- United States

- /

- Oil and Gas

- /

- NYSE:LNG

Cheniere Energy (NYSE:LNG) Declares Quarterly Dividend Of US$0.500 Per Share

Reviewed by Simply Wall St

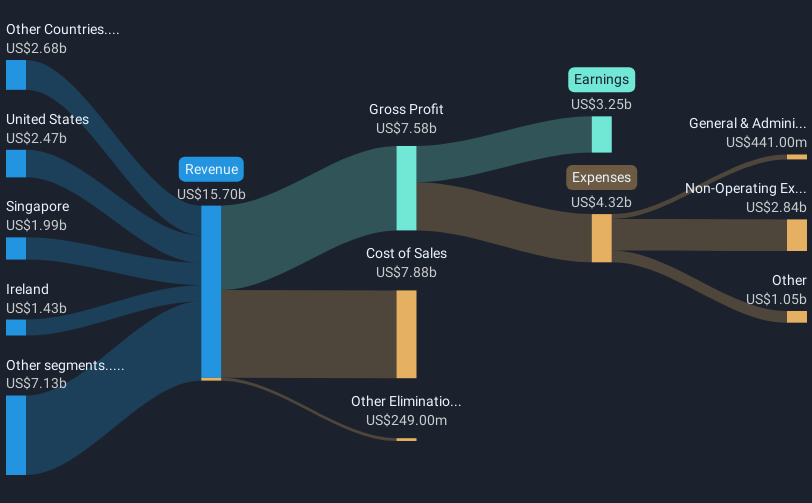

Cheniere Energy (NYSE:LNG) affirmed its quarterly dividend of $0.50 per share, payable in August, reflecting its commitment to shareholder returns, which coincided with a 3.84% upward move in its share price over the last quarter. The market remained influenced by geopolitical tensions and anticipations of the Federal Reserve's decisions, but Cheniere's stable dividend policy and robust revenue growth of 28% year-over-year provided a buffer amidst these uncertainties. While earnings saw a decline, the buyback of 1.6 million shares could have helped maintain investor confidence, aligning with modest upward trends in broader market indices.

Be aware that Cheniere Energy is showing 3 possible red flags in our investment analysis.

The recent affirmation of Cheniere Energy's quarterly dividend aligns with its broader strategy focused on enhancing shareholder value through stable returns, even in the face of geopolitical tensions and federal policy uncertainties. This approach, combined with sophisticated revenue growth tactics, supports its resilience, as evidenced by a 3.84% share price increase last quarter. Over the past five years, the company has achieved an impressive total return of very large, showcasing its strong performance. For context, during the past year, Cheniere outperformed the US market, which delivered a 9.8% return.

The projected Corpus Christi expansions aim to bolster LNG capacity, anticipated to significantly increase EBITDA and cash flow while refining net margins. Despite current headwinds such as a potential restoration of Russian gas flows impacting revenue, the company's long-term strategies including share repurchases and dividend increases foster optimism for enhanced earnings per share. Analysts forecast a revenue increase, albeit profit margins are expected to shrink from 21.0% to 12.3% over the next three years. Today's US$229.80 share price is approximately 9.5% below the consensus analyst price target of US$253.83, reflecting potential for upward movement as business strategies unfold and market conditions evolve.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LNG

Cheniere Energy

An energy infrastructure company, primarily engages in the liquefied natural gas (LNG) related businesses in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives