- Hong Kong

- /

- Construction

- /

- SEHK:1637

Does It Make Sense To Buy SH Group (Holdings) Limited (HKG:1637) For Its Yield?

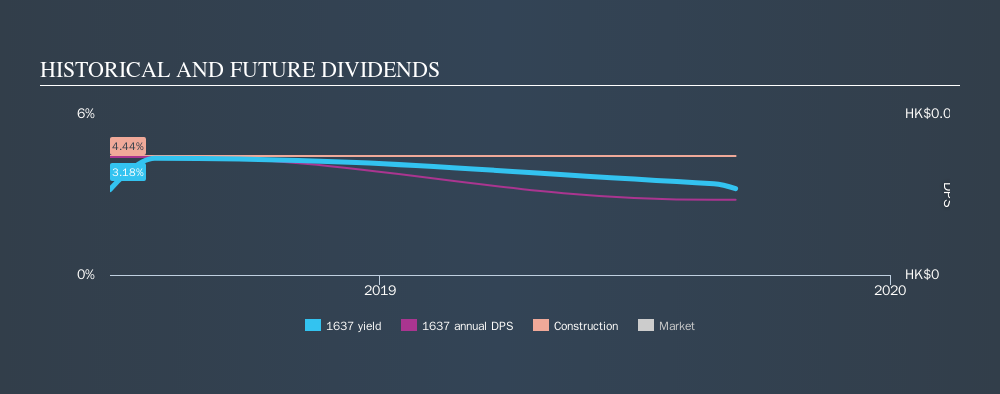

Is SH Group (Holdings) Limited (HKG:1637) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. Unfortunately, it's common for investors to be enticed in by the seemingly attractive yield, and lose money when the company has to cut its dividend payments.

SH Group (Holdings) has only been paying a dividend for a year or so, so investors might be curious about its 3.2% yield." Some simple research can reduce the risk of buying SH Group (Holdings) for its dividend - read on to learn more.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Looking at the data, we can see that 25% of SH Group (Holdings)'s profits were paid out as dividends in the last 12 months. We'd say its dividends are thoroughly covered by earnings.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. Unfortunately, while SH Group (Holdings) pays a dividend, it also reported negative free cash flow last year. While there may be a good reason for this, it's not ideal from a dividend perspective.

While the above analysis focuses on dividends relative to a company's earnings, we do note SH Group (Holdings)'s strong net cash position, which will let it pay larger dividends for a time, should it choose.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. This company has been paying a dividend for less than 2 years, which we think is too soon to consider it a reliable dividend stock. The dividend has fallen 36% over that period.

A shrinking dividend over a one-year period is not ideal, and we'd be concerned about investing in a dividend stock that lacks a solid record of growing dividends per share.

Dividend Growth Potential

Examining whether the dividend is affordable and stable is important. However, it's also important to assess if earnings per share (EPS) are growing. Over the long term, dividends need to grow at or above the rate of inflation, in order to maintain the recipient's purchasing power. Over the past five years, it looks as though SH Group (Holdings)'s EPS have declined at around 6.2% a year. A modest decline in earnings per share is not great to see, but it doesn't automatically make a dividend unsustainable. Still, we'd vastly prefer to see EPS growth when researching dividend stocks.

Conclusion

To summarise, shareholders should always check that SH Group (Holdings)'s dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. First, we like SH Group (Holdings)'s low dividend payout ratio, although we're a bit concerned that it paid out a substantially higher percentage of its free cash flow. Second, earnings per share have been in decline, and the dividend history is shorter than we'd like. In summary, SH Group (Holdings) has a number of shortcomings that we'd find it hard to get past. Things could change, but we think there are a number of better ideas out there.

Now, if you want to look closer, it would be worth checking out our free research on SH Group (Holdings) management tenure, salary, and performance.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:1637

SH Group (Holdings)

An investment holding company, provides electrical and mechanical (E&M) engineering services for public and private sectors in Hong Kong.

Flawless balance sheet slight.

Market Insights

Community Narratives