- France

- /

- Specialty Stores

- /

- ENXTPA:ALCAF

Does Centrale d'Achat Française pour l'Outre-Mer Société Anonyme (EPA:CAFO) Have A Healthy Balance Sheet?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Centrale d'Achat Française pour l'Outre-Mer Société Anonyme (EPA:CAFO) does carry debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Centrale d'Achat Française pour l'Outre-Mer Société Anonyme

How Much Debt Does Centrale d'Achat Française pour l'Outre-Mer Société Anonyme Carry?

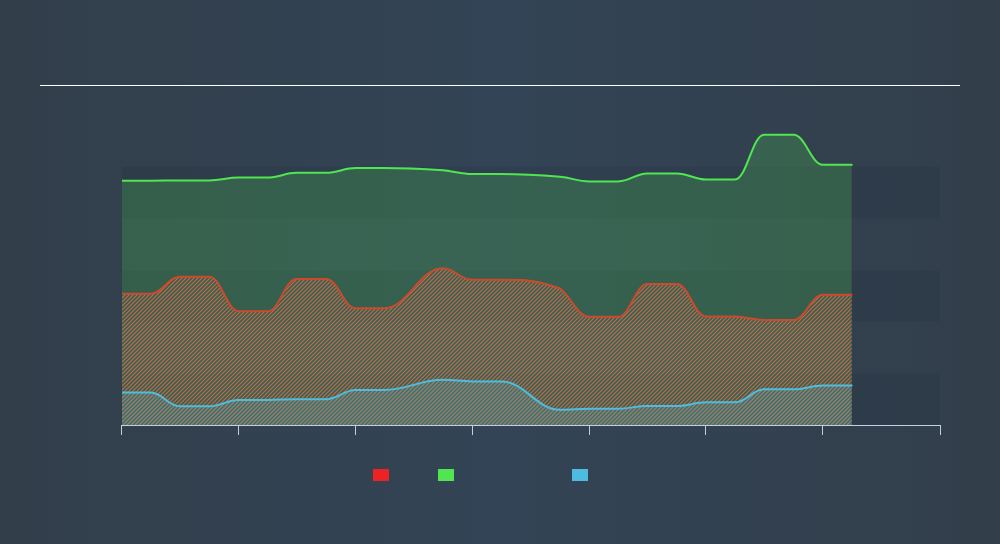

As you can see below, Centrale d'Achat Française pour l'Outre-Mer Société Anonyme had €62.9m of debt, at March 2019, which is about the same the year before. You can click the chart for greater detail. However, it also had €19.1m in cash, and so its net debt is €43.8m.

A Look At Centrale d'Achat Française pour l'Outre-Mer Société Anonyme's Liabilities

The latest balance sheet data shows that Centrale d'Achat Française pour l'Outre-Mer Société Anonyme had liabilities of €166.6m due within a year, and liabilities of €64.7m falling due after that. On the other hand, it had cash of €19.1m and €58.2m worth of receivables due within a year. So it has liabilities totalling €154.0m more than its cash and near-term receivables, combined.

This deficit casts a shadow over the €50.6m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt After all, Centrale d'Achat Française pour l'Outre-Mer Société Anonyme would likely require a major re-capitalisation if it had to pay its creditors today.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Centrale d'Achat Française pour l'Outre-Mer Société Anonyme's debt is 3.1 times its EBITDA, and its EBIT cover its interest expense 2.5 times over. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. Even worse, Centrale d'Achat Française pour l'Outre-Mer Société Anonyme saw its EBIT tank 58% over the last 12 months. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. When analysing debt levels, the balance sheet is the obvious place to start. But it is Centrale d'Achat Française pour l'Outre-Mer Société Anonyme's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Centrale d'Achat Française pour l'Outre-Mer Société Anonyme burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

To be frank both Centrale d'Achat Française pour l'Outre-Mer Société Anonyme's EBIT growth rate and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. And furthermore, its interest cover also fails to instill confidence. We think the chances that Centrale d'Achat Française pour l'Outre-Mer Société Anonyme has too much debt a very significant. To our minds, that means the stock is rather high risk, and probably one to avoid; but to each their own (investing) style. While Centrale d'Achat Française pour l'Outre-Mer Société Anonyme didn't make a statutory profit in the last year, its positive EBIT suggests that profitability might not be far away.Click here to see if its earnings are heading in the right direction, over the medium term.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTPA:ALCAF

Centrale d'Achat Française pour l'Outre-Mer Société Anonyme

Engages in the provision of home furnishing products in Europe and Asia.

Flawless balance sheet and good value.

Market Insights

Community Narratives