- Canada

- /

- Specialty Stores

- /

- TSX:GBT

Does BMTC Group Inc. (TSE:GBT) Have A Volatile Share Price?

If you own shares in BMTC Group Inc. (TSE:GBT) then it's worth thinking about how it contributes to the volatility of your portfolio, overall. In finance, Beta is a measure of volatility. Volatility is considered to be a measure of risk in modern finance theory. Investors may think of volatility as falling into two main categories. The first category is company specific volatility. This can be dealt with by limiting your exposure to any particular stock. The other type, which cannot be diversified away, is the volatility of the entire market. Every stock in the market is exposed to this volatility, which is linked to the fact that stocks prices are correlated in an efficient market.

Some stocks mimic the volatility of the market quite closely, while others demonstrate muted, exagerrated or uncorrelated price movements. Some investors use beta as a measure of how much a certain stock is impacted by market risk (volatility). While we should keep in mind that Warren Buffett has cautioned that 'Volatility is far from synonymous with risk', beta is still a useful factor to consider. To make good use of it you must first know that the beta of the overall market is one. A stock with a beta below one is either less volatile than the market, or more volatile but not corellated with the overall market. In comparison a stock with a beta of over one tends to be move in a similar direction to the market in the long term, but with greater changes in price.

Check out our latest analysis for BMTC Group

What we can learn from GBT's beta value

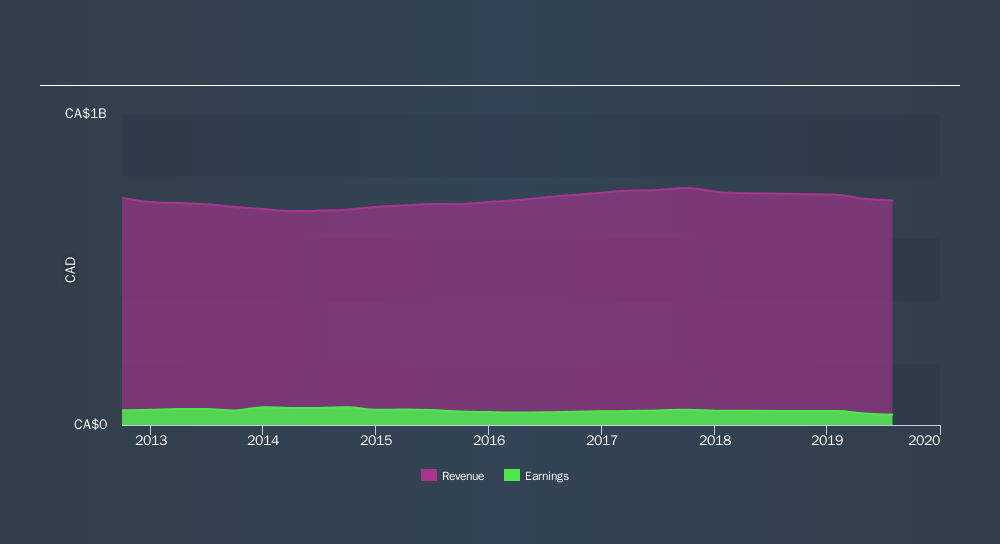

As it happens, BMTC Group has a five year beta of 1.07. This is fairly close to 1, so the stock has historically shown a somewhat similar level of volatility as the market. While history does not always repeat, this may indicate that the stock price will continue to be exposed to market risk, albeit not overly so. Share price volatility is well worth considering, but most long term investors consider the history of revenue and earnings growth to be more important. Take a look at how BMTC Group fares in that regard, below.

How does GBT's size impact its beta?

With a market capitalisation of CA$358m, BMTC Group is a very small company by global standards. It is quite likely to be unknown to most investors. Companies this small are usually more volatile than the market, whether or not that volatility is correlated. Therefore, it's a bit surprising to see that this stock has a beta value so close to the overall market.

What this means for you:

Since BMTC Group has a beta close to one, it will probably show a positive return when the market is moving up, based on history. If you're trying to generate better returns than the market, it would be worth thinking about other metrics such as cashflows, dividends and revenue growth might be a more useful guide to the future. This article aims to educate investors about beta values, but it's well worth looking at important company-specific fundamentals such as BMTC Group’s financial health and performance track record. I highly recommend you dive deeper by considering the following:

- Future Outlook: What are well-informed industry analysts predicting for GBT’s future growth? Take a look at our free research report of analyst consensus for GBT’s outlook.

- Past Track Record: Has GBT been consistently performing well irrespective of the ups and downs in the market? Go into more detail in the past performance analysis and take a look at the free visual representations of GBT's historicals for more clarity.

- Other Interesting Stocks: It's worth checking to see how GBT measures up against other companies on valuation. You could start with this free list of prospective options.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:GBT

BMTC Group

Manages and operates a retail network of furniture, household appliances, and electronic products in Canada.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

DHT Holdings, inc: Strait of Hormuz Risk Amidst US-Israel vs Iran Tensions Spikes VLCC Rates.

Duolingo: Billion Dollar Business Hiding in Plain Sight

Kyocera: The Hidden AI Enabler

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks