Did You Manage To Avoid China Sanjiang Fine Chemicals's (HKG:2198) Painful 52% Share Price Drop?

The main aim of stock picking is to find the market-beating stocks. But in any portfolio, there will be mixed results between individual stocks. So we wouldn't blame long term China Sanjiang Fine Chemicals Company Limited (HKG:2198) shareholders for doubting their decision to hold, with the stock down 52% over a half decade. And it's not just long term holders hurting, because the stock is down 29% in the last year. On top of that, the share price has dropped a further 15% in a month.

See our latest analysis for China Sanjiang Fine Chemicals

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, China Sanjiang Fine Chemicals moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

The most recent dividend was actually lower than it was in the past, so that may have sent the share price lower.

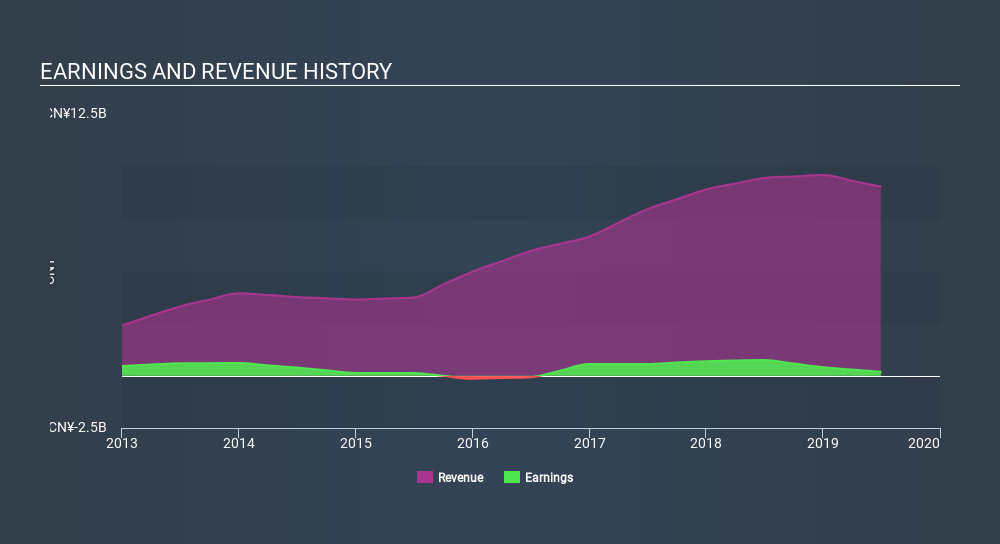

The graphic below depicts how revenue has changed over time.

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on China Sanjiang Fine Chemicals's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of China Sanjiang Fine Chemicals, it has a TSR of -33% for the last 5 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While the broader market gained around 1.9% in the last year, China Sanjiang Fine Chemicals shareholders lost 22% (even including dividends) . Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 7.6% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of China Sanjiang Fine Chemicals by clicking this link.

China Sanjiang Fine Chemicals is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:2198

China Sanjiang Fine Chemicals

An investment holding company, manufactures and supplies ethylene oxide and glycol, propylene, polypropylene, methyl tert-butyl ether (MTBE), surfactants, and ethanolamine in Mainland China, Japan, and Singapore, and internationally.

Proven track record and slightly overvalued.

Market Insights

Community Narratives