- Australia

- /

- Metals and Mining

- /

- ASX:BOA

Does Boadicea Resources' (ASX:BOA) Share Price Gain of 54% Match Its Business Performance?

Boadicea Resources Ltd (ASX:BOA) shareholders might be concerned after seeing the share price drop 23% in the last month. But that doesn't change the fact that the returns over the last three years have been pleasing. In the last three years the share price is up, 54%: better than the market.

View our latest analysis for Boadicea Resources

Boadicea Resources hasn't yet reported any revenue, so it's as much a business idea as an actual business. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. For example, investors may be hoping that Boadicea Resources finds some valuable resources, before it runs out of money.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. Boadicea Resources has already given some investors a taste of the sweet gains that high risk investing can generate, if your timing is right.

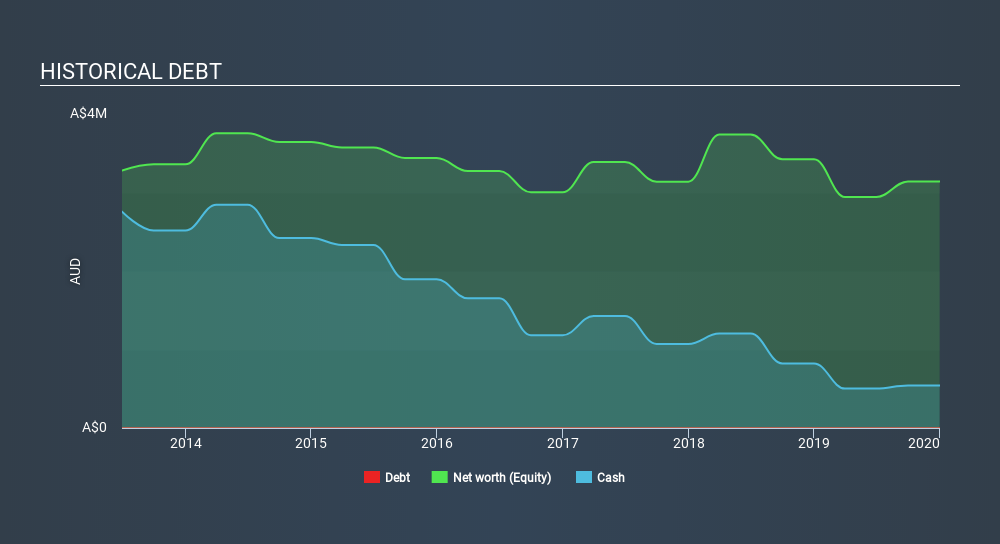

Boadicea Resources had cash in excess of all liabilities of just AU$410k when it last reported (December 2019). So if it has not already moved to replenish reserves, we think the near-term chances of a capital raising event are pretty high. It's a testament to the popularity of the business plan that the share price gained 122% per year, over 3 years , despite the weak balance sheet. You can see in the image below, how Boadicea Resources's cash levels have changed over time (click to see the values).

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. One thing you can do is check if company insiders are buying shares. If they are buying a significant amount of shares, that's certainly a good thing. Luckily we are in a position to provide you with this free chart of insider buying (and selling).

A Different Perspective

We're pleased to report that Boadicea Resources shareholders have received a total shareholder return of 23% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 8.2% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Boadicea Resources has 6 warning signs (and 4 which are potentially serious) we think you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About ASX:BOA

BOA Resources

Operates as a mineral exploration company in Western Australia.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)