Factors Income Investors Should Consider Before Adding Most Kwai Chung Limited (HKG:1716) To Their Portfolio

Could Most Kwai Chung Limited (HKG:1716) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

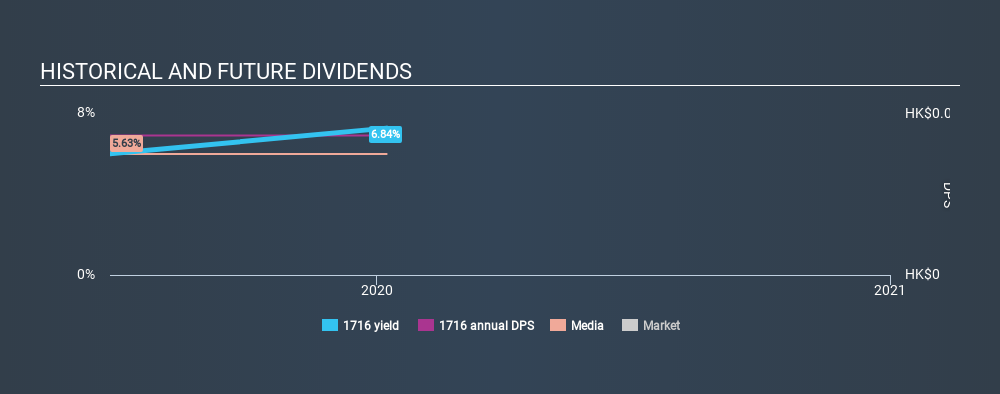

Most Kwai Chung has only been paying a dividend for a year or so, so investors might be curious about its 6.8% yield. When buying stocks for their dividends, you should always run through the checks below, to see if the dividend looks sustainable.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Looking at the data, we can see that 91% of Most Kwai Chung's profits were paid out as dividends in the last 12 months. With a payout ratio this high, we'd say its dividend is not well covered by earnings. This may be fine if earnings are growing, but it might not take much of a downturn for the dividend to come under pressure.

While the above analysis focuses on dividends relative to a company's earnings, we do note Most Kwai Chung's strong net cash position, which will let it pay larger dividends for a time, should it choose.

Consider getting our latest analysis on Most Kwai Chung's financial position here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. This company has been paying a dividend for less than 2 years, which we think is too soon to consider it a reliable dividend stock. Its most recent annual dividend was HK$0.052 per share.

Modest dividend growth is good to see, especially with the payments being relatively stable. However, the payment history is relatively short and we wouldn't want to rely on this dividend too much.

Dividend Growth Potential

The other half of the dividend investing equation is evaluating whether earnings per share (EPS) are growing. Over the long term, dividends need to grow at or above the rate of inflation, in order to maintain the recipient's purchasing power. Most Kwai Chung has grown its EPS 9.7% over the past 12 months. We're glad to see EPS up on last year, but we're conscious that growth rates typically slow as companies increase in size. Although per-share earnings are growing at a credible rate, virtually all of the income is being paid out as dividends to shareholders. This is okay, but may limit growth in the company's future dividend payments. Any one year of performance can be misleading for a variety of reasons, so we wouldn't like to form any strong conclusions based on these numbers alone.

We'd also point out that Most Kwai Chung issued a meaningful number of new shares in the past year. Regularly issuing new shares can be detrimental - it's hard to grow dividends per share when new shares are regularly being created.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. Most Kwai Chung is paying out a larger percentage of its profit than we're comfortable with. Unfortunately, earnings growth has also been mediocre, and we think it has not been paying dividends long enough to demonstrate resilience across economic cycles. In summary, we're unenthused by Most Kwai Chung as a dividend stock. It's not that we think it is a bad company; it simply falls short of our criteria in some key areas.

You can also discover whether shareholders are aligned with insider interests by checking our visualisation of insider shareholdings and trades in Most Kwai Chung stock.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:1716

Most Kwai Chung

An investment holding company, provides integrated advertising and media services primarily in Hong Kong.

Flawless balance sheet low.

Market Insights

Community Narratives