- Japan

- /

- Electronic Equipment and Components

- /

- TSE:7567

Does Sakae Electronics (TYO:7567) Have A Healthy Balance Sheet?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Sakae Electronics Corporation (TYO:7567) does use debt in its business. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Sakae Electronics

What Is Sakae Electronics's Net Debt?

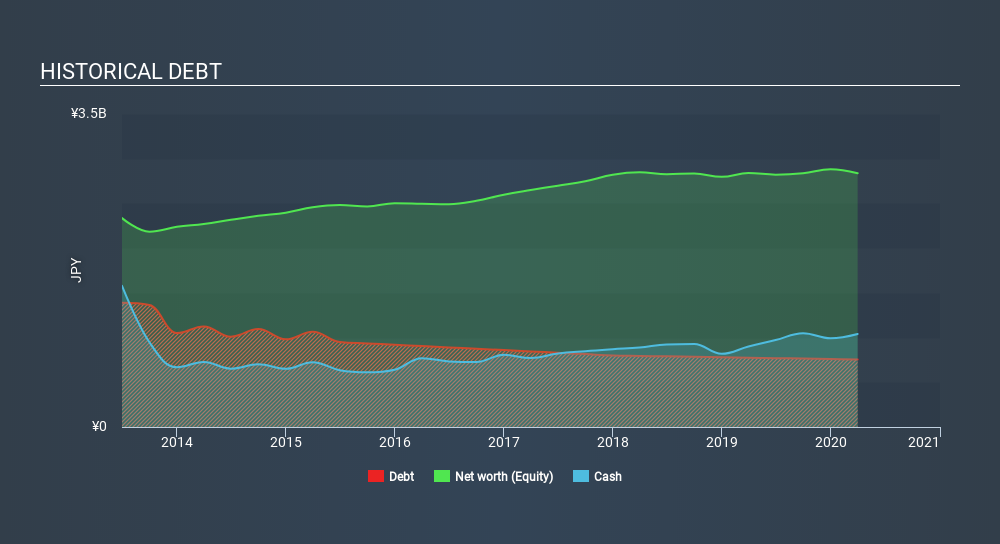

As you can see below, Sakae Electronics had JP¥755.0m of debt, at March 2020, which is about the same as the year before. You can click the chart for greater detail. But it also has JP¥1.04b in cash to offset that, meaning it has JP¥285.0m net cash.

A Look At Sakae Electronics's Liabilities

The latest balance sheet data shows that Sakae Electronics had liabilities of JP¥1.97b due within a year, and liabilities of JP¥162.0m falling due after that. On the other hand, it had cash of JP¥1.04b and JP¥1.56b worth of receivables due within a year. So it can boast JP¥463.0m more liquid assets than total liabilities.

It's good to see that Sakae Electronics has plenty of liquidity on its balance sheet, suggesting conservative management of liabilities. Because it has plenty of assets, it is unlikely to have trouble with its lenders. Simply put, the fact that Sakae Electronics has more cash than debt is arguably a good indication that it can manage its debt safely.

In fact Sakae Electronics's saving grace is its low debt levels, because its EBIT has tanked 32% in the last twelve months. Falling earnings (if the trend continues) could eventually make even modest debt quite risky. When analysing debt levels, the balance sheet is the obvious place to start. But it is Sakae Electronics's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. Sakae Electronics may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Happily for any shareholders, Sakae Electronics actually produced more free cash flow than EBIT over the last three years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Summing up

While it is always sensible to investigate a company's debt, in this case Sakae Electronics has JP¥285.0m in net cash and a decent-looking balance sheet. The cherry on top was that in converted 102% of that EBIT to free cash flow, bringing in JP¥199m. So is Sakae Electronics's debt a risk? It doesn't seem so to us. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Consider for instance, the ever-present spectre of investment risk. We've identified 5 warning signs with Sakae Electronics (at least 1 which can't be ignored) , and understanding them should be part of your investment process.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About TSE:7567

Sakae Electronics

Trades in general industrial electronic components in Japan.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Alphabet Inc. (GOOG): The Gemini Era – Consolidating AI Dominance in 2026.

Meta Platforms Inc (META): The AI Infrastructure Pivot – Monetizing the Next Frontier in 2026.

Enlight Renewable Energy Ltd. (ENLT): Scaling the Global Green Grid – A 2026 Powerhouse.

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Nu holdings will continue to disrupt the South American banking market