Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Ebix, Inc. (NASDAQ:EBIX) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Ebix

What Is Ebix's Net Debt?

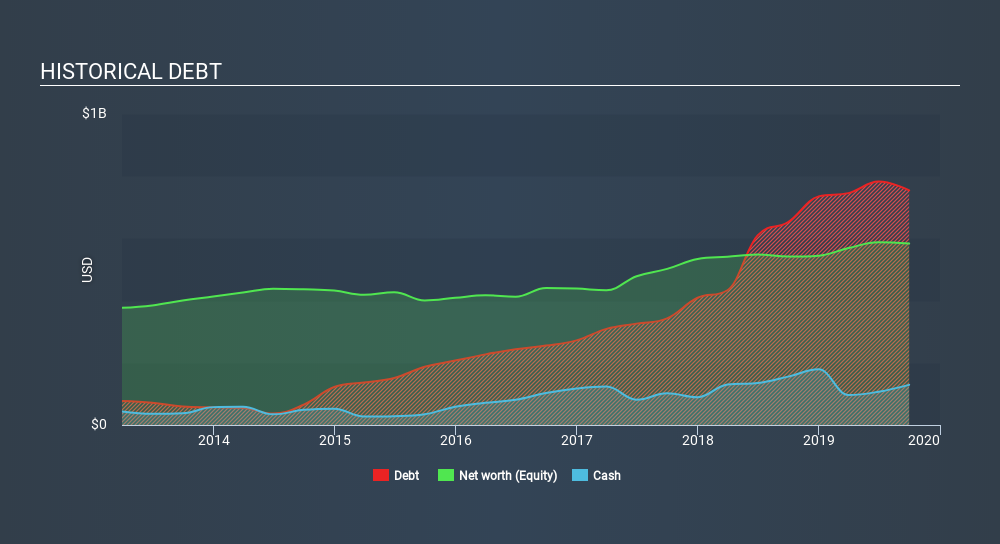

The image below, which you can click on for greater detail, shows that at September 2019 Ebix had debt of US$754.6m, up from US$652.2m in one year. On the flip side, it has US$129.0m in cash leading to net debt of about US$625.6m.

How Strong Is Ebix's Balance Sheet?

The latest balance sheet data shows that Ebix had liabilities of US$253.8m due within a year, and liabilities of US$768.2m falling due after that. Offsetting this, it had US$129.0m in cash and US$177.3m in receivables that were due within 12 months. So its liabilities total US$715.7m more than the combination of its cash and short-term receivables.

This deficit is considerable relative to its market capitalization of US$1.18b, so it does suggest shareholders should keep an eye on Ebix's use of debt. This suggests shareholders would heavily diluted if the company needed to shore up its balance sheet in a hurry.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Ebix has a debt to EBITDA ratio of 3.9 and its EBIT covered its interest expense 3.5 times. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. Notably, Ebix's EBIT was pretty flat over the last year, which isn't ideal given the debt load. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Ebix's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. During the last three years, Ebix produced sturdy free cash flow equating to 59% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Both Ebix's net debt to EBITDA and its interest cover were discouraging. At least its conversion of EBIT to free cash flow gives us reason to be optimistic. When we consider all the factors discussed, it seems to us that Ebix is taking some risks with its use of debt. While that debt can boost returns, we think the company has enough leverage now. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 3 warning signs for Ebix (1 can't be ignored) you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About OTCPK:EBIX.Q

Ebix

Provides on-demand infrastructure software exchanges and e-commerce services to the insurance, financial, travel, cash remittance, and healthcare industries in the United States and internationally.

Medium-low and good value.

Similar Companies

Market Insights

Community Narratives