- New Zealand

- /

- Food

- /

- NZSE:SEK

Chief Executive Officer Michael Franks Just Bought 7.2% More Shares In Seeka Limited (NZSE:SEK)

Even if it's not a huge purchase, we think it was good to see that Michael Franks, the Chief Executive Officer of Seeka Limited (NZSE:SEK) recently shelled out NZ$62k to buy stock, at NZ$6.20 per share. However, it only increased their shares held by 7.2%, and it wasn't a huge purchase by absolute value, either.

View our latest analysis for Seeka

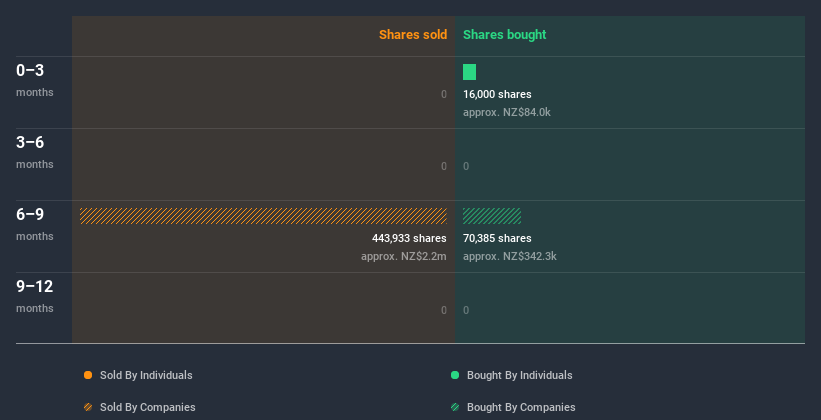

Seeka Insider Transactions Over The Last Year

In fact, the recent purchase by Michael Franks was the biggest purchase of Seeka shares made by an insider individual in the last twelve months, according to our records. So it's clear an insider wanted to buy, even at a higher price than the current share price (being NZ$4.00). It's very possible they regret the purchase, but it's more likely they are bullish about the company. We always take careful note of the price insiders pay when purchasing shares. It is generally more encouraging if they paid above the current price, as it suggests they saw value, even at higher levels.

In the last twelve months Seeka insiders were buying shares, but not selling. The average buy price was around NZ$5.49. This is nice to see since it implies that insiders might see value around current prices (around NZ$4.00). You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

Seeka is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Insider Ownership

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. I reckon it's a good sign if insiders own a significant number of shares in the company. Insiders own 21% of Seeka shares, worth about NZ$25m. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

What Might The Insider Transactions At Seeka Tell Us?

It is good to see recent purchasing. And the longer term insider transactions also give us confidence. When combined with notable insider ownership, these factors suggest Seeka insiders are well aligned, and that they may think the share price is too low. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Seeka. For instance, we've identified 3 warning signs for Seeka (2 are concerning) you should be aware of.

Of course Seeka may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you’re looking to trade Seeka, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NZSE:SEK

Seeka

Provides orchard lease and management, and post-harvest and retail services to the horticulture industry in New Zealand and Australia.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives