- Poland

- /

- Entertainment

- /

- WSE:IMG

European Penny Stocks To Watch In June 2025

Reviewed by Simply Wall St

As the European markets navigate renewed uncertainty surrounding U.S. trade policies and escalating geopolitical tensions in the Middle East, investors are keeping a close eye on potential opportunities. Penny stocks, though an older term, continue to represent intriguing prospects for growth by focusing on smaller or newer companies that might not yet have captured widespread attention. When these stocks are backed by strong financials and clear growth potential, they can offer an appealing mix of stability and opportunity for those looking to explore this segment of the market.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| KebNi (OM:KEBNI B) | SEK1.878 | SEK509.23M | ✅ 3 ⚠️ 4 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.69 | SEK276.69M | ✅ 4 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €3.02 | €63.7M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.57 | €17.09M | ✅ 2 ⚠️ 3 View Analysis > |

| Abak (WSE:ABK) | PLN4.00 | PLN10.78M | ✅ 2 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.37 | SEK2.27B | ✅ 4 ⚠️ 1 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.70 | SEK225.1M | ✅ 2 ⚠️ 2 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €1.04 | €83.92M | ✅ 3 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.125 | €293.39M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.982 | €33.12M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 453 stocks from our European Penny Stocks screener.

Let's dive into some prime choices out of the screener.

ELES Semiconductor Equipment (BIT:ELES)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ELES Semiconductor Equipment S.p.A. designs, manufactures, and sells test equipment, fixtures, solutions, and services for the semiconductor industry both in Italy and internationally, with a market cap of €36.31 million.

Operations: The company's revenue is primarily derived from its Semiconductor Equipment and Services segment, which generated €35.73 million.

Market Cap: €36.31M

ELES Semiconductor Equipment S.p.A. has shown robust financial performance with earnings growth of 55.6% over the past year, surpassing industry trends and reversing a five-year decline. The company's short-term assets comfortably cover both its short and long-term liabilities, indicating strong liquidity. Its debt is well managed, with a net debt to equity ratio of 28.7% and interest payments adequately covered by EBIT. However, the stock remains highly volatile compared to other Italian stocks, and recent hostile acquisition attempts by Mare Engineering Group S.p.A., offering €2.25 per share, add uncertainty to its market position.

- Navigate through the intricacies of ELES Semiconductor Equipment with our comprehensive balance sheet health report here.

- Gain insights into ELES Semiconductor Equipment's outlook and expected performance with our report on the company's earnings estimates.

Glycorex Transplantation (NGM:GTAB B)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Glycorex Transplantation AB (publ) is a medical technology company specializing in transplantation, blood transfusion, and autoimmune diseases, with a market cap of SEK189.25 million.

Operations: The company's revenue is primarily derived from its Organ Transplantation segment, totaling SEK36.76 million.

Market Cap: SEK189.25M

Glycorex Transplantation AB faces challenges typical of penny stocks, with its recent quarterly revenue at SEK10.26 million and a net loss of SEK1.66 million, reflecting ongoing unprofitability. The company benefits from having more cash than debt and a sufficient cash runway exceeding three years, even as free cash flow declines by 37.4% annually. While the board is relatively inexperienced with an average tenure of 2.4 years, short-term assets surpass both short- and long-term liabilities, suggesting manageable financial stability despite negative return on equity and increased debt-to-equity ratio over five years to 0.5%.

- Click here to discover the nuances of Glycorex Transplantation with our detailed analytical financial health report.

- Gain insights into Glycorex Transplantation's historical outcomes by reviewing our past performance report.

Immersion Games (WSE:IMG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Immersion Games S.A. specializes in designing, developing, and producing virtual reality and PC games in the United States, with a market cap of PLN16.03 million.

Operations: Immersion Games S.A. has not reported any specific revenue segments.

