- United States

- /

- Electrical

- /

- NYSE:EMR

Emerson Electric (EMR) Unveils AI-Enabled Virtual Advisor For Power And Water Sectors

Reviewed by Simply Wall St

Emerson Electric (EMR) recently launched the Ovation™ AI-enabled Virtual Advisor, marking a significant step in AI integration within automation solutions for the power and water industries. This product-related announcement may have influenced Emerson's stock, which saw a 39% increase over the past quarter. During a period when major market indexes displayed mixed trends due to inflation data and varied earnings reports, Emerson's advancements in AI and their strategic partnerships, such as with Tata Technologies, likely bolstered investor confidence. Additionally, the broader tech rally driven by Nvidia's positive performance could have supported Emerson's upward trajectory.

The recent launch of Emerson Electric's Ovation™ AI-enabled Virtual Advisor underscores the firm's ongoing commitment to innovation in the power and water automation sectors. This progression in artificial intelligence may contribute to reinforcing Emerson's market position, potentially enhancing revenue streams and investor sentiment. Over the past five years, Emerson's stock has provided a total shareholder return of 150.31%, illustrating robust long-term growth. However, within the past year, Emerson underperformed compared to the US Electrical industry, which had a return of 31.6%.

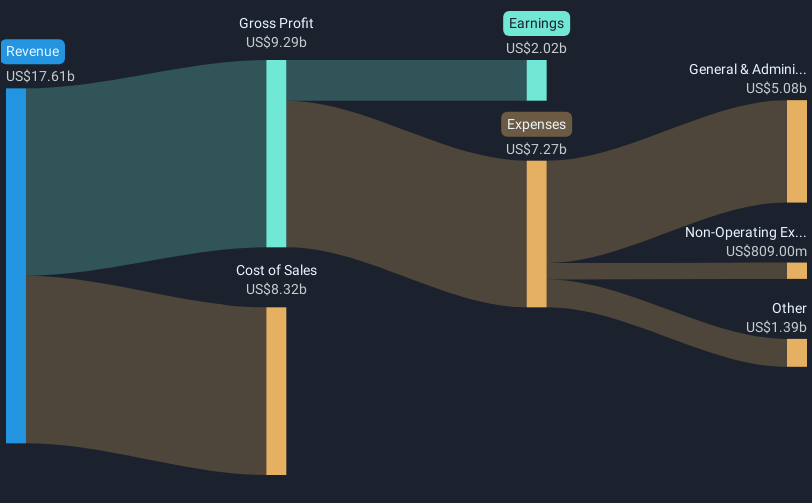

Despite the recent positive news and short-term gains, Emerson's current share price of $139.90 is slightly above analysts' consensus price target of $141.38. This marginal gap suggests that the market has already priced in much of the anticipated growth and innovation. Analysts foresee Emerson's revenue increasing to $20.20 billion with earnings reaching $3.20 billion by 2028. The integration with AspenTech and tariff mitigation measures remain critical to achieving these forecasts, particularly in maintaining and improving profit margins. Consequently, the success of these endeavors could notably impact the company's future valuation and competitiveness in various global markets.

Assess Emerson Electric's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emerson Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EMR

Emerson Electric

A technology and software company, provides various solutions in the Americas, Asia, the Middle East, Africa, and Europe.

Established dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives