- United States

- /

- Medical Equipment

- /

- NasdaqGS:XRAY

Did You Manage To Avoid DENTSPLY SIRONA's (NASDAQ:XRAY) 34% Share Price Drop?

For many investors, the main point of stock picking is to generate higher returns than the overall market. But the risk of stock picking is that you will likely buy under-performing companies. Unfortunately, that's been the case for longer term DENTSPLY SIRONA Inc. (NASDAQ:XRAY) shareholders, since the share price is down 34% in the last three years, falling well short of the market return of around 22%. More recently, the share price has dropped a further 26% in a month. But this could be related to poor market conditions -- stocks are down 17% in the same time.

Check out our latest analysis for DENTSPLY SIRONA

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During five years of share price growth, DENTSPLY SIRONA moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. So it's worth looking at other metrics to try to understand the share price move.

The modest 0.9% dividend yield is unlikely to be guiding the market view of the stock. With revenue flat over three years, it seems unlikely that the share price is reflecting the top line. There doesn't seem to be any clear correlation between the fundamental business metrics and the share price. That could mean that the stock was previously overrated, or it could spell opportunity now.

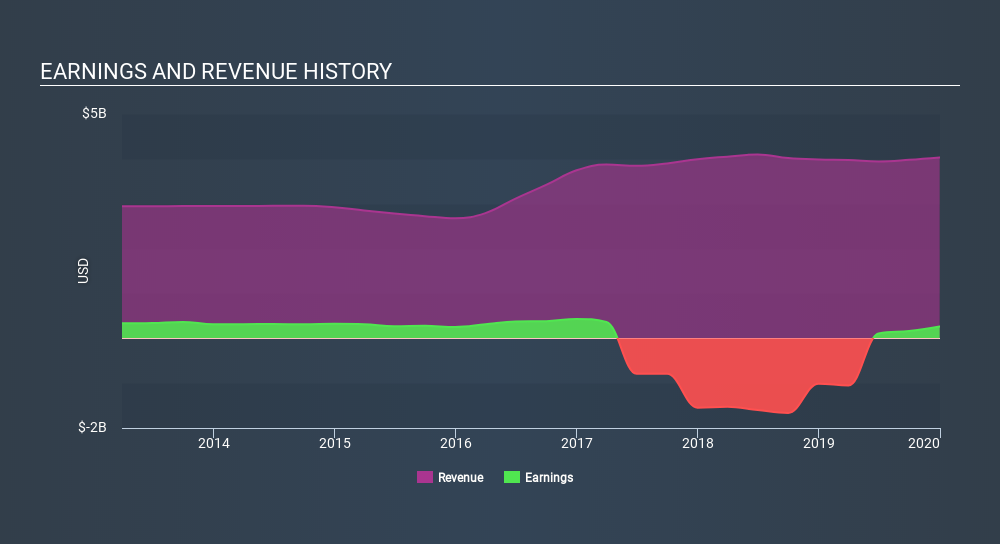

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. You can see what analysts are predicting for DENTSPLY SIRONA in this interactive graph of future profit estimates.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between DENTSPLY SIRONA's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. DENTSPLY SIRONA's TSR of was a loss of 32% for the 3 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

While the broader market lost about 1.1% in the twelve months, DENTSPLY SIRONA shareholders did even worse, losing 14% (even including dividends) . However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 3.2% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with DENTSPLY SIRONA , and understanding them should be part of your investment process.

DENTSPLY SIRONA is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:XRAY

DENTSPLY SIRONA

Develops, manufactures, and markets dental equipment supported by cloud-enabled solutions, dental products, and healthcare consumable products in urology and enterology worldwide.

Undervalued with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives