- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A051380

Do PC Direct's (KOSDAQ:051380) Earnings Warrant Your Attention?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

So if you're like me, you might be more interested in profitable, growing companies, like PC Direct (KOSDAQ:051380). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for PC Direct

How Quickly Is PC Direct Increasing Earnings Per Share?

As one of my mentors once told me, share price follows earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. It certainly is nice to see that PC Direct has managed to grow EPS by 22% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

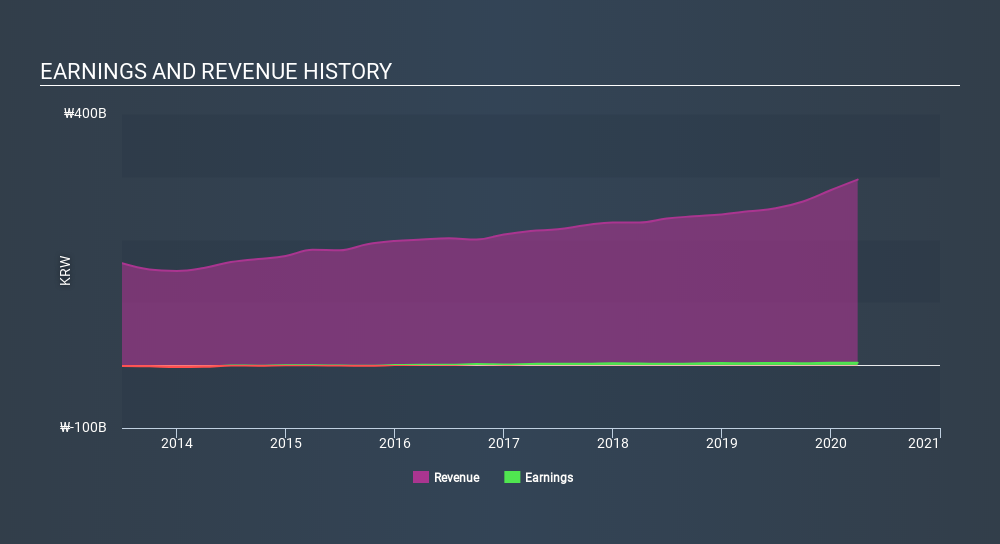

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). While we note PC Direct's EBIT margins were flat over the last year, revenue grew by a solid 21% to ₩295b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

PC Direct isn't a huge company, given its market capitalization of ₩70b. That makes it extra important to check on its balance sheet strength.

Are PC Direct Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. As a result, I'm encouraged by the fact that insiders own PC Direct shares worth a considerable sum. Indeed, they hold ₩20b worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 28% of the company; visible skin in the game.

Should You Add PC Direct To Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about PC Direct's strong EPS growth. Further, the high level of insider ownership impresses me, and suggests that I'm not the only one who appreciates the EPS growth. So this is very likely the kind of business that I like to spend time researching, with a view to discerning its true value. We should say that we've discovered 3 warning signs for PC Direct (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

Although PC Direct certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About KOSDAQ:A051380

PC Direct

Distributes IT components in South Korea and internationally.

Low risk and slightly overvalued.

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Realty Income - A Fundamental and Historical Valuation

A Structured Counter‑Analysis of "The Leaking Dreadnought"

Alphabet Inc. (GOOG): The Gemini Era – Consolidating AI Dominance in 2026.

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Nu holdings will continue to disrupt the South American banking market