- Hong Kong

- /

- Capital Markets

- /

- SEHK:388

Does Hong Kong Exchanges and Clearing's (HKG:388) Share Price Gain of 39% Match Its Business Performance?

Stock pickers are generally looking for stocks that will outperform the broader market. Buying under-rated businesses is one path to excess returns. For example, the Hong Kong Exchanges and Clearing Limited (HKG:388) share price is up 39% in the last 5 years, clearly besting the market return of around -2.9% (ignoring dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 11% , including dividends .

Check out our latest analysis for Hong Kong Exchanges and Clearing

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

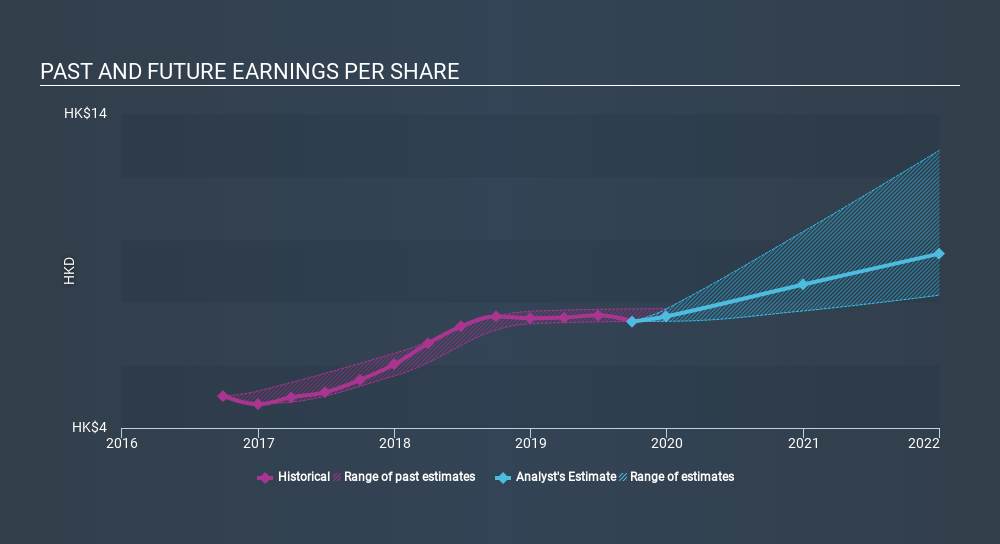

During five years of share price growth, Hong Kong Exchanges and Clearing achieved compound earnings per share (EPS) growth of 13% per year. This EPS growth is higher than the 6.8% average annual increase in the share price. So one could conclude that the broader market has become more cautious towards the stock.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Hong Kong Exchanges and Clearing, it has a TSR of 58% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's good to see that Hong Kong Exchanges and Clearing has rewarded shareholders with a total shareholder return of 11% in the last twelve months. That's including the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 9.6% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Is Hong Kong Exchanges and Clearing cheap compared to other companies? These 3 valuation measures might help you decide.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:388

Hong Kong Exchanges and Clearing

Owns and operates stock and futures exchanges, and related clearing houses in Hong Kong, the United Kingdom, and Mainland China.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives