Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Delko (WSE:DEL). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Delko

Delko's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. Over the last three years, Delko has grown EPS by 8.6% per year. That growth rate is fairly good, assuming the company can keep it up.

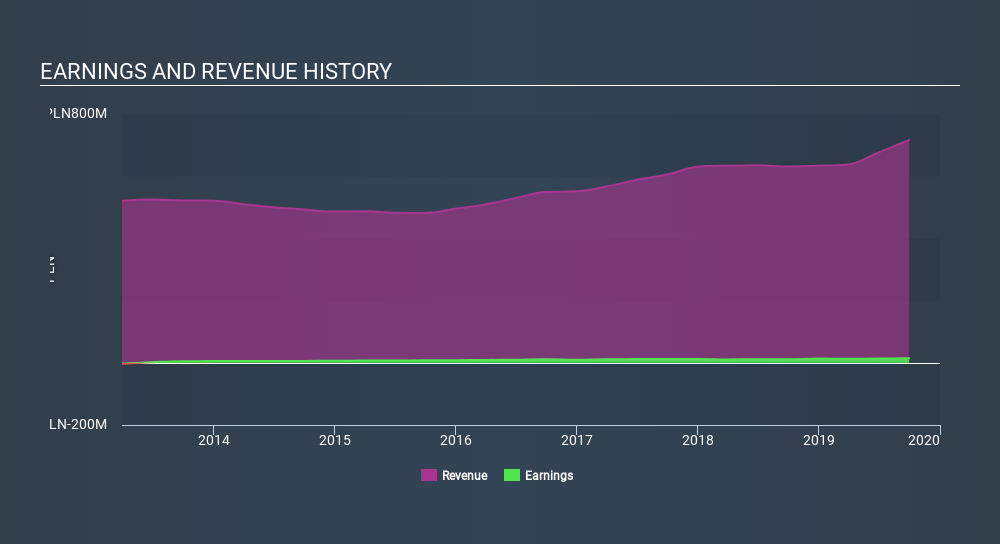

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Delko maintained stable EBIT margins over the last year, all while growing revenue 13% to zł716m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Delko isn't a huge company, given its market capitalization of zł66m. That makes it extra important to check on its balance sheet strength.

Are Delko Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that Delko insiders own a significant number of shares certainly appeals to me. In fact, they own 56% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes me think they will be incentivised to plan for the long term - something I like to see. Valued at only zł66m Delko is really small for a listed company. So despite a large proportional holding, insiders only have zł37m worth of stock. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Does Delko Deserve A Spot On Your Watchlist?

As I already mentioned, Delko is a growing business, which is what I like to see. Just as polish makes silverware pop, the high level of insider ownership enhances my enthusiasm for this growth. That combination appeals to me, for one. So yes, I do think the stock is worth keeping an eye on. Another important measure of business quality not discussed here, is return on equity (ROE). Click on this link to see how Delko shapes up to industry peers, when it comes to ROE.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About WSE:DEL

Delko

Engages in the wholesale of household chemical, cosmetics, industrial, and hygiene products in Poland.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives