Does Tongda Group Holdings Limited's (HKG:698) CEO Pay Matter?

Ya Nan Wang is the CEO of Tongda Group Holdings Limited (HKG:698). This report will, first, examine the CEO compensation levels in comparison to CEO compensation at companies of similar size. Next, we'll consider growth that the business demonstrates. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. The aim of all this is to consider the appropriateness of CEO pay levels.

View our latest analysis for Tongda Group Holdings

How Does Ya Nan Wang's Compensation Compare With Similar Sized Companies?

At the time of writing, our data says that Tongda Group Holdings Limited has a market cap of HK$2.8b, and reported total annual CEO compensation of HK$1.3m for the year to December 2019. That's below the compensation, last year. We think total compensation is more important but we note that the CEO salary is lower, at HK$360k. We further remind readers that the CEO may face performance requirements to receive the non-salary part of the total compensation. When we examined a selection of companies with market caps ranging from HK$1.6b to HK$6.2b, we found the median CEO total compensation was HK$3.2m.

Next, let's break down remuneration compositions to understand how the industry and company compare with each other. On a sector level, around 78% of total compensation represents salary and 22% is other remuneration. Readers will want to know that Tongda Group Holdings pays a modest slice of remuneration through salary, as compared to the wider sector.

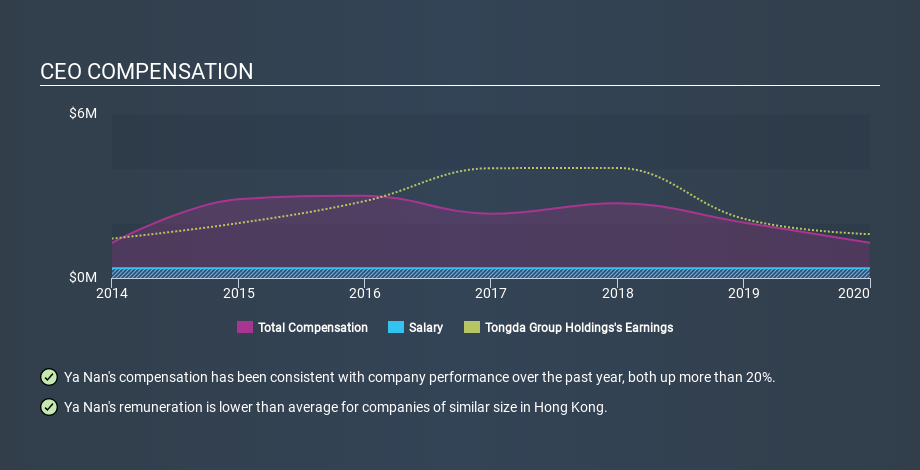

Most shareholders would consider it a positive that Ya Nan Wang takes less total compensation than the CEOs of most similar size companies, leaving more for shareholders. Though positive, it's important we delve into the performance of the actual business. The graphic below shows how CEO compensation at Tongda Group Holdings has changed from year to year.

Is Tongda Group Holdings Limited Growing?

Over the last three years Tongda Group Holdings Limited has shrunk its earnings per share by an average of 34% per year (measured with a line of best fit). It achieved revenue growth of 3.2% over the last year.

Unfortunately, earnings per share have trended lower over the last three years. The modest increase in revenue in the last year isn't enough to make me overlook the disappointing change in earnings per share. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Shareholders might be interested in this free visualization of analyst forecasts.

Has Tongda Group Holdings Limited Been A Good Investment?

With a three year total loss of 78%, Tongda Group Holdings Limited would certainly have some dissatisfied shareholders. So shareholders would probably think the company shouldn't be too generous with CEO compensation.

In Summary...

It appears that Tongda Group Holdings Limited remunerates its CEO below most similar sized companies.

Ya Nan Wang is paid less than CEOs of similar size companies, but the company isn't growing and total shareholder returns have been disappointing. Considering all these factors, we'd stop short of saying the CEO pay is too high, but we don't think shareholders would want to see a pay rise before business performance improves. Shifting gears from CEO pay for a second, we've picked out 2 warning signs for Tongda Group Holdings that investors should be aware of in a dynamic business environment.

If you want to buy a stock that is better than Tongda Group Holdings, this free list of high return, low debt companies is a great place to look.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About SEHK:698

Tongda Group Holdings

An investment holding company, provides high-precision structural components for smart mobile communications and consumer electronic products.

Reasonable growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion