- United States

- /

- Capital Markets

- /

- BATS:CBOE

Cboe Global Markets (BATS:CBOE) Consolidates Digital Futures On CFE For Unified Trading Experience

Reviewed by Simply Wall St

Cboe Global Markets (BATS:CBOE) recently announced significant advancements, including the consolidation of its digital exchange futures onto the Cboe Futures Exchange and the introduction of Bitcoin and Ether futures on CFE. This move aims to enhance operational efficiencies and customer access, underpinning its leadership in volatility trading. Over the last quarter, Cboe's stock rose 4%, congruent with overall market trends buoyed by optimism surrounding U.S.-China trade talks. Particularly noteworthy were changes in the executive team and robust Q1 earnings, which included a significant increase in revenue and net income, providing further support to the company's market performance.

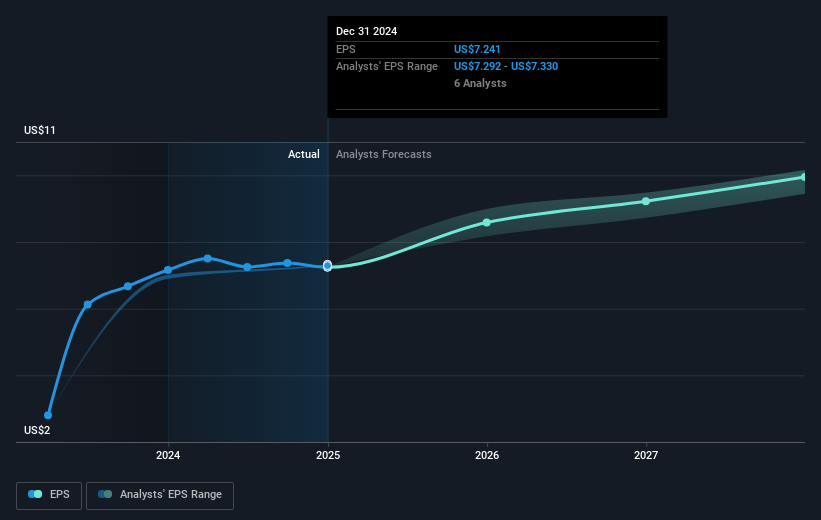

The recent advancements by Cboe Global Markets, such as consolidating its digital exchange futures and introducing Bitcoin and Ether futures, position the company to enhance operational efficiencies, which could potentially improve revenue and earnings forecasts. This move aligns with Cboe's focus on innovation and global expansion, likely boosting trading volumes and market share. However, these expansions are not without challenges, as regulatory complexities and market uncertainties could impact financial performance.

Over the past five years, Cboe's total shareholder return was a remarkable 133.71%, illustrating strong long-term performance and resilience. In the past year, Cboe's shares matched the US Capital Markets industry's return of 28.9%, while the broader US market return was 12.4%. This indicates a robust position at both an industry and market level.

Though Cboe's short-term share price increase of 4% follows market optimism, the current price remains $217.05, narrowly below analysts' consensus price target of $221.33. This suggests that the stock may be fairly priced, with analysts expecting meaningful price alignment as Cboe executes its growth strategies. The anticipated improvements in revenue and earnings could further support the stock reaching or surpassing the target. However, there are risks such as regulatory challenges and market conditions that could influence future performance projections.

Review our historical performance report to gain insights into Cboe Global Markets' track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BATS:CBOE

Cboe Global Markets

Through its subsidiaries, operates as an options exchange in the United States and internationally.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives