Did You Manage To Avoid Nagarjuna Fertilizers and Chemicals' (NSE:NAGAFERT) Painful 63% Share Price Drop?

It is doubtless a positive to see that the Nagarjuna Fertilizers and Chemicals Limited (NSE:NAGAFERT) share price has gained some 122% in the last three months. But that is small recompense for the exasperating returns over three years. Indeed, the share price is down a tragic 63% in the last three years. So it's good to see it climbing back up. After all, could be that the fall was overdone.

Check out our latest analysis for Nagarjuna Fertilizers and Chemicals

Given that Nagarjuna Fertilizers and Chemicals didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years Nagarjuna Fertilizers and Chemicals saw its revenue shrink by 37% per year. That's definitely a weaker result than most pre-profit companies report. With no profits and falling revenue it is no surprise that investors have been dumping the stock, pushing the price down by 28% per year over that time. When revenue is dropping, and losses are still costing, and the share price sinking fast, it's fair to ask if something is remiss. After losing money on a declining business with falling stock price, we always consider whether eager bagholders are still offering us a reasonable exit price.

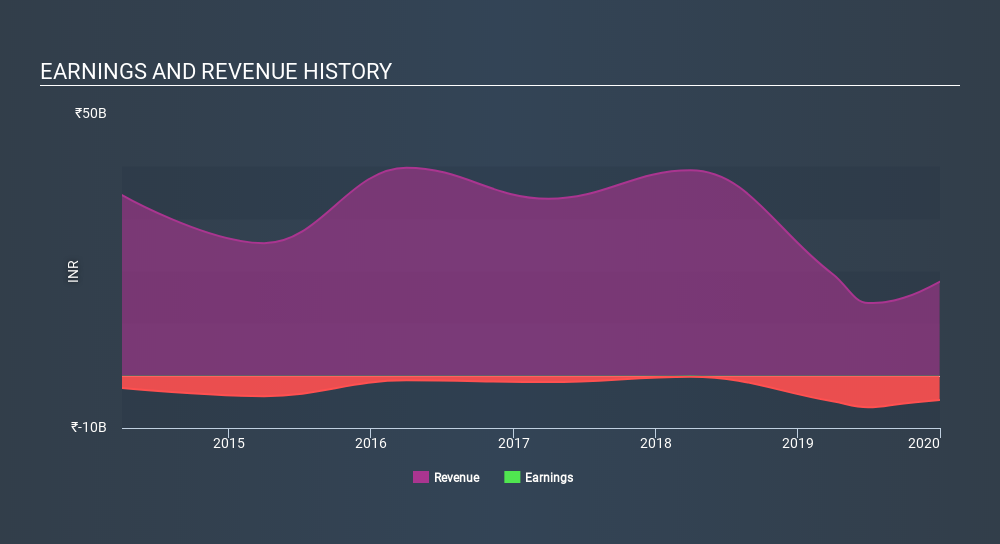

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's nice to see that Nagarjuna Fertilizers and Chemicals shareholders have gained 18% (in total) over the last year. What is absolutely clear is that is far preferable to the dismal 28% average annual loss suffered over the last three years. It could well be that the business has turned around -- or else regained the confidence of investors. It's always interesting to track share price performance over the longer term. But to understand Nagarjuna Fertilizers and Chemicals better, we need to consider many other factors. For example, we've discovered 3 warning signs for Nagarjuna Fertilizers and Chemicals (1 is a bit unpleasant!) that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About NSEI:NAGAFERT

Nagarjuna Fertilizers and Chemicals

Manufactures and markets fertilizers and micro irrigation equipment in India.

Slight risk with weak fundamentals.

Market Insights

Community Narratives