Amid escalating geopolitical tensions and trade-related concerns, Asian markets have experienced mixed performance, reflecting broader global economic uncertainties. In such a climate, investors often turn their attention to smaller or newer companies that may offer unique opportunities for growth. While the term "penny stocks" might seem outdated, it still signifies companies with potential value hidden beneath their modest market prices. By focusing on those with solid financials and clear growth potential, investors can uncover promising opportunities in this segment of the market.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| YKGI (Catalist:YK9) | SGD0.104 | SGD44.2M | ✅ 2 ⚠️ 3 View Analysis > |

| JBM (Healthcare) (SEHK:2161) | HK$2.74 | HK$2.23B | ✅ 3 ⚠️ 0 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.19 | HK$750.83M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.455 | SGD184.41M | ✅ 3 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.18 | HK$1.97B | ✅ 4 ⚠️ 2 View Analysis > |

| Halcyon Technology (SET:HTECH) | THB2.60 | THB780M | ✅ 2 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.25 | SGD8.86B | ✅ 5 ⚠️ 0 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.181 | SGD36.06M | ✅ 4 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.13 | SGD858.72M | ✅ 3 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.61 | HK$52.81B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,158 stocks from our Asian Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Logory Logistics Technology (SEHK:2482)

Simply Wall St Financial Health Rating: ★★★★★★

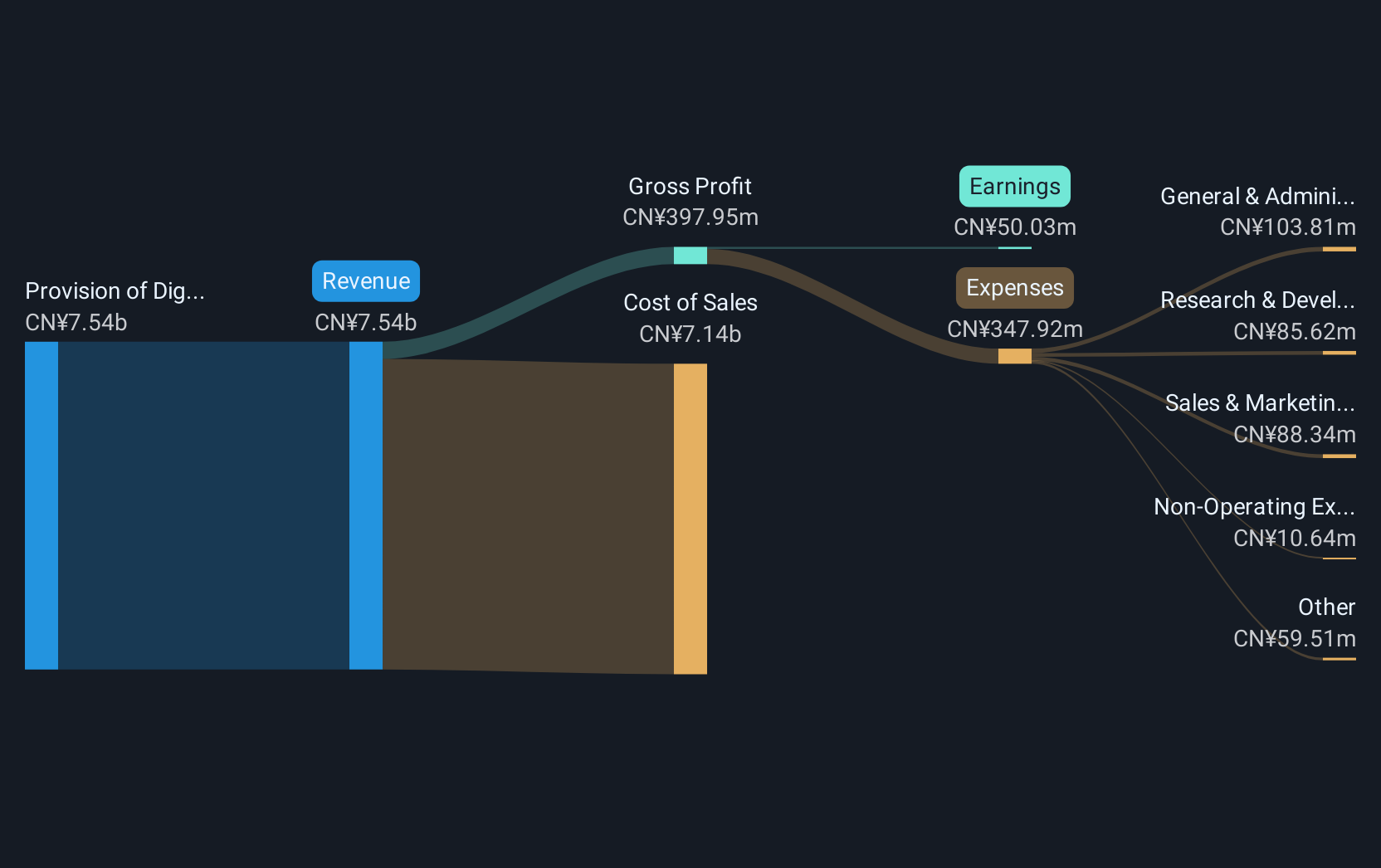

Overview: Logory Logistics Technology Co., Ltd. offers road freight transportation services and solutions to various stakeholders in the logistics industry in China, with a market cap of HK$1.73 billion.

Operations: The company's revenue of CN¥7.54 billion is generated from its digital freight businesses and related services.

Market Cap: HK$1.73B

Logory Logistics Technology, with a market cap of HK$1.73 billion, has shown significant financial improvement by becoming profitable this year. Its revenue stands at CN¥7.54 billion, driven by its digital freight services in China. The company maintains a solid financial position with short-term assets exceeding both short and long-term liabilities and more cash than total debt. Recent changes include the appointment of Long Ke as an executive director and amendments to the Articles of Association to allow for potential share issuance adjustments, reflecting strategic governance updates aimed at enhancing operational flexibility and growth prospects in the logistics sector.

- Jump into the full analysis health report here for a deeper understanding of Logory Logistics Technology.

- Gain insights into Logory Logistics Technology's historical outcomes by reviewing our past performance report.

Uni-Bio Science Group (SEHK:690)

Simply Wall St Financial Health Rating: ★★★★★☆

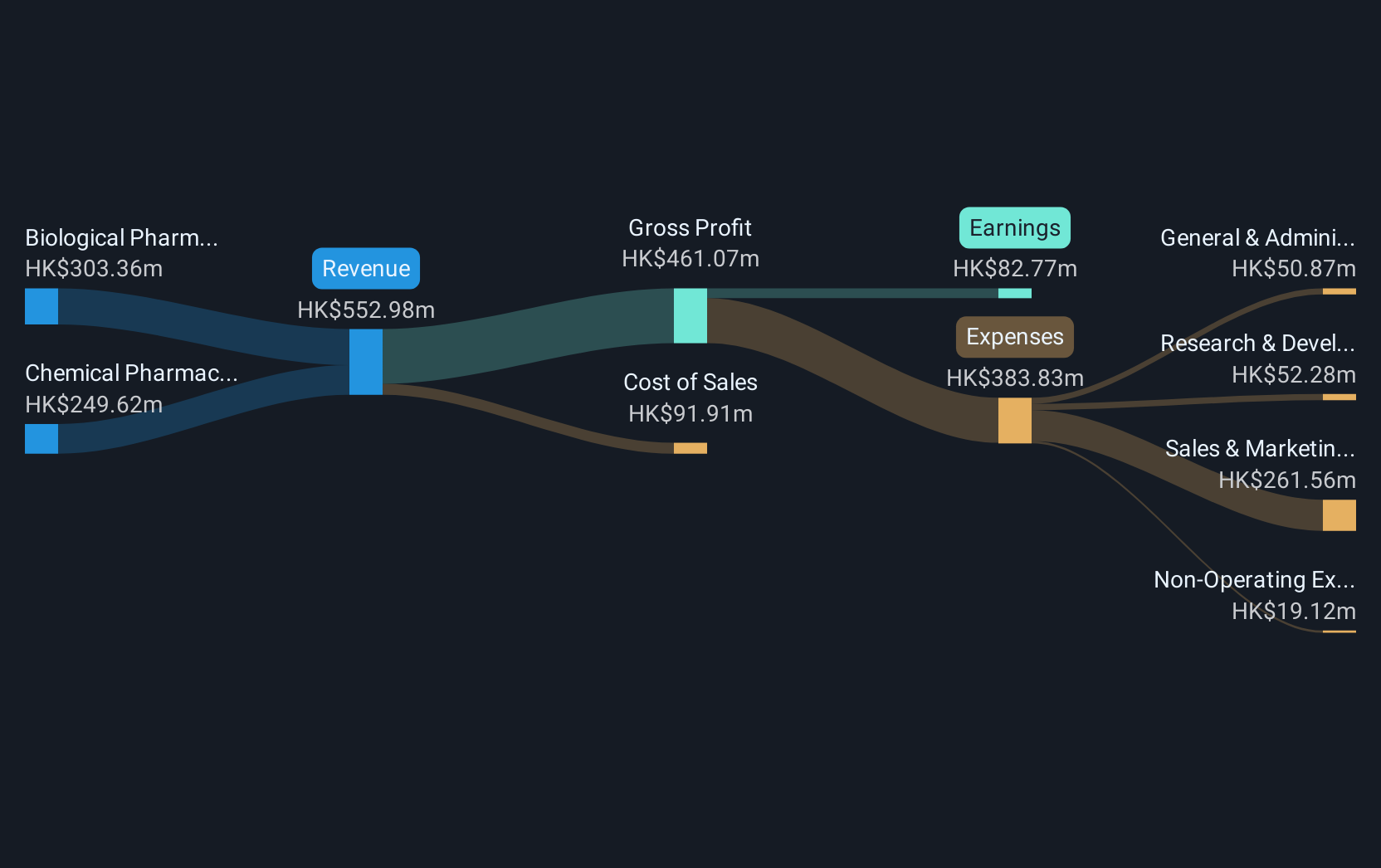

Overview: Uni-Bio Science Group Limited is an investment holding company that focuses on the research, development, manufacturing, and sale of biological and chemical pharmaceutical products for treating human diseases in China, with a market cap of HK$746.40 million.

Operations: The company generates revenue from its Chemical Pharmaceutical Products segment, contributing HK$249.62 million, and its Biological Pharmaceutical Products segment, which brings in HK$303.36 million.

Market Cap: HK$746.4M

Uni-Bio Science Group, with a market cap of HK$746.40 million, has demonstrated financial stability and growth potential in the biotech sector. The company reported revenues of HK$552.98 million for 2024, with net income rising to HK$82.77 million from the previous year. Its short-term assets significantly exceed liabilities, ensuring liquidity strength while maintaining a high Return on Equity at 25.4%. Recent approval for Diquafosol Sodium Eye Drops by China's National Medical Products Administration enhances its ophthalmology portfolio, promising further market penetration amidst growing demand for dry eye treatments in China’s expanding healthcare market.

- Navigate through the intricacies of Uni-Bio Science Group with our comprehensive balance sheet health report here.

- Assess Uni-Bio Science Group's previous results with our detailed historical performance reports.

Beijing Kingee Culture Development (SZSE:002721)

Simply Wall St Financial Health Rating: ★★★★☆☆

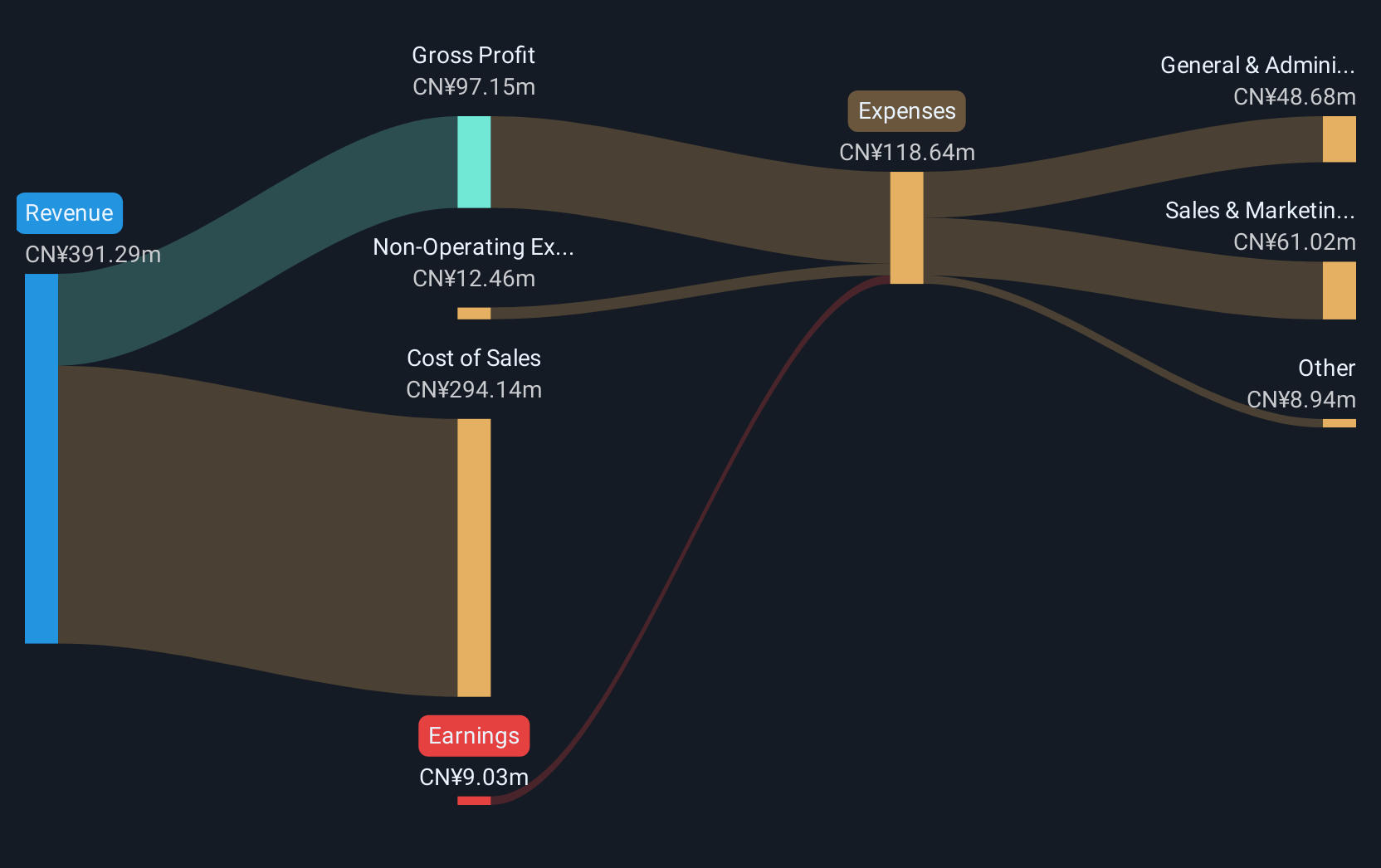

Overview: Beijing Kingee Culture Development Co., Ltd. operates in the cultural and creative industries, focusing on design and production services, with a market cap of CN¥9.31 billion.

Operations: There are no reported revenue segments for Beijing Kingee Culture Development Co., Ltd.

Market Cap: CN¥9.31B

Beijing Kingee Culture Development, with a market cap of CN¥9.31 billion, operates in the cultural and creative industries. Despite being unprofitable, it reported Q1 2025 sales of CN¥144.17 million, an increase from the previous year. The company has no debt and strong liquidity with short-term assets of CN¥2.1 billion surpassing its liabilities significantly, indicating financial resilience despite current losses. Its board is experienced with an average tenure of 3.7 years, although management experience data is insufficient. Shareholders have not faced dilution recently, which may appeal to investors seeking stability in equity value amidst volatile penny stock markets.

- Click here to discover the nuances of Beijing Kingee Culture Development with our detailed analytical financial health report.

- Understand Beijing Kingee Culture Development's track record by examining our performance history report.

Taking Advantage

- Dive into all 1,158 of the Asian Penny Stocks we have identified here.

- Ready To Venture Into Other Investment Styles? This technology could replace computers: discover the 24 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:690

Uni-Bio Science Group

An investment holding company, researches and develops, manufactures, and sells biological and chemical pharmaceutical products to treat human diseases in the People’s Republic of China.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives