- Finland

- /

- Healthcare Services

- /

- HLSE:TTALO

Did You Manage To Avoid Terveystalo Oyj's (HEL:TTALO) 13% Share Price Drop?

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. That downside risk was realized by Terveystalo Oyj (HEL:TTALO) shareholders over the last year, as the share price declined 13%. That contrasts poorly with the market return of 0.05%. We wouldn't rush to judgement on Terveystalo Oyj because we don't have a long term history to look at. Unfortunately the share price momentum is still quite negative, with prices down 9.1% in thirty days.

Check out our latest analysis for Terveystalo Oyj

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

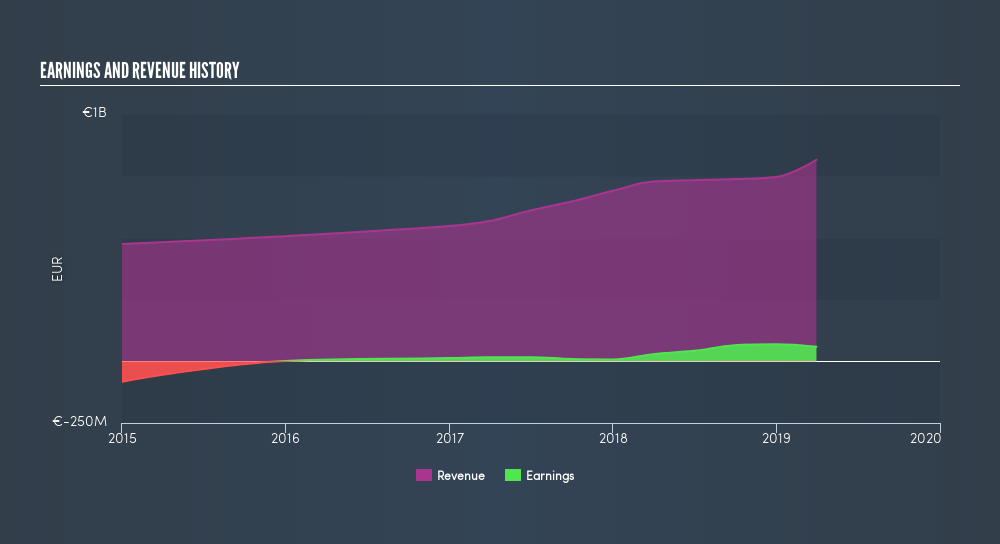

During the unfortunate twelve months during which the Terveystalo Oyj share price fell, it actually saw its earnings per share (EPS) improve by 95%. Of course, the situation might betray previous over-optimism about growth. It's fair to say that the share price does not seem to be reflecting the EPS growth. But we might find some different metrics explain the share price movements better.

Terveystalo Oyj managed to grow revenue over the last year, which is usually a real positive. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

It is of course excellent to see how Terveystalo Oyj has grown profits over the years, but the future is more important for shareholders. If you are thinking of buying or selling Terveystalo Oyj stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Given that the market gained 0.05% in the last year, Terveystalo Oyj shareholders might be miffed that they lost 11% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 0.6% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. Before forming an opinion on Terveystalo Oyj you might want to consider these 3 valuation metrics.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FI exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About HLSE:TTALO

Terveystalo Oyj

Provides occupational healthcare services in Finland, Sweden, and Estonia.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives