- Hong Kong

- /

- Semiconductors

- /

- SEHK:1010

Did You Manage To Avoid PacRay International Holdings' (HKG:1010) Devastating 79% Share Price Drop?

Even the best investor on earth makes unsuccessful investments. But it's not unreasonable to try to avoid truly shocking capital losses. It must have been painful to be a PacRay International Holdings Limited (HKG:1010) shareholder over the last year, since the stock price plummeted 79% in that time. While some investors are willing to stomach this sort of loss, they are usually professionals who spread their bets thinly. We wouldn't rush to judgement on PacRay International Holdings because we don't have a long term history to look at. Unfortunately the share price momentum is still quite negative, with prices down 47% in thirty days. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

Check out our latest analysis for PacRay International Holdings

Given that PacRay International Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last twelve months, PacRay International Holdings increased its revenue by 22%. We think that is pretty nice growth. Unfortunately, the market wanted something better, given it sent the share price 79% lower during the year. It could be that the losses are too much for investors to handle without losing their nerve. It seems that the market has concerns about the future, because that share price action does not seem to reflect the revenue growth at all.

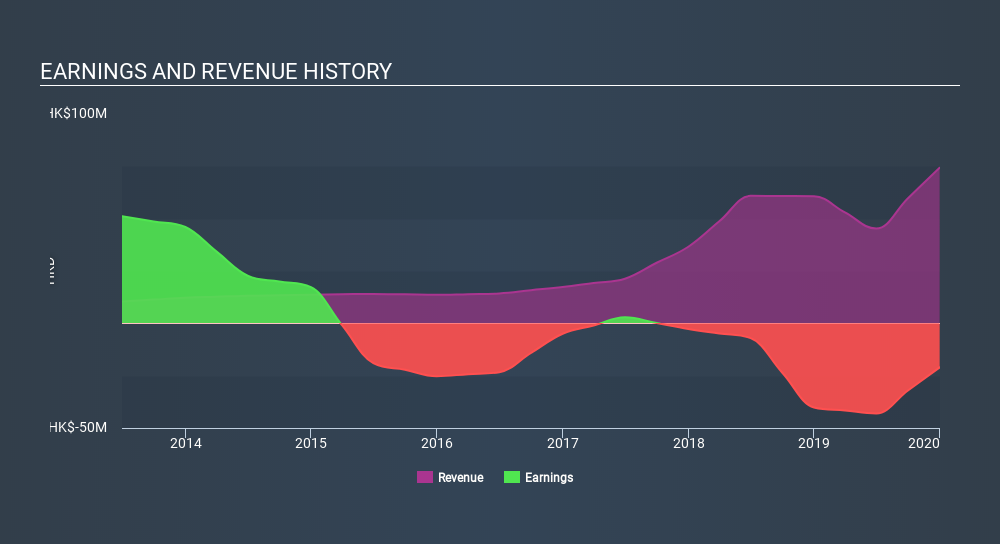

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling PacRay International Holdings stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We regret to report that PacRay International Holdings shareholders are down 79% for the year. Unfortunately, that's worse than the broader market decline of 6.5%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 25% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 3 warning signs for PacRay International Holdings (1 is a bit unpleasant!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About SEHK:1010

Sky Blue 11

An investment holding company, engages in the design, distribution, and trade of integrated circuits and semiconductor parts in the People’s Republic of China, Hong Kong, and Taiwan.

Medium-low and overvalued.

Market Insights

Community Narratives