- Hong Kong

- /

- Real Estate

- /

- SEHK:1064

Did Changing Sentiment Drive Zhong Hua International Holdings' (HKG:1064) Share Price Down A Worrying 65%?

Statistically speaking, long term investing is a profitable endeavour. But that doesn't mean long term investors can avoid big losses. To wit, the Zhong Hua International Holdings Limited (HKG:1064) share price managed to fall 65% over five long years. That's an unpleasant experience for long term holders. Contrary to the longer term story, the last month has been good for stockholders, with a share price gain of 8.6%.

Check out our latest analysis for Zhong Hua International Holdings

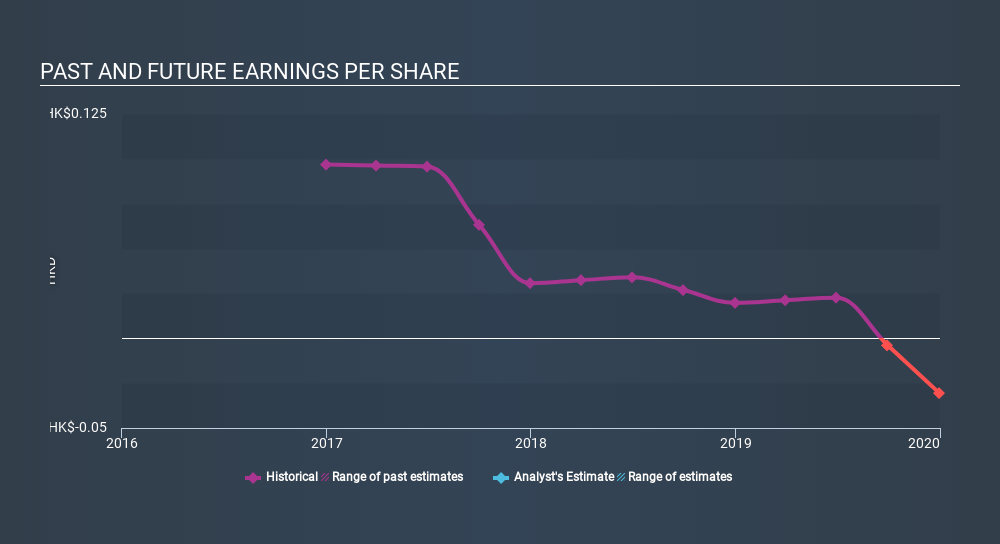

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over five years Zhong Hua International Holdings's earnings per share dropped significantly, falling to a loss, with the share price also lower. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. However, we can say we'd expect to see a falling share price in this scenario.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

It's nice to see that Zhong Hua International Holdings shareholders have received a total shareholder return of 5.6% over the last year. There's no doubt those recent returns are much better than the TSR loss of 19% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand Zhong Hua International Holdings better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Zhong Hua International Holdings (at least 1 which can't be ignored) , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About SEHK:1064

Zhong Hua International Holdings

An investment holding company, engages in the property development, investment, and management activities in Mainland China.

Excellent balance sheet slight.

Market Insights

Community Narratives