Founder Sukumar Srinivas Just Bought A Handful Of Shares In Shankara Building Products Limited (NSE:SHANKARA)

Even if it's not a huge purchase, we think it was good to see that Sukumar Srinivas, the Founder of Shankara Building Products Limited (NSE:SHANKARA) recently shelled out ₹326k to buy stock, at ₹326 per share. Nevertheless, it only increased their shareholding by a minuscule percentage, and it wasn't a massive purchase by absolute value, either.

View our latest analysis for Shankara Building Products

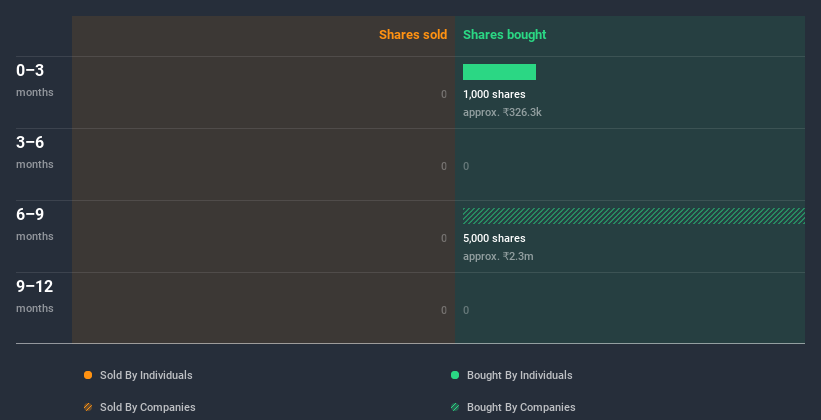

The Last 12 Months Of Insider Transactions At Shankara Building Products

Notably, that recent purchase by Sukumar Srinivas is the biggest insider purchase of Shankara Building Products shares that we've seen in the last year. That implies that an insider found the current price of ₹333 per share to be enticing. Of course they may have changed their mind. But this suggests they are optimistic. We do always like to see insider buying, but it is worth noting if those purchases were made at well below today's share price, as the discount to value may have narrowed with the rising price. Happily, the Shankara Building Products insider decided to buy shares at close to current prices. Sukumar Srinivas was the only individual insider to buy shares in the last twelve months.

The chart below shows insider transactions (by companies and individuals) over the last year. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

Shankara Building Products is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Insider Ownership

For a common shareholder, it is worth checking how many shares are held by company insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Shankara Building Products insiders own about ₹4.3b worth of shares (which is 56% of the company). I like to see this level of insider ownership, because it increases the chances that management are thinking about the best interests of shareholders.

So What Does This Data Suggest About Shankara Building Products Insiders?

The recent insider purchase is heartening. We also take confidence from the longer term picture of insider transactions. Along with the high insider ownership, this analysis suggests that insiders are quite bullish about Shankara Building Products. That's what I like to see! In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Shankara Building Products. For instance, we've identified 4 warning signs for Shankara Building Products (2 make us uncomfortable) you should be aware of.

Of course Shankara Building Products may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

When trading Shankara Building Products or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:SHANKARA

Shankara Building Products

Operates as a retailer of home improvement and building products in India.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026