Market Cap: PLN16.02M

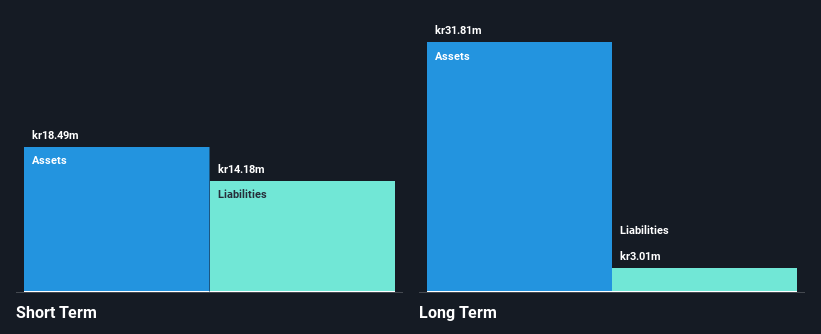

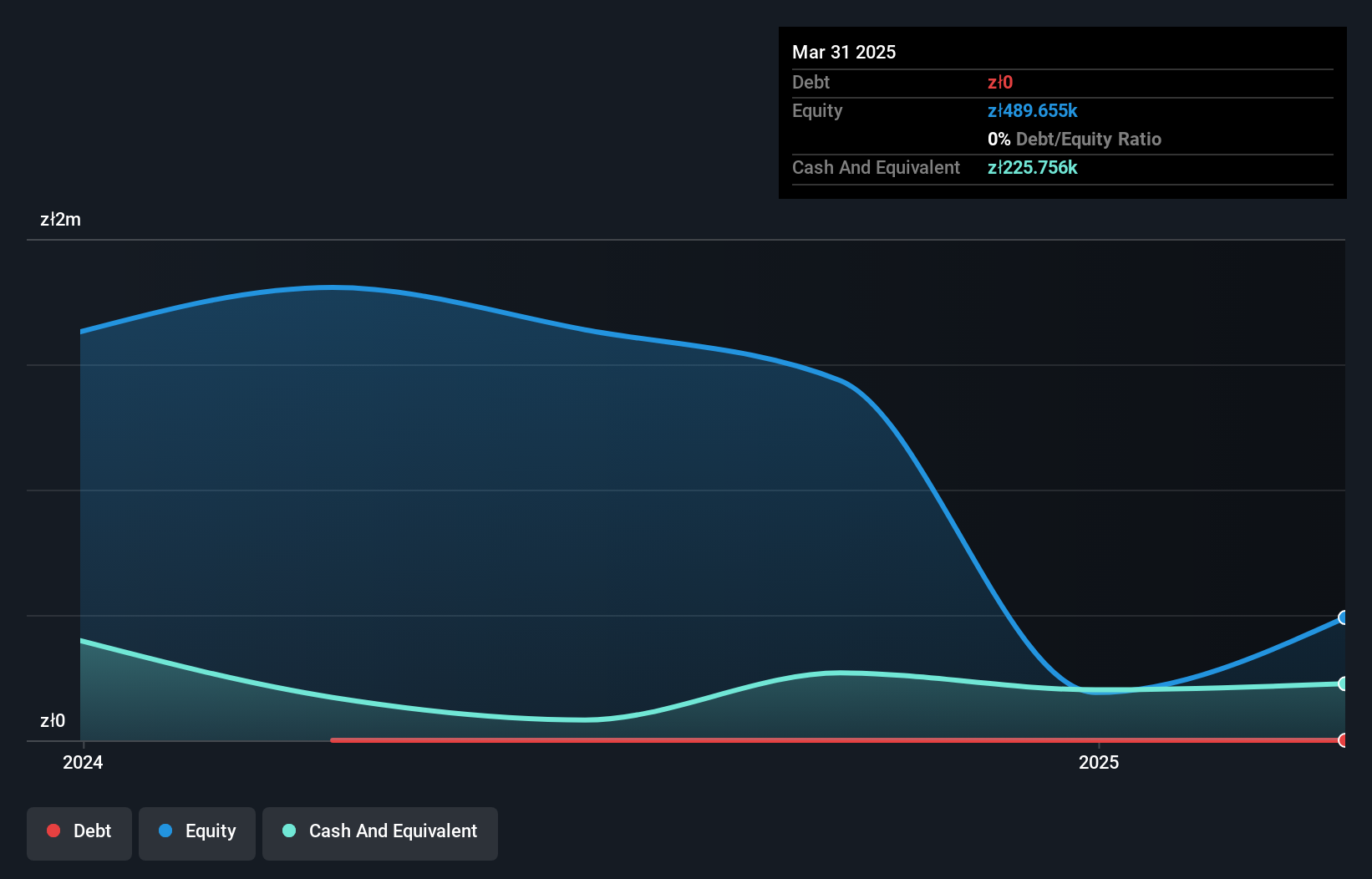

Immersion Games S.A., with a market cap of PLN16.03 million, remains pre-revenue despite recent revenue growth, reporting PLN0.66 million for Q1 2025 and PLN2.43 million for the full year 2024. The company is unprofitable but debt-free, with short-term assets exceeding liabilities and a cash runway extending beyond three years even as free cash flow shrinks significantly annually. Shareholders have not faced dilution recently, though the company's negative return on equity highlights ongoing financial challenges typical of penny stocks in this sector.

- Unlock comprehensive insights into our analysis of Immersion Games stock in this financial health report.

- Examine Immersion Games' past performance report to understand how it has performed in prior years.

Next Steps

- Take a closer look at our European Penny Stocks list of 453 companies by clicking here.

- Interested In Other Possibilities? AI is about to change healthcare. These 22 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:IMG

Immersion Games

Engages in the design, development, and production of virtual reality and PC games in the United States.

Flawless balance sheet slight.

Market Insights

Community Narratives