- United States

- /

- Pharma

- /

- NYSE:LLY

Eli Lilly (NYSE:LLY) Eyes US$1.3 Billion Acquisition Of Verve Therapeutics

Reviewed by Simply Wall St

Eli Lilly (NYSE:LLY) recently saw its stock price rise by 6.63% over the last month, a movement potentially influenced by significant events such as its advanced negotiations to acquire gene editing startup Verve Therapeutics for up to $1.3 billion. This acquisition aligns with Lilly's focus on expanding its pipeline of experimental medicines. Additionally, the company engaged in a global partnership with Juvena Therapeutics, which could further enhance its portfolio. Despite broader market volatility due to geopolitical tensions and fluctuating oil prices, these strategic endeavors likely contributed positively to Eli Lilly's share performance amidst a largely stable market.

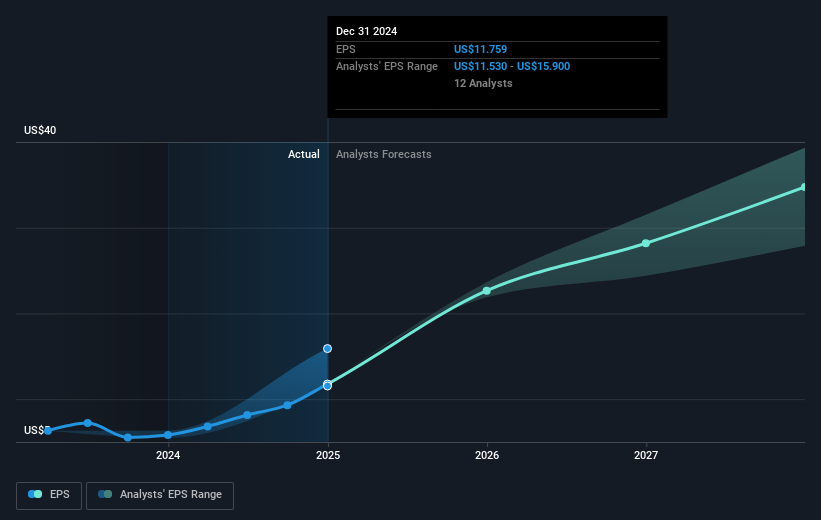

The recent developments involving Eli Lilly's acquisition talks with Verve Therapeutics and partnership with Juvena Therapeutics could significantly influence the company's revenue and earnings forecast. By expanding its pipeline into gene editing and bolstering its portfolio, Lilly is strategically positioning itself in high-demand areas, potentially accelerating its revenue growth. These moves could also affect upcoming Phase III trial results, thereby offering new growth avenues.

Over the past five years, Eli Lilly has demonstrated considerable strength, delivering a total return of 433.75%. This long-term performance is substantial, especially when considering recent fluctuations in broader markets. While over the past year, Eli Lilly's return is aligned with the US Pharmaceuticals industry, which saw a 7.9% decline, it has underperformed compared to the US Market's 10.9% gain.

The company's current share price movement, rising 6.63% last month, shows promise but remains below the consensus analyst price target of US$981.63. This indicates potential room for further appreciation as investors factor in future earnings growth and margin expansion. Analysts expect revenue of US$85.1 billion with a PE ratio alignment at 33.0x by 2028, highlighting a market-optimistic view even amidst potential risks like regulatory delays and tariff impacts.

Our valuation report unveils the possibility Eli Lilly's shares may be trading at a premium.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eli Lilly might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LLY

Eli Lilly

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals in the United States, Europe, China, Japan, and internationally.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives