- Italy

- /

- Electrical

- /

- BIT:CMB

European Dividend Stocks Yielding Up To 6.2%

Reviewed by Simply Wall St

Amid renewed uncertainty about U.S. trade policy and escalating geopolitical tensions in the Middle East, European markets have experienced a downturn, with major indexes such as Germany's DAX and Italy's FTSE MIB seeing significant declines. In this challenging environment, dividend stocks can offer investors a measure of stability and income potential, making them an attractive choice for those seeking to navigate market volatility while benefiting from regular payouts.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.54% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.01% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.45% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.42% | ★★★★★★ |

| Mapfre (BME:MAP) | 4.88% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.51% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.98% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.81% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.92% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.55% | ★★★★★★ |

Click here to see the full list of 238 stocks from our Top European Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Cembre (BIT:CMB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cembre S.p.A. manufactures and sells electrical connectors, cable accessories, and tools across Italy, Europe, and internationally, with a market cap of €939.96 million.

Operations: Cembre S.p.A.'s revenue primarily stems from its Electric Connectors and Related Tools segment, which generated €231.29 million.

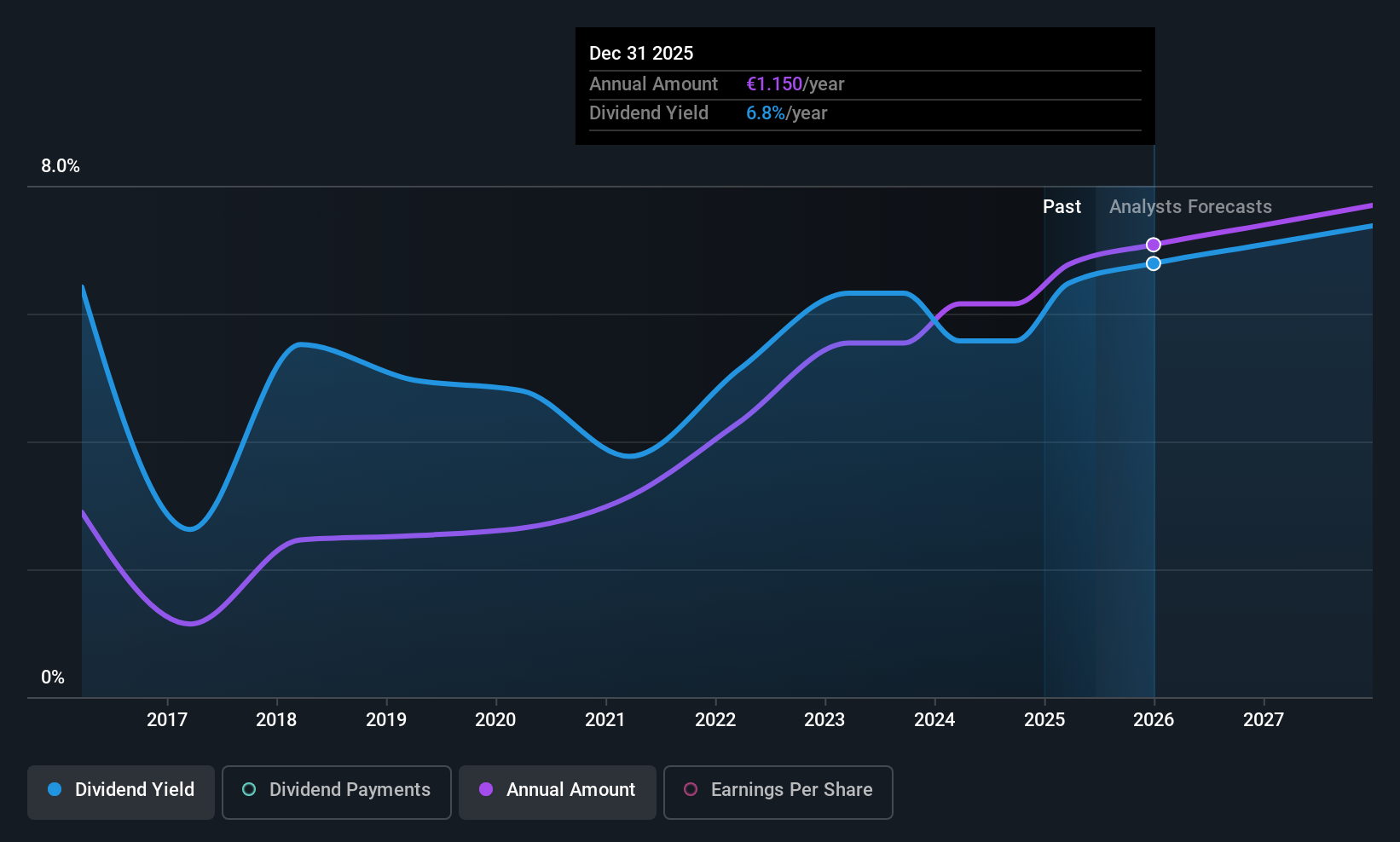

Dividend Yield: 3.4%

Cembre's dividend yield of 3.36% is below the top quartile in Italy, but dividends have been reliably growing over the past decade with minimal volatility. Despite a reasonable payout ratio of 70.6%, dividends are not well covered by free cash flows, indicated by a high cash payout ratio of 121.4%. Recent Q1 earnings showed growth with net income at €11.9 million compared to €9.72 million last year, reflecting solid financial performance amidst dividend sustainability concerns.

- Click here and access our complete dividend analysis report to understand the dynamics of Cembre.

- Our comprehensive valuation report raises the possibility that Cembre is priced higher than what may be justified by its financials.

United Bankers Oyj (HLSE:UNITED)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: United Bankers Oyj offers investment products and services in Finland and Sweden, with a market cap of €191.09 million.

Operations: United Bankers Oyj generates revenue primarily through Wealth Management, which accounts for €59.23 million, and Capital Market Services, contributing €0.71 million.

Dividend Yield: 6.3%

United Bankers Oyj offers a compelling dividend yield of 6.29%, placing it in the top quartile of Finnish dividend payers. Despite a volatile dividend history, recent payments have been well-covered by earnings and cash flows, with payout ratios at 66.2% and 41.8% respectively, suggesting sustainability. Recent strategic moves include share repurchases and management changes to strengthen operations, while dividends are affirmed at €1.10 per share for 2025, reflecting confidence in ongoing financial health.

- Click here to discover the nuances of United Bankers Oyj with our detailed analytical dividend report.

- The analysis detailed in our United Bankers Oyj valuation report hints at an deflated share price compared to its estimated value.

Luzerner Kantonalbank (SWX:LUKN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Luzerner Kantonalbank AG offers a range of banking products and services in Switzerland and has a market capitalization of CHF3.48 billion.

Operations: Luzerner Kantonalbank AG generates revenue through its diverse banking products and services within Switzerland.

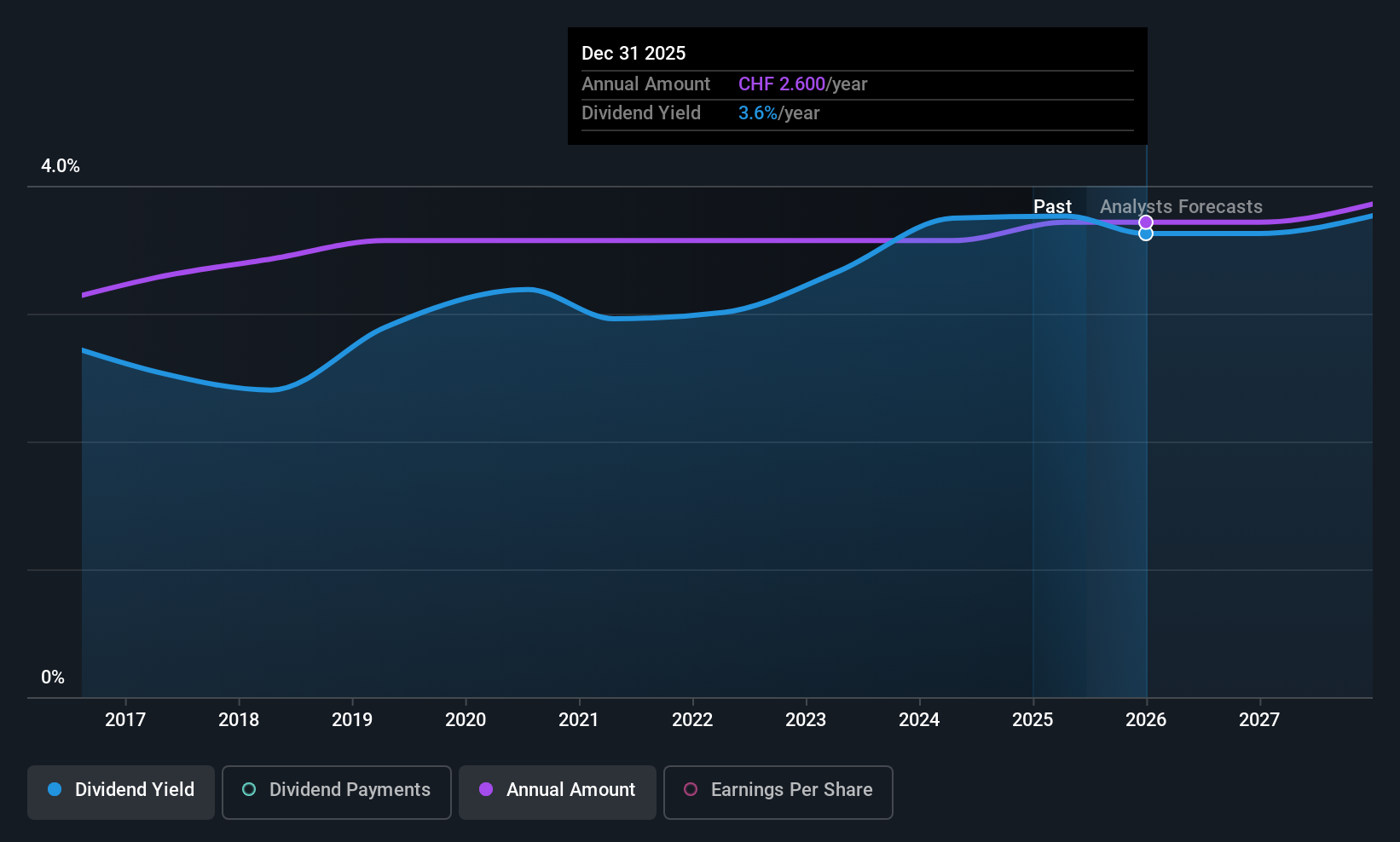

Dividend Yield: 3.7%

Luzerner Kantonalbank maintains a stable dividend history with consistent growth over the past decade, supported by a low payout ratio of 44.7%, indicating sustainability. Despite offering a modest yield of 3.69%, below the top Swiss market payers, its dividends remain well-covered and reliable. Recent earnings for Q1 2025 showed net interest income rising to CHF 229.39 million and net income increasing to CHF 76.59 million, reinforcing its financial resilience and dividend potential.

- Take a closer look at Luzerner Kantonalbank's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Luzerner Kantonalbank is trading behind its estimated value.

Where To Now?

- Explore the 238 names from our Top European Dividend Stocks screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:CMB

Cembre

Engages in the manufacture and sale of electrical connectors, cable accessories, and tools in Italy, the rest of Europe, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives