Did You Manage To Avoid Bumitama Agri's (SGX:P8Z) 26% Share Price Drop?

Bumitama Agri Ltd. (SGX:P8Z) shareholders should be happy to see the share price up 28% in the last quarter. But if you look at the last five years the returns have not been good. You would have done a lot better buying an index fund, since the stock has dropped 26% in that half decade.

View our latest analysis for Bumitama Agri

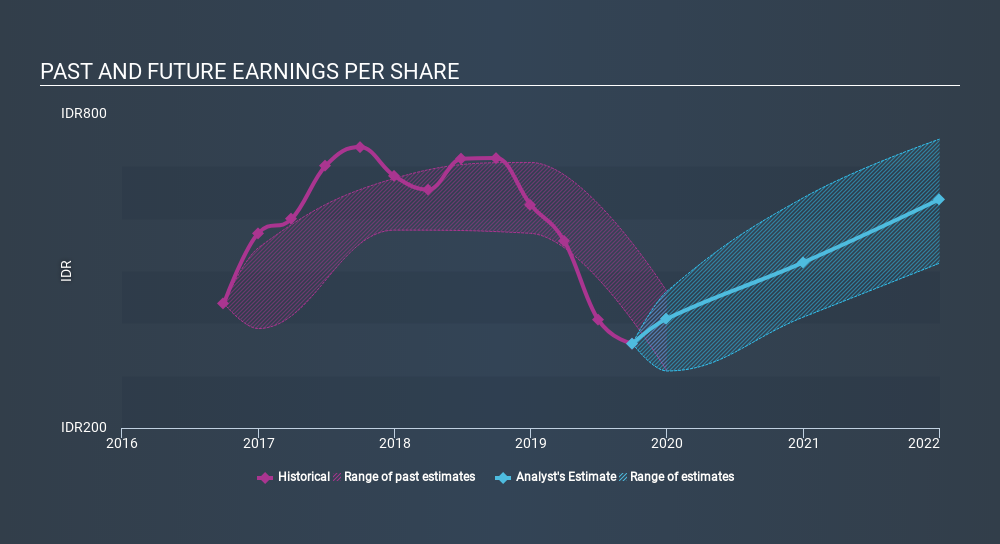

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the five years over which the share price declined, Bumitama Agri's earnings per share (EPS) dropped by 13% each year. This fall in the EPS is worse than the 6.0% compound annual share price fall. So investors might expect EPS to bounce back -- or they may have previously foreseen the EPS decline.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Bumitama Agri's key metrics by checking this interactive graph of Bumitama Agri's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Bumitama Agri's TSR for the last 5 years was -16%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

It's nice to see that Bumitama Agri shareholders have received a total shareholder return of 18% over the last year. Of course, that includes the dividend. Notably the five-year annualised TSR loss of 3.5% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. Keeping this in mind, a solid next step might be to take a look at Bumitama Agri's dividend track record. This free interactive graph is a great place to start.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SGX:P8Z

Bumitama Agri

An investment holding company, engages in the production of crude palm oil (CPO) and palm kernel (PK) in Indonesia.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives