- United States

- /

- Hotel and Resort REITs

- /

- NYSE:AHT

Did Changing Sentiment Drive Ashford Hospitality Trust's (NYSE:AHT) Share Price Down A Worrying 68%?

Ashford Hospitality Trust, Inc. (NYSE:AHT) shareholders should be happy to see the share price up 26% in the last quarter. But over the last half decade, the stock has not performed well. After all, the share price is down 68% in that time, significantly under-performing the market.

See our latest analysis for Ashford Hospitality Trust

Given that Ashford Hospitality Trust didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over five years, Ashford Hospitality Trust grew its revenue at 10% per year. That's a pretty good rate for a long time period. The share price, meanwhile, has fallen 20% compounded, over five years. That suggests the market is disappointed with the current growth rate. A pessimistic market can create opportunities.

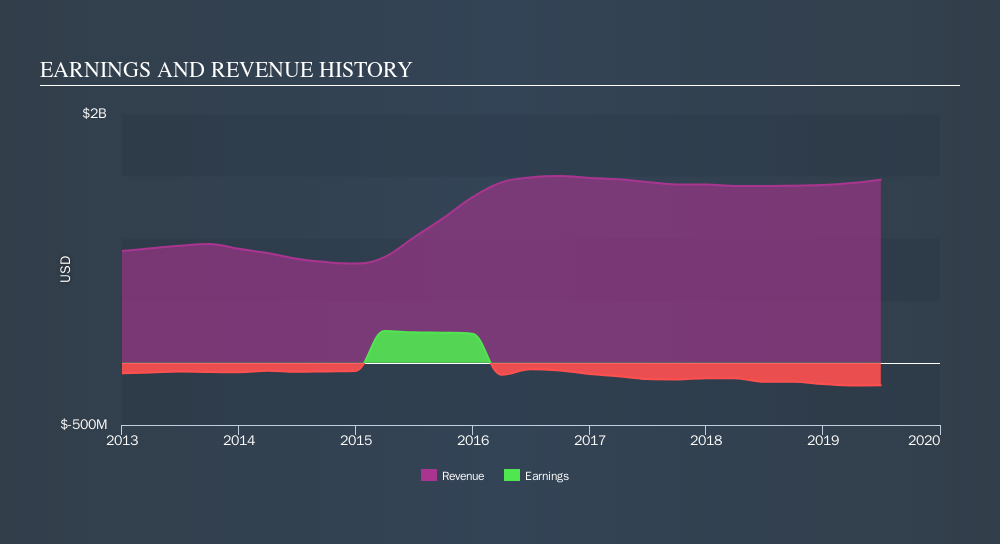

You can see how earnings and revenue have changed over time in the image below.

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. You can see what analysts are predicting for Ashford Hospitality Trust in this interactive graph of future profit estimates.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Ashford Hospitality Trust, it has a TSR of -47% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Investors in Ashford Hospitality Trust had a tough year, with a total loss of 42% (including dividends) , against a market gain of about 5.2%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 12% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:AHT

Moderate and fair value.

Market Insights

Community Narratives