- Poland

- /

- Capital Markets

- /

- WSE:CPA

European Penny Stocks Spotlight: Windon Energy Group And Two More Picks

Reviewed by Simply Wall St

The European market has recently experienced a boost, with the pan-European STOXX Europe 600 Index rising by 1.77%, driven partly by the reopening of the U.S. federal government, although tempered by cooling sentiment on artificial intelligence. In this context, penny stocks—often representing smaller or newer companies—continue to capture investor interest due to their potential for growth at lower price points. Despite being considered an outdated term, these stocks remain relevant as they can offer significant opportunities when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €3.628 | €1.26B | ✅ 5 ⚠️ 2 View Analysis > |

| Orthex Oyj (HLSE:ORTHEX) | €4.78 | €84.89M | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €246.7M | ✅ 3 ⚠️ 3 View Analysis > |

| Altri SGPS (ENXTLS:ALTR) | €4.555 | €934.37M | ✅ 3 ⚠️ 2 View Analysis > |

| Libertas 7 (BME:LIB) | €3.28 | €69.57M | ✅ 3 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.34 | SEK203.2M | ✅ 2 ⚠️ 2 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.30 | €380.05M | ✅ 4 ⚠️ 1 View Analysis > |

| High (ENXTPA:HCO) | €4.01 | €78.44M | ✅ 1 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.095 | €289.57M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 276 stocks from our European Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Windon Energy Group (DB:NW1)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Windon Energy Group AB operates in the energy sector with a market capitalization of €18.24 million.

Operations: Windon Energy Group AB has not reported any revenue segments.

Market Cap: €18.24M

Windon Energy Group AB, with a market cap of €18.24 million, operates in the energy sector and has reported revenue of SEK 13.75 million for the first half of 2025, showing a slight increase from the previous year. Despite being debt-free and having sufficient short-term assets to cover liabilities, the company remains unprofitable with a negative return on equity of -26.8%. Its share price is highly volatile compared to most German stocks, and it lacks meaningful revenue growth due to limited financial data availability. However, Windon Energy's cash runway suggests operational sustainability for over a year without additional funding needs.

- Unlock comprehensive insights into our analysis of Windon Energy Group stock in this financial health report.

- Examine Windon Energy Group's past performance report to understand how it has performed in prior years.

BrainCool (OM:BRAIN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: BrainCool AB (publ) is a medical device company that develops, markets, and sells medical cooling systems for the healthcare sector in Sweden, with a market cap of SEK147.73 million.

Operations: The company generates revenue of SEK46.13 million from its medical products segment.

Market Cap: SEK147.73M

BrainCool AB, with a market cap of SEK147.73 million, reported third-quarter sales of SEK14.89 million, showing growth from the previous year but remains unprofitable with a net loss of SEK9.24 million. The company is debt-free and has sufficient short-term assets to cover liabilities but faces high share price volatility and limited cash runway despite raising additional capital through a rights offering of approximately SEK42.23 million. Management is experienced; however, the board lacks tenure stability. While trading significantly below estimated fair value, BrainCool's revenue growth potential offers an intriguing yet cautious opportunity in penny stocks.

- Get an in-depth perspective on BrainCool's performance by reading our balance sheet health report here.

- Assess BrainCool's future earnings estimates with our detailed growth reports.

Capital Partners (WSE:CPA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Capital Partners S.A. offers strategic and transaction consulting services in Poland with a market capitalization of PLN8.73 million.

Operations: Capital Partners S.A. has not reported any specific revenue segments.

Market Cap: PLN8.73M

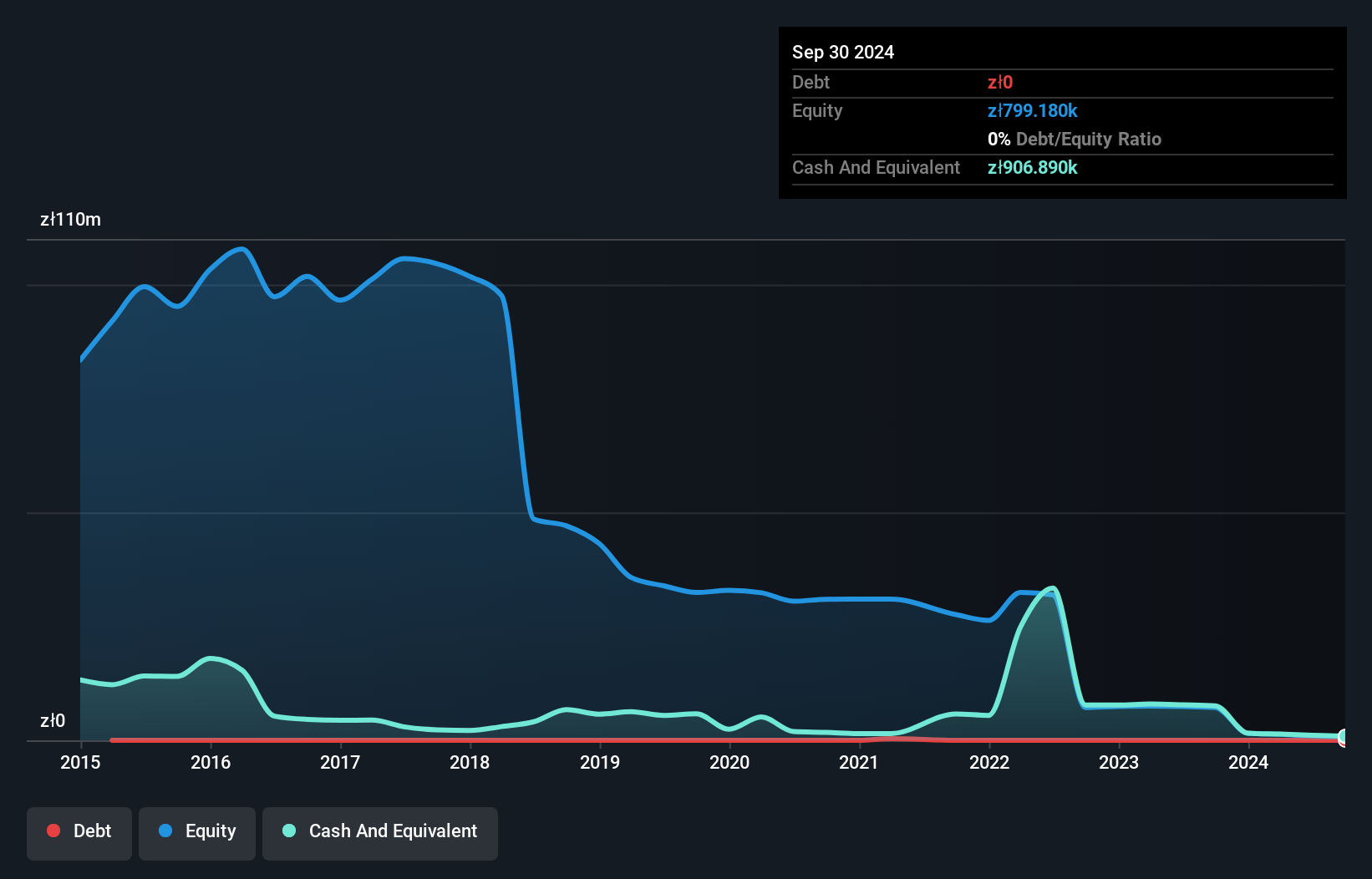

Capital Partners S.A., with a market cap of PLN8.73 million, is pre-revenue, reporting minimal revenues and consistent net losses, including a PLN0.12769 million loss in Q3 2025. The company is debt-free and has sufficient short-term assets to cover its liabilities but experiences high share price volatility. Shareholders have not faced significant dilution recently, and the board boasts extensive experience with an average tenure of 16.5 years. Despite its unprofitability and negative return on equity of -166.24%, Capital Partners remains free from long-term liabilities, presenting both risks and potential opportunities typical for penny stocks.

- Click here and access our complete financial health analysis report to understand the dynamics of Capital Partners.

- Evaluate Capital Partners' historical performance by accessing our past performance report.

Where To Now?

- Dive into all 276 of the European Penny Stocks we have identified here.

- Interested In Other Possibilities? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:CPA

Capital Partners

Provides strategic and transaction consulting services in Poland.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives