Corning Incorporated (NYSE:GLW): What Can We Expect In The Future?

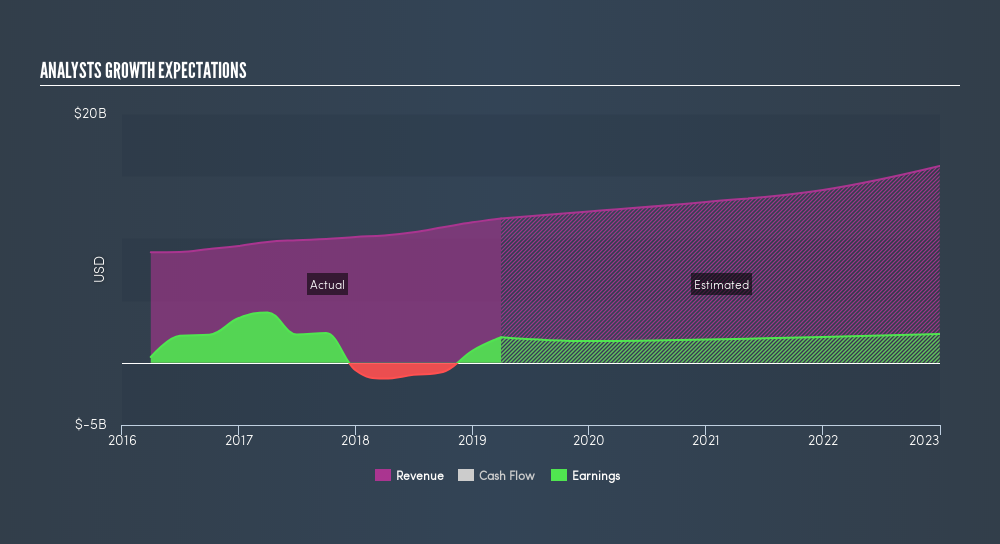

In March 2019, Corning Incorporated (NYSE:GLW) released its earnings update. Generally, analyst consensus outlook seem bearish, with earnings expected to decline by 14% in the upcoming year. However, compared to its 5-year track record of the average earnings growth rate of -19%, this is still an improvement. With trailing-twelve-month net income at current levels of US$968m, the consensus growth rate suggests that earnings will decline to US$836m by 2020. I will provide a brief commentary around the figures and analyst expectations in the near term. Readers that are interested in understanding the company beyond these figures should research its fundamentals here.

Check out our latest analysis for Corning

How is Corning going to perform in the near future?

Longer term expectations from the 12 analysts covering GLW’s stock is one of positive sentiment. Since forecasting becomes more difficult further into the future, broker analysts generally project out to around three years. I've plotted out each year's earnings expectations and inserted a line of best fit to calculate an annual growth rate from the slope in order to understand the overall trajectory of GLW's earnings growth over these next few years.

This results in an annual growth rate of 6.1% based on the most recent earnings level of US$968m to the final forecast of US$1.0b by 2022. EPS reaches $2.48 in the final year of forecast compared to the current $1.19 EPS today. This high rate of growth of revenue squeezes margins, as analysts predict an upcoming margin contraction from the current 8.6% to 7.2% by the end of 2022.

Next Steps:

Future outlook is only one aspect when you're building an investment case for a stock. For Corning, I've put together three relevant factors you should look at:

- Financial Health: Does it have a healthy balance sheet? Take a look at our free balance sheet analysis with six simple checks on key factors like leverage and risk.

- Valuation: What is Corning worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether Corning is currently mispriced by the market.

- Other High-Growth Alternatives : Are there other high-growth stocks you could be holding instead of Corning? Explore our interactive list of stocks with large growth potential to get an idea of what else is out there you may be missing!

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:GLW

Corning

Operates in optical communications, display, specialty materials, automotive, and life sciences businesses in the United States, Canada, Mexico, Japan, Taiwan, China, South Korea, Germany, and internationally.

High growth potential with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

Energy One (ASX:EOL): Sticky software with improving margins

Circle Internet Group: From Crypto Proxy to Rate-Sensitive Financial Infrastructure

Salesforce (CRM) The Agentic Pivot: Salesforce Redefines the SaaS Era

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks