Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Hind Rectifiers Limited (NSE:HIRECT) does use debt in its business. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Hind Rectifiers

What Is Hind Rectifiers's Net Debt?

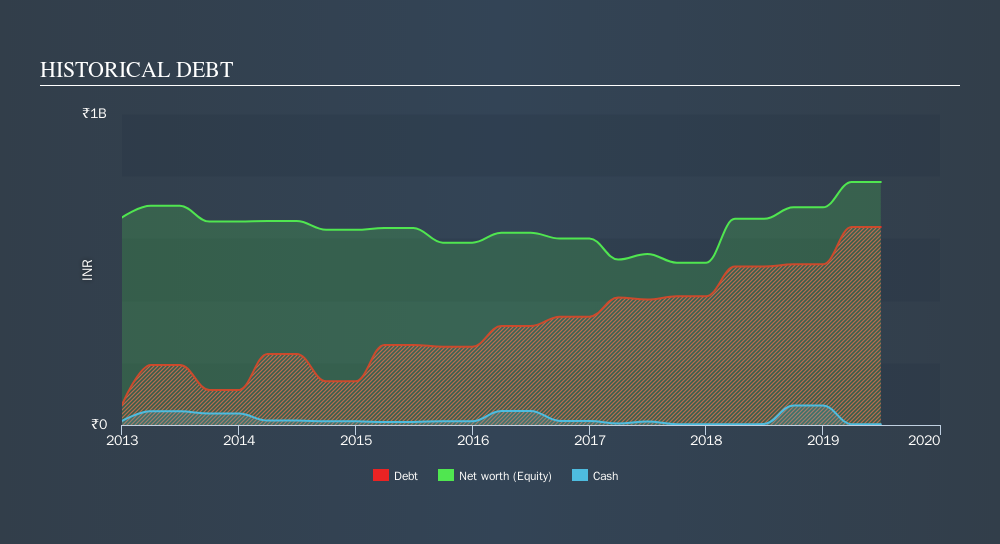

As you can see below, at the end of March 2019, Hind Rectifiers had ₹636.4m of debt, up from ₹509.3m a year ago. Click the image for more detail. Net debt is about the same, since the it doesn't have much cash.

How Healthy Is Hind Rectifiers's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Hind Rectifiers had liabilities of ₹874.1m due within 12 months and liabilities of ₹189.8m due beyond that. On the other hand, it had cash of ₹2.52m and ₹665.4m worth of receivables due within a year. So it has liabilities totalling ₹396.0m more than its cash and near-term receivables, combined.

Of course, Hind Rectifiers has a market capitalization of ₹2.72b, so these liabilities are probably manageable. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Hind Rectifiers's net debt is sitting at a very reasonable 2.1 times its EBITDA, while its EBIT covered its interest expense just 4.3 times last year. While that doesn't worry us too much, it does suggest the interest payments are somewhat of a burden. Notably, Hind Rectifiers's EBIT launched higher than Elon Musk, gaining a whopping 134% on last year. When analysing debt levels, the balance sheet is the obvious place to start. But it is Hind Rectifiers's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. During the last three years, Hind Rectifiers burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

Hind Rectifiers's conversion of EBIT to free cash flow was a real negative on this analysis, although the other factors we considered were considerably better There's no doubt that its ability to grow its EBIT is pretty flash. Looking at all this data makes us feel a little cautious about Hind Rectifiers's debt levels. While debt does have its upside in higher potential returns, we think shareholders should definitely consider how debt levels might make the stock more risky. Of course, we wouldn't say no to the extra confidence that we'd gain if we knew that Hind Rectifiers insiders have been buying shares: if you're on the same wavelength, you can find out if insiders are buying by clicking this link.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:HIRECT

Hind Rectifiers

Engages in the designs, development, manufacture, and marketing of power semiconductor devices, power electronic equipment, and railway transportation equipment in India and internationally.

Outstanding track record with adequate balance sheet.

Market Insights

Community Narratives