- United States

- /

- Construction

- /

- NasdaqCM:SGBX

Did Changing Sentiment Drive SG Blocks's (NASDAQ:SGBX) Share Price Down A Painful 90%?

As every investor would know, you don't hit a homerun every time you swing. But it would be foolish to simply accept every extremely large loss as an inevitable part of the game. It must have been painful to be a SG Blocks, Inc. (NASDAQ:SGBX) shareholder over the last year, since the stock price plummeted 90% in that time. A loss like this is a stark reminder that portfolio diversification is important. SG Blocks hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. Furthermore, it's down 50% in about a quarter. That's not much fun for holders.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

View our latest analysis for SG Blocks

SG Blocks isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

SG Blocks's revenue didn't grow at all in the last year. In fact, it fell 6.8%. That's not what investors generally want to see. The market obviously agrees, since the share price tanked 90%. That's a stern reminder that profitless companies need to grow the top line, at the very least. Of course, extreme share price falls can be an opportunity for those who are willing to really dig deeper to understand a high risk company like this.

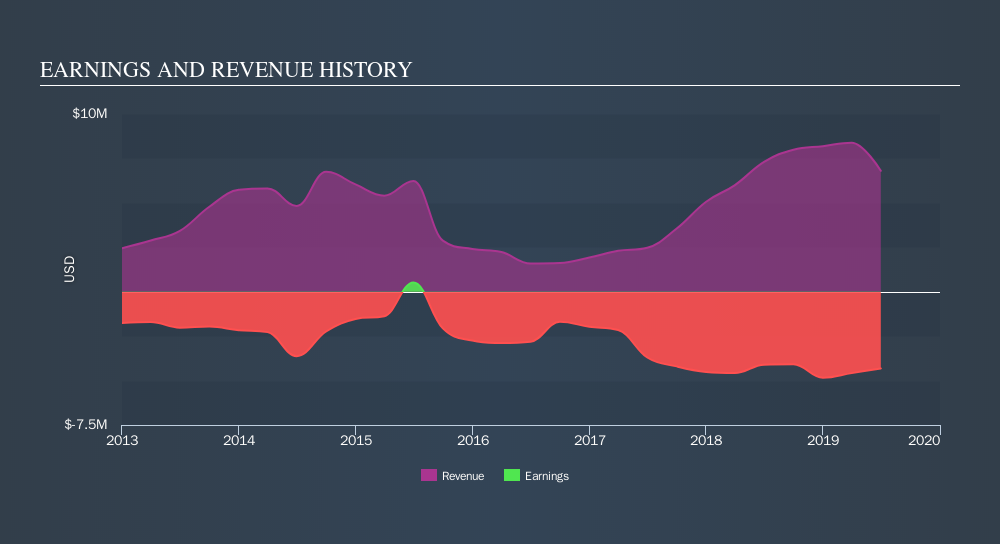

The company's revenue and earnings (over time) are depicted in the image below.

Take a more thorough look at SG Blocks's financial health with this free report on its balance sheet.

A Different Perspective

Given that the market gained 11% in the last year, SG Blocks shareholders might be miffed that they lost 90%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. The share price decline has continued throughout the most recent three months, down 50%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. If you would like to research SG Blocks in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqCM:SGBX

Safe & Green Holdings

Provides prefabricated modular structures using wood or steel as the base material for residential and commercial use in the United States.

Medium-low with imperfect balance sheet.

Market Insights

Community Narratives