Did Changing Sentiment Drive Shaw Communications's (TSE:SJR.B) Share Price Down By 12%?

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But every investor is virtually certain to have both over-performing and under-performing stocks. So we wouldn't blame long term Shaw Communications Inc. (TSE:SJR.B) shareholders for doubting their decision to hold, with the stock down 12% over a half decade.

Check out our latest analysis for Shaw Communications

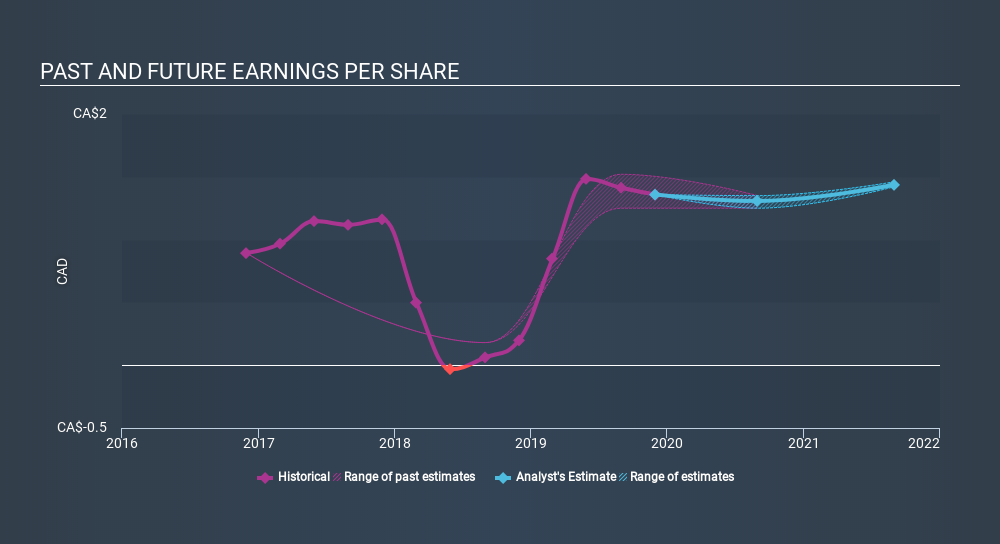

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the five years over which the share price declined, Shaw Communications's earnings per share (EPS) dropped by 3.7% each year. The share price decline of 2.6% per year isn't as bad as the EPS decline. So the market may previously have expected a drop, or else it expects the situation will improve.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Shaw Communications, it has a TSR of 9.7% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Shaw Communications provided a TSR of 3.2% over the last twelve months. But that was short of the market average. The silver lining is that the gain was actually better than the average annual return of 1.9% per year over five year. This suggests the company might be improving over time. It's always interesting to track share price performance over the longer term. But to understand Shaw Communications better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for Shaw Communications you should be aware of.

Shaw Communications is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:SJR.B

Shaw Communications

Shaw Communications Inc. operates as a connectivity company in North America.

Established dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives