For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like Genting Singapore (SGX:G13). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Genting Singapore

Genting Singapore's Improving Profits

In the last three years Genting Singapore's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Genting Singapore has grown its trailing twelve month EPS from S$0.056 to S$0.061, in the last year. That's a modest gain of 9.3%. It also seems the company is in good financial health, since it has boosted EPS by buying back shares.

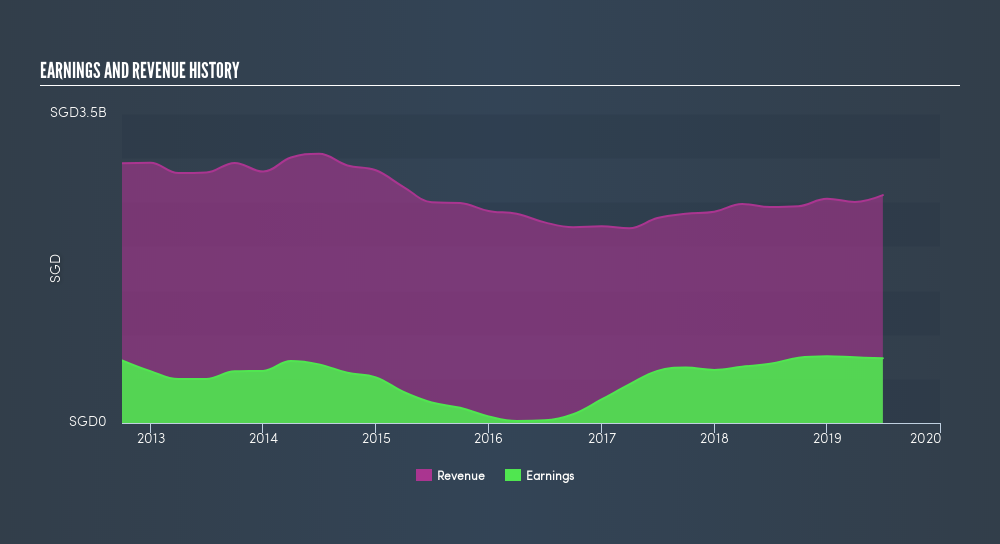

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. While Genting Singapore did well to grow revenue over the last year, EBIT margins were dampened at the same time. So it seems the future my hold further growth, especially if EBIT margins can stabilize.

Fortunately, we've got access to analyst forecasts of Genting Singapore's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Genting Singapore Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a S$11b company like Genting Singapore. But we are reassured by the fact they have invested in the company. Indeed, they hold S$27m worth of its stock. That's a lot of money, and no small incentive to work hard. Despite being just 0.3% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Does Genting Singapore Deserve A Spot On Your Watchlist?

As I already mentioned, Genting Singapore is a growing business, which is what I like to see. Just as polish makes silverware pop, the high level of insider ownership enhances my enthusiasm for this growth. The combination sparks joy for me, so I'd consider keeping the company on a watchlist. Of course, identifying quality businesses is only half the battle; investors need to know whether the stock is undervalued. So you might want to consider this free discounted cashflow valuation of Genting Singapore.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SGX:G13

Genting Singapore

An investment holding company, primarily engages in the development, management, and operation of integrated resort destinations in Asia.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives