- United States

- /

- Medical Equipment

- /

- OTCPK:THMO

Does Cesca Therapeutics Inc.'s (NASDAQ:KOOL) CEO Pay Matter?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Chris Xu became the CEO of Cesca Therapeutics Inc. (NASDAQ:KOOL) in 2016. This report will, first, examine the CEO compensation levels in comparison to CEO compensation at companies of similar size. Then we'll look at a snap shot of the business growth. And finally - as a second measure of performance - we will look at the returns shareholders have received over the last few years. This process should give us an idea about how appropriately the CEO is paid.

Check out our latest analysis for Cesca Therapeutics

How Does Chris Xu's Compensation Compare With Similar Sized Companies?

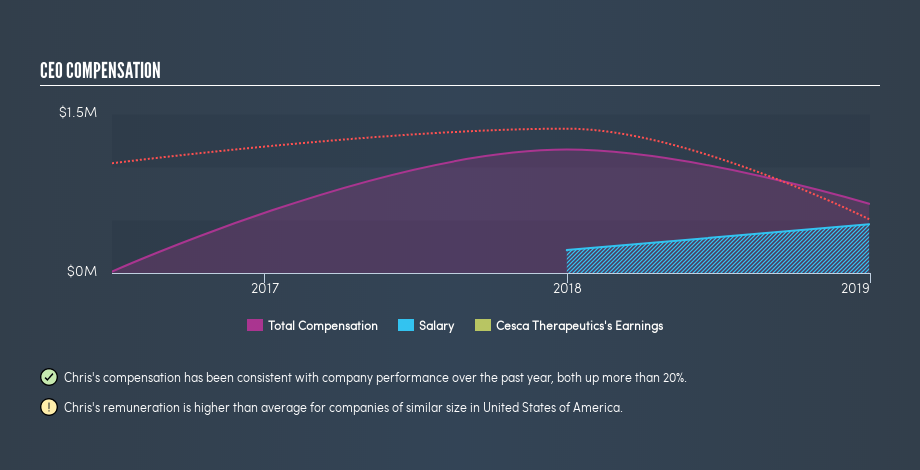

Our data indicates that Cesca Therapeutics Inc. is worth US$8.3m, and total annual CEO compensation is US$653k. (This number is for the twelve months until December 2018). While we always look at total compensation first, we note that the salary component is less, at US$460k. We took a group of companies with market capitalizations below US$200m, and calculated the median CEO total compensation to be US$468k.

Thus we can conclude that Chris Xu receives more in total compensation than the median of a group of companies in the same market, and of similar size to Cesca Therapeutics Inc.. However, this doesn't necessarily mean the pay is too high. We can better assess whether the pay is overly generous by looking into the underlying business performance.

You can see, below, how CEO compensation at Cesca Therapeutics has changed over time.

Is Cesca Therapeutics Inc. Growing?

Cesca Therapeutics Inc. has increased its earnings per share (EPS) by an average of 67% a year, over the last three years (using a line of best fit). Its revenue is down -5.4% over last year.

This demonstrates that the company has been improving recently. A good result. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business.

Has Cesca Therapeutics Inc. Been A Good Investment?

Since shareholders would have lost about 89% over three years, some Cesca Therapeutics Inc. shareholders would surely be feeling negative emotions. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

We compared total CEO remuneration at Cesca Therapeutics Inc. with the amount paid at companies with a similar market capitalization. As discussed above, we discovered that the company pays more than the median of that group.

Importantly, though, the company has impressed with its earnings per share growth, over three years. On the other hand returns to investors over the same period have probably disappointed many. Considering the per share profit growth, but keeping in mind the weak returns, we'd need more time to form a view on CEO compensation. Whatever your view on compensation, you might want to check if insiders are buying or selling Cesca Therapeutics shares (free trial).

If you want to buy a stock that is better than Cesca Therapeutics, this free list of high return, low debt companies is a great place to look.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OTCPK:THMO

ThermoGenesis Holdings

Develops, commercializes, and markets a range of automated technologies for cell-banking, cell-processing, and cell-based therapeutics in the United States, China, the United Arab Emirates, Vietnam, and internationally.

Low risk with weak fundamentals.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion