- Singapore

- /

- Real Estate

- /

- SGX:T24

Did You Manage To Avoid Tuan Sing Holdings's (SGX:T24) 20% Share Price Drop?

Ideally, your overall portfolio should beat the market average. But in any portfolio, there will be mixed results between individual stocks. At this point some shareholders may be questioning their investment in Tuan Sing Holdings Limited (SGX:T24), since the last five years saw the share price fall 20%. The silver lining is that the stock is up 1.5% in about a week.

See our latest analysis for Tuan Sing Holdings

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

While the share price declined over five years, Tuan Sing Holdings actually managed to increase EPS by an average of 14% per year. So it doesn't seem like EPS is a great guide to understanding how the market is valuing the stock. Or possibly, the market was previously very optimistic, so the stock has disappointed, despite improving EPS.

Generally speaking we'd expect to see stronger share price increases on the back of sustained EPS growth, but other metrics may hold a clue to why the share price performance is relatively modest.

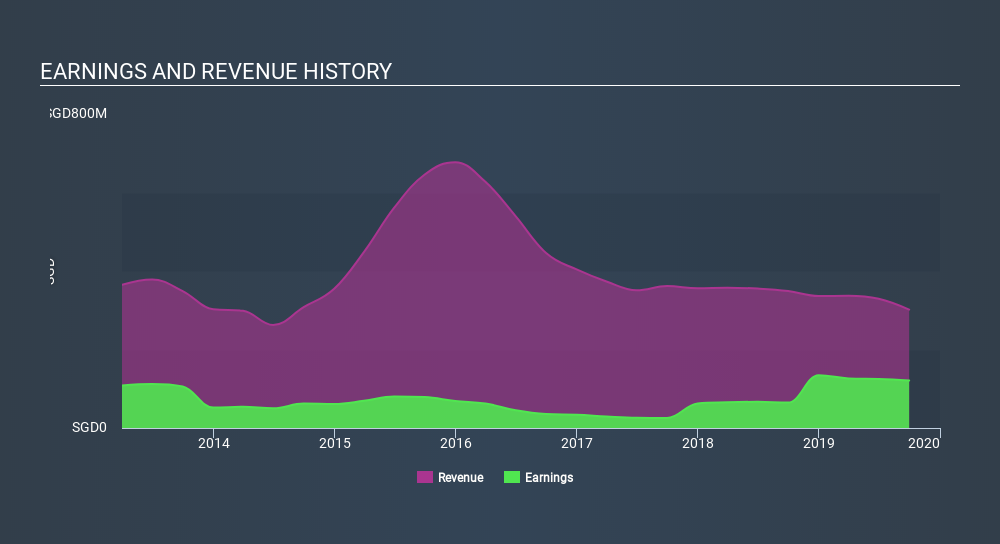

We don't think that the 1.8% is big factor in the share price, since it's quite small, as dividends go. It could be that the revenue decline of 9.9% per year is viewed as evidence that Tuan Sing Holdings is shrinking. That could explain the weak share price.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Tuan Sing Holdings the TSR over the last 5 years was -13%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Tuan Sing Holdings shareholders are down 12% for the year (even including dividends) , but the market itself is up 5.8%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 2.7% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Be aware that Tuan Sing Holdings is showing 2 warning signs in our investment analysis , and 1 of those makes us a bit uncomfortable...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SGX:T24

Tuan Sing Holdings

An investment holding company, engages in the real estate investment and development, hospitality, and other businesses in Singapore, Australia, China, Malaysia, and Indonesia.

Slight second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives