- United States

- /

- Retail REITs

- /

- NYSE:ADC

Did You Participate In Any Of Agree Realty's (NYSE:ADC) Fantastic 140% Return ?

Agree Realty Corporation (NYSE:ADC) shareholders might be concerned after seeing the share price drop 17% in the last quarter. But that doesn't change the fact that the returns over the last five years have been pleasing. Its return of 94% has certainly bested the market return!

View our latest analysis for Agree Realty

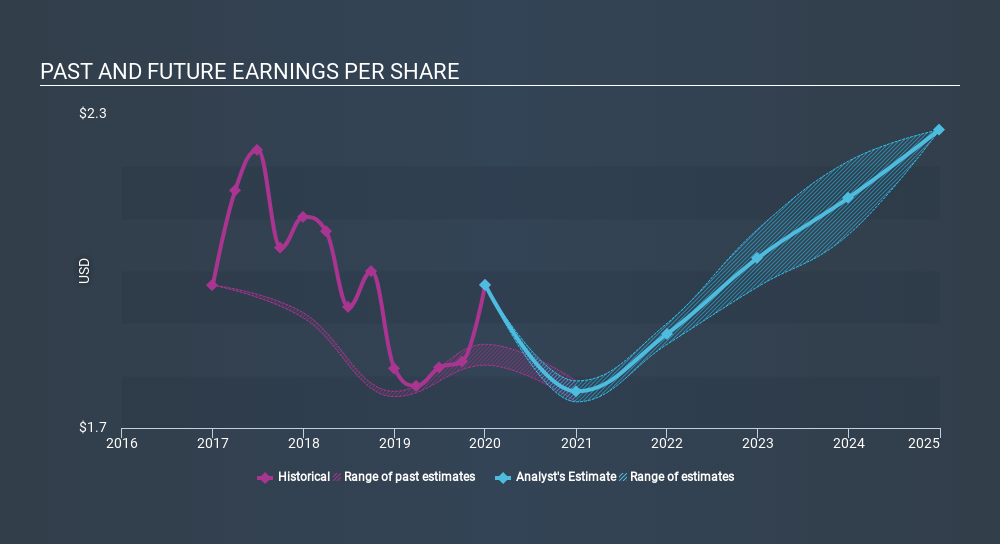

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Agree Realty achieved compound earnings per share (EPS) growth of 9.9% per year. This EPS growth is lower than the 14% average annual increase in the share price. This suggests that market participants hold the company in higher regard, these days. And that's hardly shocking given the track record of growth.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. It might be well worthwhile taking a look at our free report on Agree Realty's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Agree Realty the TSR over the last 5 years was 140%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Although it hurts that Agree Realty returned a loss of 2.1% in the last twelve months, the broader market was actually worse, returning a loss of 4.9%. Longer term investors wouldn't be so upset, since they would have made 19%, each year, over five years. In the best case scenario the last year is just a temporary blip on the journey to a brighter future. It's always interesting to track share price performance over the longer term. But to understand Agree Realty better, we need to consider many other factors. Take risks, for example - Agree Realty has 4 warning signs (and 1 which is concerning) we think you should know about.

Agree Realty is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:ADC

Agree Realty

A publicly traded real estate investment trust that is RETHINKING RETAIL through the acquisition and development of properties net leased to industry-leading, omni-channel retail tenants.

Established dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives