- United States

- /

- IT

- /

- NYSEAM:WYY

Did Changing Sentiment Drive WidePoint's (NYSEMKT:WYY) Share Price Down A Worrying 67%?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

WidePoint Corporation (NYSEMKT:WYY) shareholders should be happy to see the share price up 19% in the last month. But that doesn't change the fact that the returns over the last half decade have been disappointing. In fact, the share price has declined rather badly, down some 67% in that time. So we're hesitant to put much weight behind the short term increase. Of course, this could be the start of a turnaround.

View our latest analysis for WidePoint

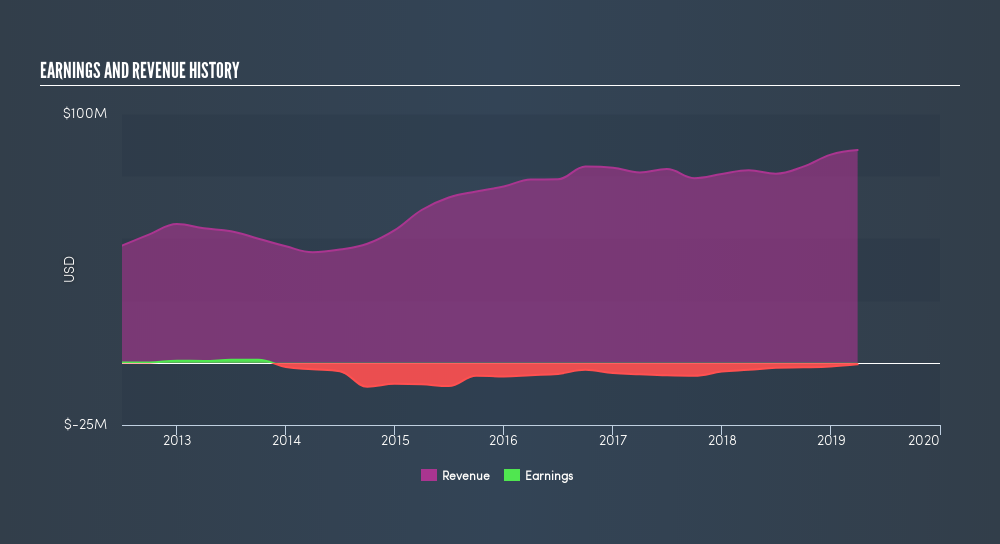

Because WidePoint is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last half decade, WidePoint saw its revenue increase by 10% per year. That's a pretty good rate for a long time period. The share price, meanwhile, has fallen 20% compounded, over five years. That suggests the market is disappointed with the current growth rate. A pessimistic market can create opportunities.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

This free interactive report on WidePoint's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in WidePoint had a tough year, with a total loss of 1.0%, against a market gain of about 3.7%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 20% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

Of course WidePoint may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSEAM:WYY

WidePoint

Provides technology management as a service (TMaaS) to the government and business enterprises in the United States and Europe.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives