- United Kingdom

- /

- Hospitality

- /

- LSE:PPH

Does PPHE Hotel Group Limited's (LON:PPH) P/E Ratio Signal A Buying Opportunity?

Today, we'll introduce the concept of the P/E ratio for those who are learning about investing. To keep it practical, we'll show how PPHE Hotel Group Limited's (LON:PPH) P/E ratio could help you assess the value on offer. Looking at earnings over the last twelve months, PPHE Hotel Group has a P/E ratio of 15.00. In other words, at today's prices, investors are paying £15.00 for every £1 in prior year profit.

View our latest analysis for PPHE Hotel Group

How Do I Calculate A Price To Earnings Ratio?

The formula for price to earnings is:

Price to Earnings Ratio = Share Price ÷ Earnings per Share (EPS)

Or for PPHE Hotel Group:

P/E of 15.00 = £12.000 ÷ £0.800 (Based on the trailing twelve months to December 2019.)

(Note: the above calculation results may not be precise due to rounding.)

Is A High P/E Ratio Good?

A higher P/E ratio means that buyers have to pay a higher price for each £1 the company has earned over the last year. That isn't necessarily good or bad, but a high P/E implies relatively high expectations of what a company can achieve in the future.

Does PPHE Hotel Group Have A Relatively High Or Low P/E For Its Industry?

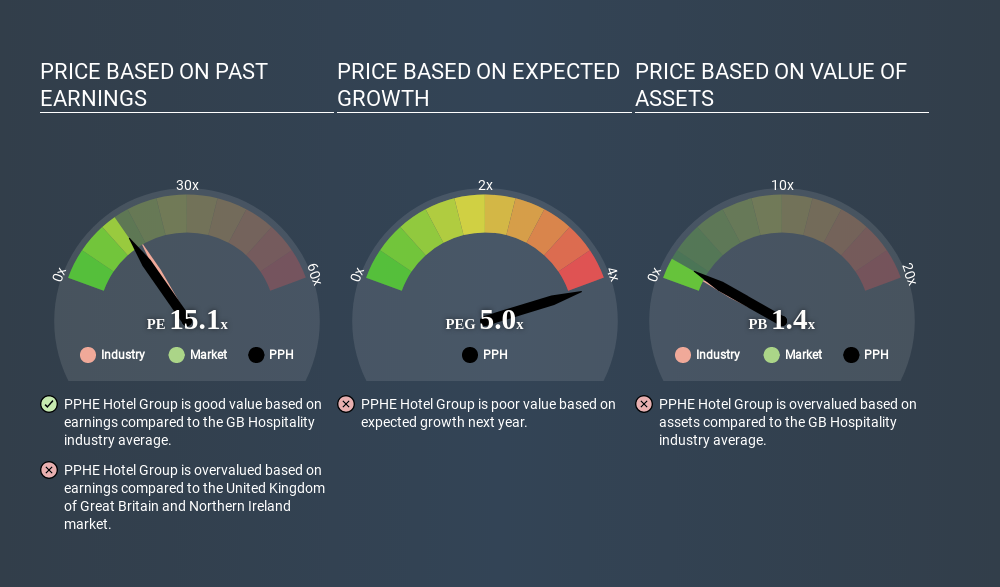

The P/E ratio indicates whether the market has higher or lower expectations of a company. If you look at the image below, you can see PPHE Hotel Group has a lower P/E than the average (18.0) in the hospitality industry classification.

PPHE Hotel Group's P/E tells us that market participants think it will not fare as well as its peers in the same industry. Many investors like to buy stocks when the market is pessimistic about their prospects. If you consider the stock interesting, further research is recommended. For example, I often monitor director buying and selling.

How Growth Rates Impact P/E Ratios

Companies that shrink earnings per share quickly will rapidly decrease the 'E' in the equation. Therefore, even if you pay a low multiple of earnings now, that multiple will become higher in the future. So while a stock may look cheap based on past earnings, it could be expensive based on future earnings.

PPHE Hotel Group saw earnings per share decrease by 11% last year. And it has shrunk its earnings per share by 1.3% per year over the last three years. This could justify a low P/E.

Remember: P/E Ratios Don't Consider The Balance Sheet

One drawback of using a P/E ratio is that it considers market capitalization, but not the balance sheet. In other words, it does not consider any debt or cash that the company may have on the balance sheet. Hypothetically, a company could reduce its future P/E ratio by spending its cash (or taking on debt) to achieve higher earnings.

Spending on growth might be good or bad a few years later, but the point is that the P/E ratio does not account for the option (or lack thereof).

So What Does PPHE Hotel Group's Balance Sheet Tell Us?

PPHE Hotel Group has net debt worth a very significant 102% of its market capitalization. This level of debt justifies a relatively low P/E, so remain cognizant of the debt, if you're comparing it to other stocks.

The Verdict On PPHE Hotel Group's P/E Ratio

PPHE Hotel Group trades on a P/E ratio of 15.0, which is fairly close to the GB market average of 15.0. With significant debt and no EPS growth last year, the P/E suggests shareholders are expecting higher profit in the future.

Investors have an opportunity when market expectations about a stock are wrong. If it is underestimating a company, investors can make money by buying and holding the shares until the market corrects itself. So this free report on the analyst consensus forecasts could help you make a master move on this stock.

You might be able to find a better buy than PPHE Hotel Group. If you want a selection of possible winners, check out this free list of interesting companies that trade on a P/E below 20 (but have proven they can grow earnings).

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About LSE:PPH

PPHE Hotel Group

Owns, co-owns, develops, leases, operates, and franchises hospitality real estate in the Netherlands, the United Kingdom, Germany, Croatia, Austria, Hungary, Italy, and Serbia.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion