- United States

- /

- Healthcare Services

- /

- NasdaqCM:DCGO

DocGo Leads The Pack Of 3 Promising Penny Stocks

Reviewed by Simply Wall St

As global markets remain on edge due to geopolitical tensions and the impending Federal Reserve rate decision, investors are cautiously optimistic with major indices showing modest gains. For those willing to explore beyond established market giants, penny stocks—often representing smaller or newer companies—offer intriguing possibilities. While the term may seem outdated, these stocks continue to present unique growth opportunities at lower price points, especially when supported by strong financial health and promising fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Imperial Petroleum (IMPP) | $3.56 | $117.01M | ✅ 4 ⚠️ 1 View Analysis > |

| New Horizon Aircraft (HOVR) | $1.76 | $57.75M | ✅ 4 ⚠️ 5 View Analysis > |

| Waterdrop (WDH) | $1.31 | $473.78M | ✅ 4 ⚠️ 0 View Analysis > |

| Greenland Technologies Holding (GTEC) | $2.14 | $36.53M | ✅ 2 ⚠️ 5 View Analysis > |

| WM Technology (MAPS) | $1.04 | $176.59M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $2.03 | $210.83M | ✅ 3 ⚠️ 0 View Analysis > |

| Flexible Solutions International (FSI) | $4.36 | $55.02M | ✅ 1 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.8331 | $6.14M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.87 | $90.78M | ✅ 3 ⚠️ 2 View Analysis > |

| TETRA Technologies (TTI) | $3.85 | $472.41M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 720 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

DocGo (DCGO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: DocGo Inc. operates in the United States and the United Kingdom, offering mobile health and medical transportation services, with a market cap of $152.62 million.

Operations: The company's revenue is derived from Mobile Health Services, generating $324.39 million, and Transportation Services, contributing $196.11 million.

Market Cap: $152.62M

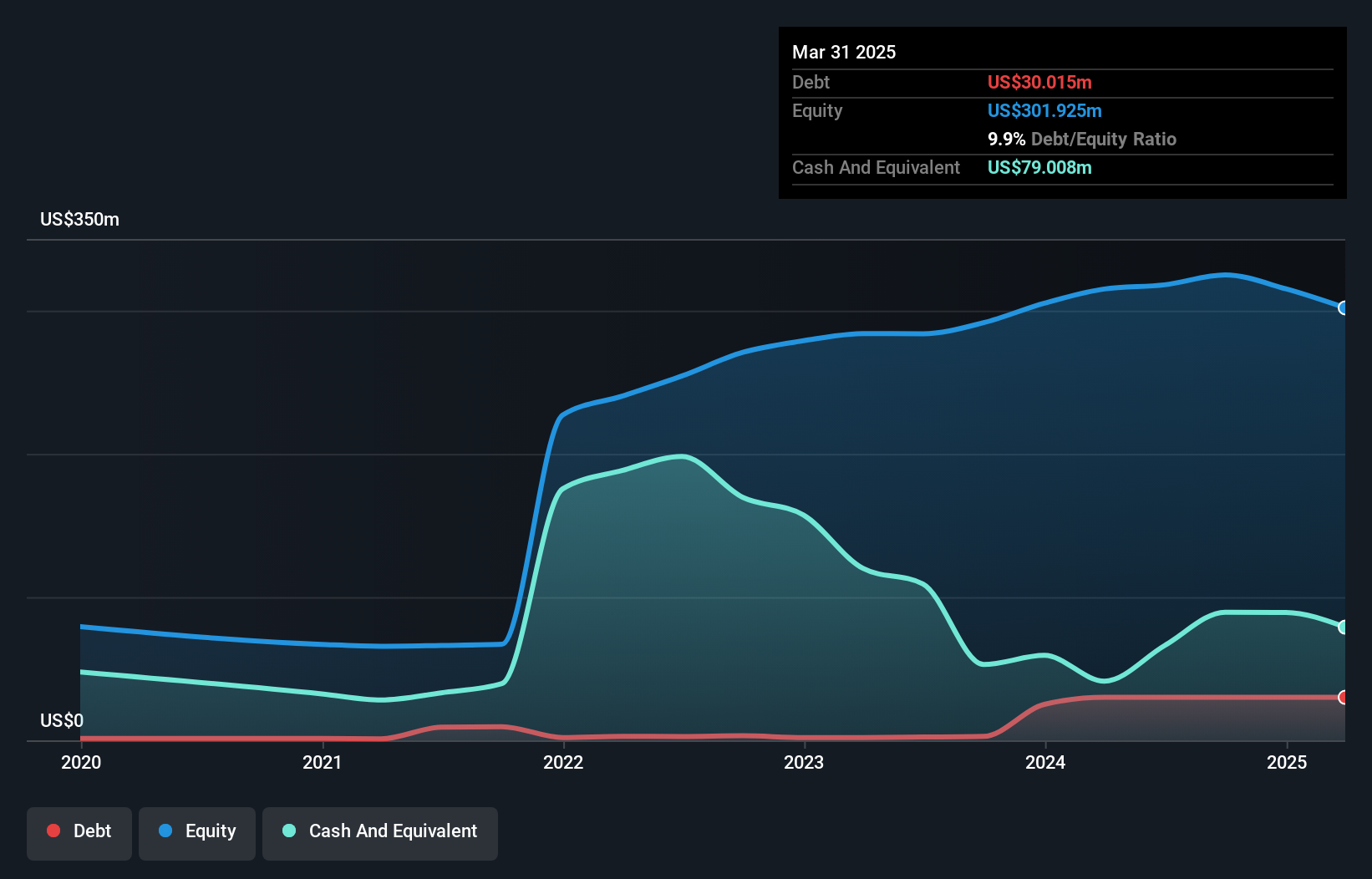

DocGo Inc., with a market cap of US$152.62 million, is currently unprofitable but has reduced losses over the past five years by 19.8% annually. Despite a negative return on equity and increased debt-to-equity ratio, its short-term assets of US$262.5 million exceed both short-term and long-term liabilities, indicating strong liquidity. The company recently lowered its revenue guidance for 2025 to US$300-330 million due to strategic adjustments in service offerings, while maintaining stable expectations from core business areas. Shareholder dilution has been minimal over the past year amidst ongoing share buybacks totaling approximately 2.89%.

- Take a closer look at DocGo's potential here in our financial health report.

- Gain insights into DocGo's future direction by reviewing our growth report.

Lantronix (LTRX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Lantronix, Inc. is involved in developing, marketing, and selling industrial and enterprise IoT products and services across various regions including the Americas, EMEA, and Asia Pacific Japan, with a market cap of $96.06 million.

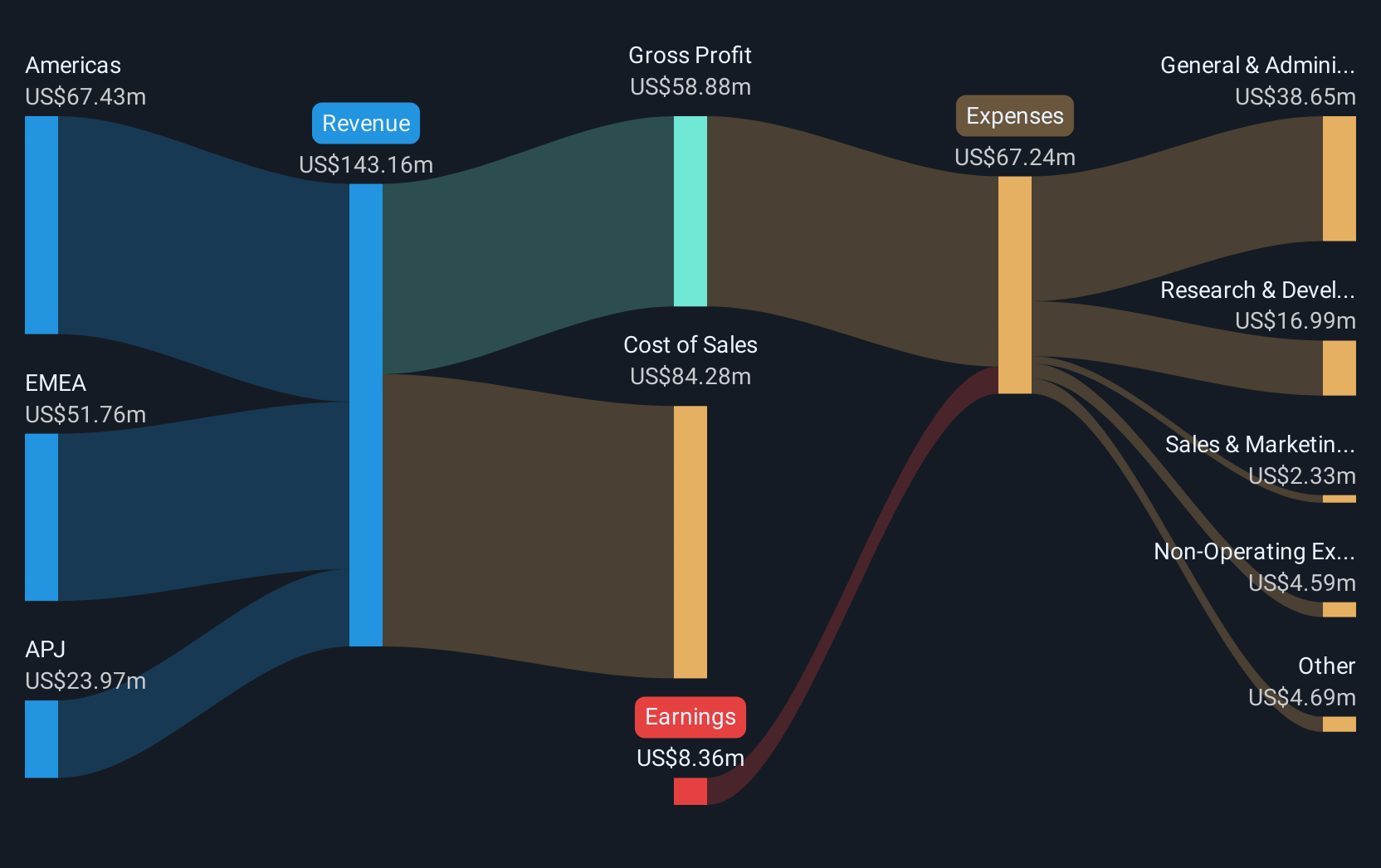

Operations: The company generates revenue of $143.16 million from its computer networks segment.

Market Cap: $96.06M

Lantronix, Inc., with a market cap of US$96.06 million, is navigating challenges as it remains unprofitable despite reducing losses by 6.2% annually over five years. Its short-term assets of US$76.5 million comfortably cover both short-term and long-term liabilities, reflecting solid liquidity. Recent collaborations, such as the one with Aerora for Edge AI solutions in drones and robotics, highlight strategic efforts to expand its technological footprint amidst an evolving market landscape projected to reach significant growth by 2030. Although management and board tenure are relatively new at under two years on average, Lantronix maintains a positive cash runway exceeding three years through growing free cash flow.

- Click here and access our complete financial health analysis report to understand the dynamics of Lantronix.

- Review our growth performance report to gain insights into Lantronix's future.

FDCTech (FDCT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: FDCTech, Inc. is a technology provider and software developer focused on digital assets, with a market cap of $19.02 million.

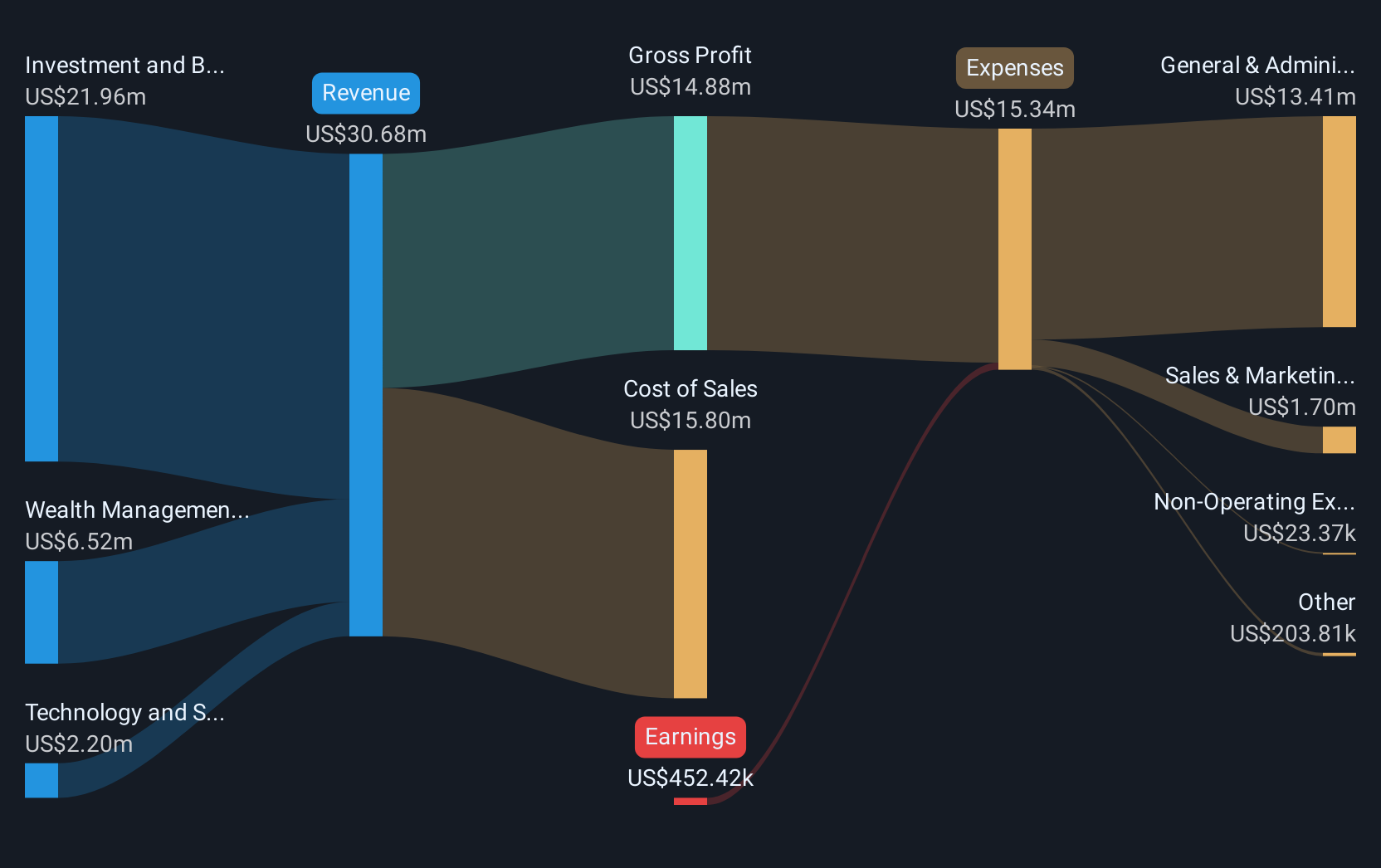

Operations: FDCTech generates revenue through three main segments: Wealth Management ($6.52 million), Investment and Brokerage ($21.96 million), and Technology and Software Development ($2.20 million).

Market Cap: $19.02M

FDCTech, Inc., with a market cap of US$19.02 million, has shown revenue growth across its segments, notably in Investment and Brokerage at US$21.96 million. Despite being unprofitable, it has reduced losses by 34.9% annually over five years and improved its financial position from negative to positive shareholder equity. Its short-term assets of US$39.4 million exceed liabilities, indicating strong liquidity. Recent strategic expansion through the formation of PIG Eurasia in Mauritius aims to bolster international operations and regulatory capabilities across Asia, the Middle East, and Africa but faces ongoing volatility challenges despite decreased weekly fluctuations over the past year.

- Dive into the specifics of FDCTech here with our thorough balance sheet health report.

- Explore historical data to track FDCTech's performance over time in our past results report.

Turning Ideas Into Actions

- Navigate through the entire inventory of 720 US Penny Stocks here.

- Curious About Other Options? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:DCGO

DocGo

Provides mobile health and medical transportation services in the United States and the United Kingdom.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives