In 2012, Neal Coleman was appointed CEO of Pulse Seismic Inc. (TSE:PSD). This report will, first, examine the CEO compensation levels in comparison to CEO compensation at companies of similar size. Then we'll look at a snap shot of the business growth. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. The aim of all this is to consider the appropriateness of CEO pay levels.

See our latest analysis for Pulse Seismic

How Does Neal Coleman's Compensation Compare With Similar Sized Companies?

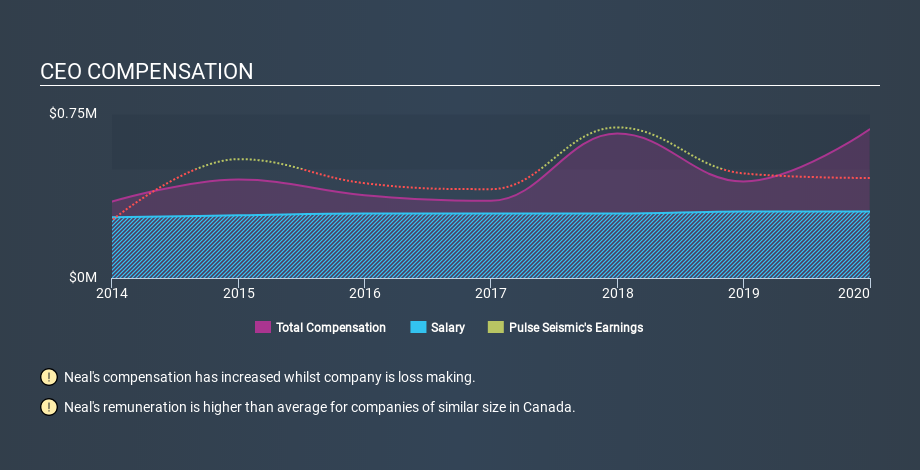

At the time of writing, our data says that Pulse Seismic Inc. has a market cap of CA$42m, and reported total annual CEO compensation of CA$680k for the year to December 2019. Notably, that's an increase of 54% over the year before. While we always look at total compensation first, we note that the salary component is less, at CA$304k. We looked at a group of companies with market capitalizations under CA$279m, and the median CEO total compensation was CA$217k.

Pay mix tells us a lot about how a company functions versus the wider industry, and it's no different in the case of Pulse Seismic. On an industry level, roughly 42% of total compensation represents salary and 58% is other remuneration. Pulse Seismic does not set aside a larger portion of remuneration in the form of salary, maintaining the same rate as the wider market.

It would therefore appear that Pulse Seismic Inc. pays Neal Coleman more than the median CEO remuneration at companies of a similar size, in the same market. However, this fact alone doesn't mean the remuneration is too high. A closer look at the performance of the underlying business will give us a better idea about whether the pay is particularly generous. You can see, below, how CEO compensation at Pulse Seismic has changed over time.

Is Pulse Seismic Inc. Growing?

Pulse Seismic Inc. has reduced its earnings per share by an average of 8.3% a year, over the last three years (measured with a line of best fit). In the last year, its revenue is up 137%.

The reduction in earnings per share, over three years, is arguably concerning. But in contrast the revenue growth is strong, suggesting future potential for earnings growth. It's hard to reach a conclusion about business performance right now. This may be one to watch. You might want to check this free visual report on analyst forecasts for future earnings.

Has Pulse Seismic Inc. Been A Good Investment?

Since shareholders would have lost about 66% over three years, some Pulse Seismic Inc. shareholders would surely be feeling negative emotions. It therefore might be upsetting for shareholders if the CEO were paid generously.

In Summary...

We compared the total CEO remuneration paid by Pulse Seismic Inc., and compared it to remuneration at a group of similar sized companies. As discussed above, we discovered that the company pays more than the median of that group.

Over the last three years, shareholder returns have been downright disappointing, and the underlying business has failed to impress us. This doesn't look great when you consider CEO remuneration is up on last year. Although we'd stop short of calling it inappropriate, we think the CEO compensation is probably more on the generous side of things. On another note, we've spotted 4 warning signs for Pulse Seismic that investors should look into moving forward.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:PSD

Pulse Seismic

Acquires, markets, and licenses two-dimensional (2D) and three-dimensional (3D) seismic data for the energy sector in Canada.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

Hims & Hers Health aims for three dimensional revenue expansion

West Africa's 20 Baggers Gold Play (Nigeria/Senegal)

Tesla’s Nvidia Moment – The AI & Robotics Inflection Point

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Early mover in a fast growing industry. Likely to experience share price volatility as they scale