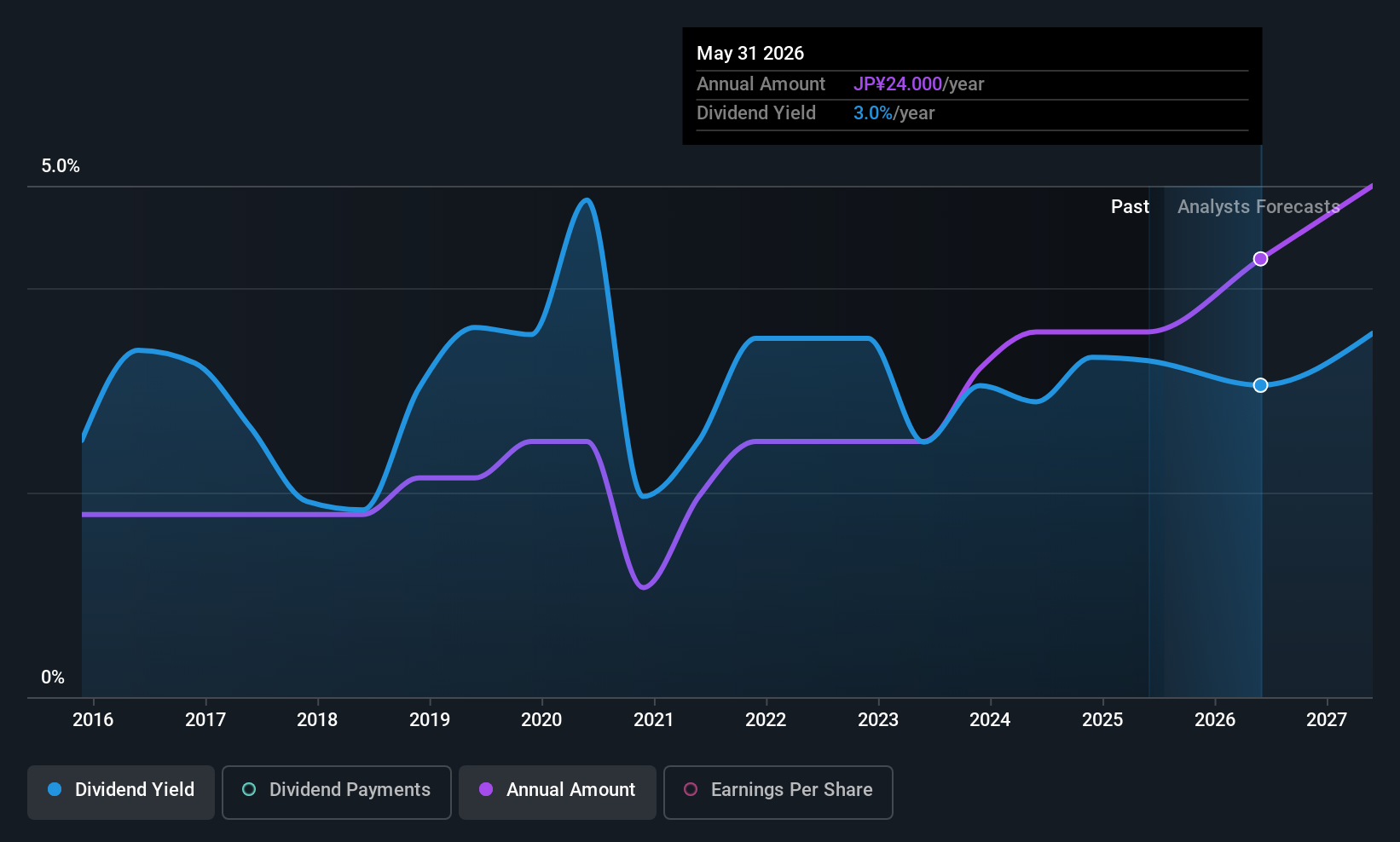

Sanko Gosei (TSE:7888)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sanko Gosei Ltd. is involved in the molding and sale of plastic parts both in Japan and internationally, with a market cap of ¥23.90 billion.

Operations: Sanko Gosei Ltd. generates its revenue through the molding and sale of plastic components across domestic and international markets.

Dividend Yield: 3.5%

Sanko Gosei Ltd. recently increased its annual dividend to ¥14 per share from ¥10, reflecting a commitment to rewarding shareholders. The company's dividends are well-covered by earnings and cash flows, with payout ratios of 19% and 25.7%, respectively. However, the dividend history has been volatile over the past decade despite recent growth in payments. Trading at 76.7% below estimated fair value, Sanko Gosei offers potential value but lacks top-tier yield compared to peers in Japan.

- Click to explore a detailed breakdown of our findings in Sanko Gosei's dividend report.

- Our valuation report here indicates Sanko Gosei may be undervalued.

Where To Now?

- Investigate our full lineup of 1521 Top Global Dividend Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7888

Sanko Gosei

Engages in the molding and sale of plastic parts in Japan and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives